Answered step by step

Verified Expert Solution

Question

1 Approved Answer

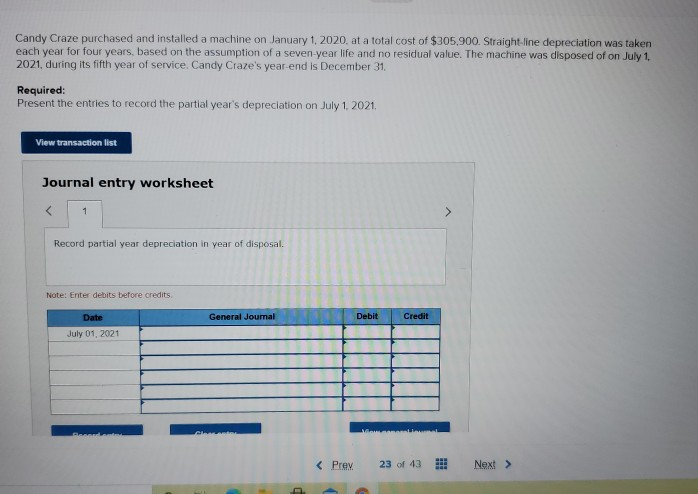

Candy Craze purchased and installed a machine on January 1, 2020. at a total cost of $305,900. Straight line depreciation was taken each year for

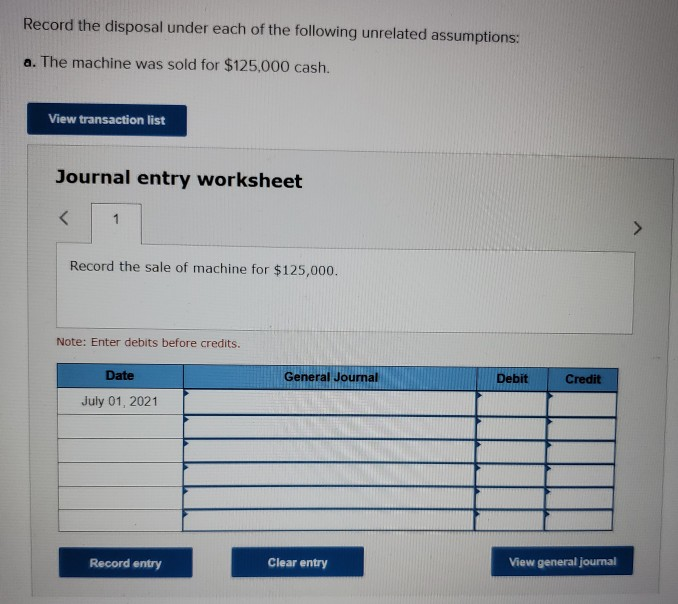

Candy Craze purchased and installed a machine on January 1, 2020. at a total cost of $305,900. Straight line depreciation was taken each year for four years, based on the assumption of a seven-year life and no residual value. The machine was disposed of on July 1. 2021, during its fifth year of service. Candy Craze's year-end Is December 31 Required: Present the entries to record the partial year's depreciation on July 1, 2021 View transaction list Journal entry worksheet 1 Record partial year depreciation in year of disposal. Note: Enter debits before credits Date General Journal Debit Credit July 01, 2021 Record the disposal under each of the following unrelated assumptions: a. The machine was sold for $125,000 cash. View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started