Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Canadian bond in US dollars, rated AAA, with a 30-year maturity or a Brazilian bond in US dollars, rated BB-, with a 5-year maturity.

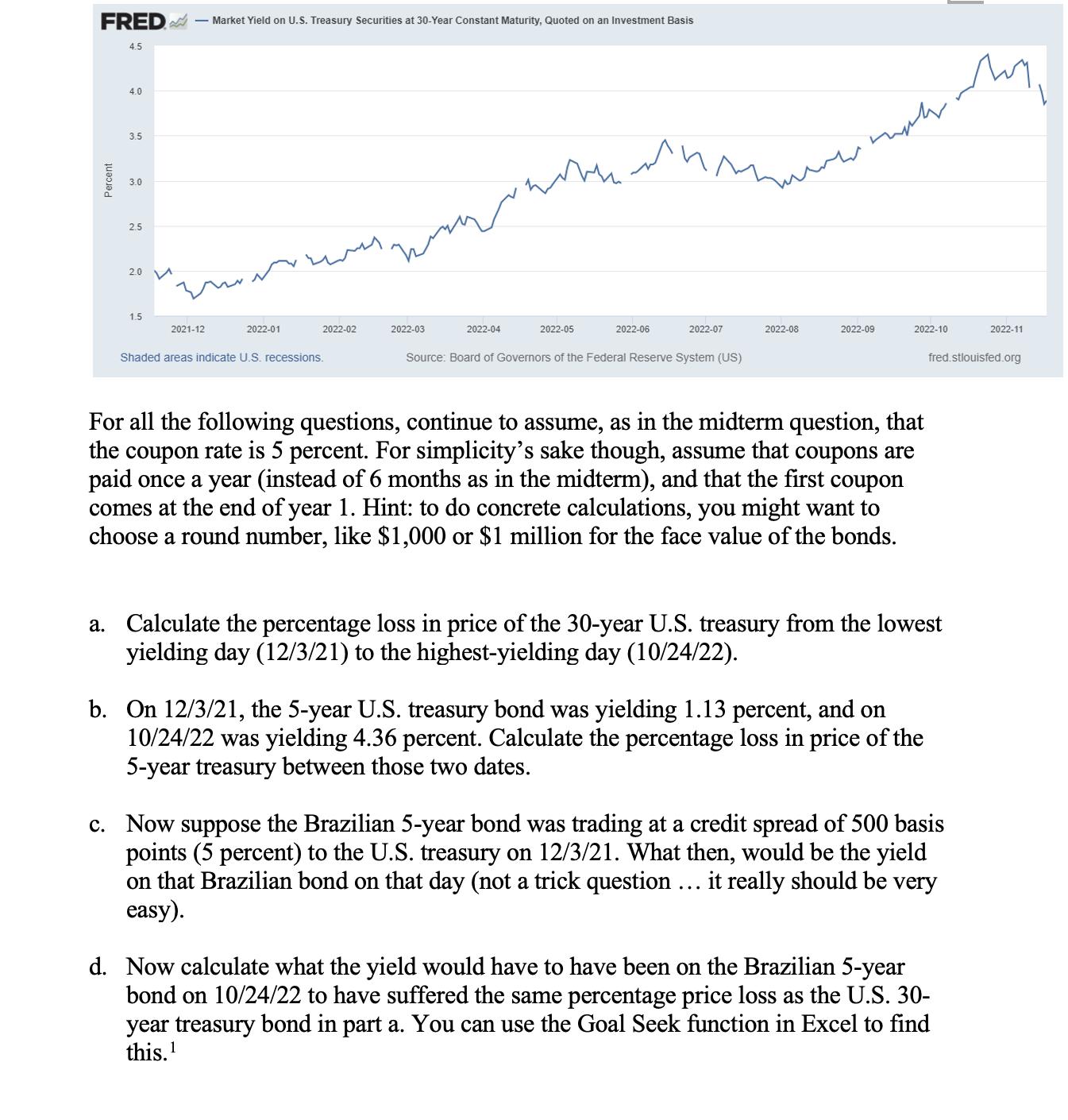

Canadian bond in US dollars, rated AAA, with a 30-year maturity or a Brazilian bond in US dollars, rated BB-, with a 5-year maturity. The correct answer was that you cannot say which was riskier. While the Brazilian bond has higher credit risk, the Canadian bond has much higher duration risk. Many said that the Brazilian bond was riskier because it had higher credit risk. If you completely ignored the higher duration risk of the Canadian bond, you would have lost a point or more. If you at least showed some recognition that the Canadian bond had a higher duration, then you might have gotten full credit. FRED - Market Yield on U.S. Treasury Securities at 30-Year Constant Maturity, Quoted on an Investment Basis Percent 4.5 4.0 3.5 3.0 2.5 20 1.5 2021-12 2022-01 2022-02 Shaded areas indicate U.S. recessions. 2022-03 2022-04 2022-05 2022-06 2022-07 Source: Board of Governors of the Federal Reserve System (US) www 2022-08 mah 2022-09 2022-10 For all the following questions, continue to assume, as in the midterm question, that the coupon rate is 5 percent. For simplicity's sake though, assume that coupons are paid once a year (instead of 6 months as in the midterm), and that the first coupon comes at the end of year 1. Hint: to do concrete calculations, you might want to choose a round number, like $1,000 or $1 million for the face value of the bonds. a. Calculate the percentage loss in price of the 30-year U.S. treasury from the lowest yielding day (12/3/21) to the highest-yielding day (10/24/22). b. On 12/3/21, the 5-year U.S. treasury bond was yielding 1.13 percent, and on 10/24/22 was yielding 4.36 percent. Calculate the percentage loss in price of the 5-year treasury between those two dates. fred.stlouisfed.org c. Now suppose the Brazilian 5-year bond was trading at a credit spread of 500 basis points (5 percent) to the U.S. treasury on 12/3/21. What then, would be the yield on that Brazilian bond on that day (not a trick question ... it really should be very easy). d. Now calculate what the yield would have to have been on the Brazilian 5-year bond on 10/24/22 to have suffered the same percentage price loss as the U.S. 30- year treasury bond in part a. You can use the Goal Seek function in Excel to find this. 2022-11 e. Based on your answer to d, calculate the credit spread to the 5-year U.S. treasury for the Brazilian 5-year bond on 10/24/22. How much has Brazil's credit spread changed from 12/3/21 to 10/24/22.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started