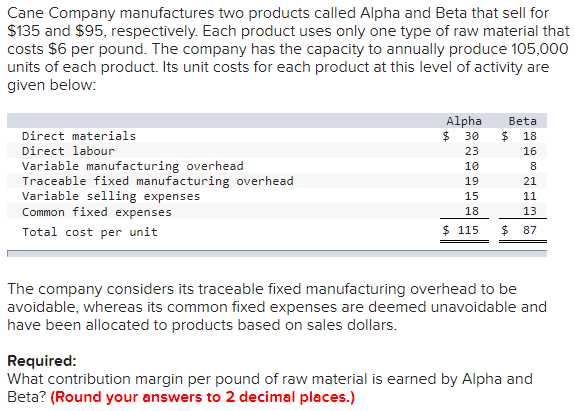

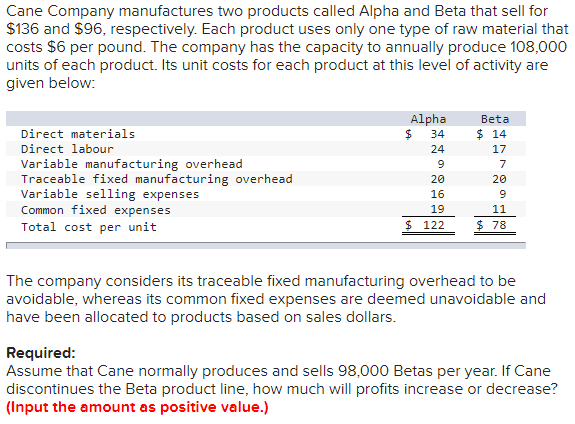

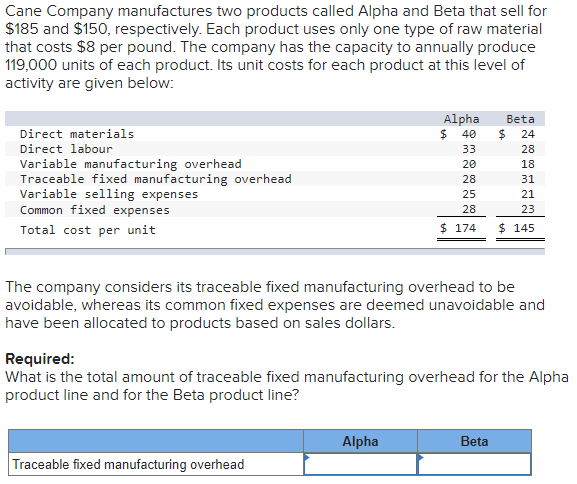

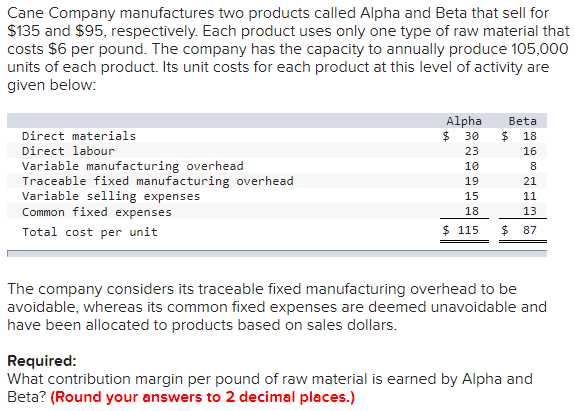

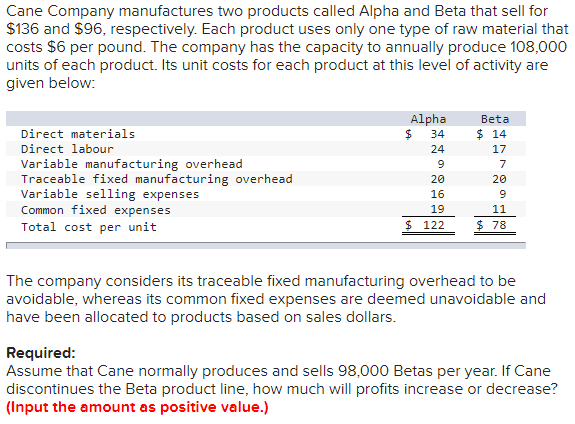

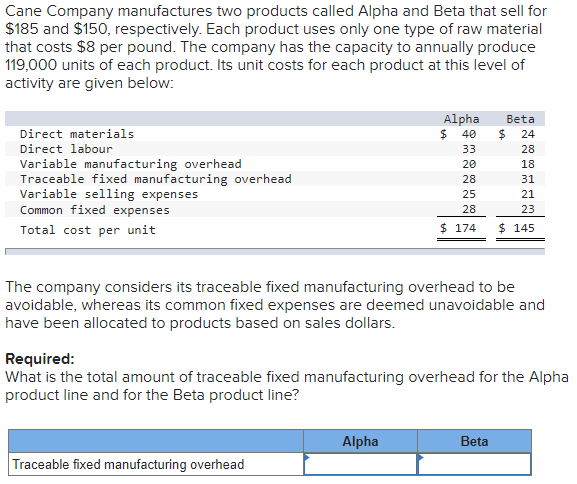

Cane Company manufactures two products called Alpha and Beta that sell for $135 and $95, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annually produce 105,000 units of each product. Its unit costs for each product at this level of activity are given below: Direct materials Direct labour Variable manufacturing overhead Traceable fixed manufacturing overhead Variable selling expenses Common fixed expenses Total cost per unit Alpha $ 30 23 10 19 15 18 Beta $ 18 16 8 21 11 13 $ 87 $ 115 The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are deemed unavoidable and have been allocated to products based on sales dollars. Required: What contribution margin per pound of raw material is earned by Alpha and Beta? (Round your answers to 2 decimal places.) Cane Company manufactures two products called Alpha and Beta that sell for $136 and $96, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annually produce 108,000 units of each product. Its unit costs for each product at this level of activity are given below: Direct materials Direct labour Variable manufacturing overhead Traceable fixed manufacturing overhead Variable selling expenses Common fixed expenses Total cost per unit Alpha $ 34 24 9 20 16 19 $ 122 Beta $ 14 17 7 20 9 11 $ 78 The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are deemed unavoidable and have been allocated to products based on sales dollars. Required: Assume that Cane normally produces and sells 98,000 Betas per year. If Cane discontinues the Beta product line, how much will profits increase or decrease? (Input the amount as positive value.) Cane Company manufactures two products called Alpha and Beta that sell for $185 and $150, respectively. Each product uses only one type of raw material that costs $8 per pound. The company has the capacity to annually produce 119,000 units of each product. Its unit costs for each product at this level of activity are given below: Alpha $ 40 33 20 Direct materials Direct labour Variable manufacturing overhead Traceable fixed manufacturing overhead Variable selling expenses Common fixed expenses Total cost per unit Beta $ 24 28 18 31 21 23 28 25 28 $ 174 $ 145 The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are deemed unavoidable and have been allocated to products based on sales dollars. Required: What is the total amount of traceable fixed manufacturing overhead for the Alpha product line and for the Beta product line? Alpha Beta Traceable fixed manufacturing overhead Cane Company manufactures two products called Alpha and Beta that sell for $190 and $155, respectively. Each product uses only one type of raw material that costs $8 per pound. The company has the capacity to annually produce 122,000 units of each product. Its unit costs for each product at this level of activity are given below: Direct materials Direct labour Variable manufacturing overhead Traceable fixed manufacturing overhead Variable selling expenses Common fixed expenses Total cost per unit Alpha $ 40 34 21 29 26 29 Beta $ 24 28 19 32 22 24 $ 179 $ 149 The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are deemed unavoidable and have been allocated to products based on sales dollars. Required: How many pounds of raw material are needed to make one unit of Alpha and one unit of Beta? Alpha Beta Pounds of raw materials per unit Cane Company manufactures two products called Alpha and Beta that sell for $210 and $172, respectively. Each product uses only one type of raw material that costs $8 per pound. The company has the capacity to annually produce 128,000 units of each product. Its unit costs for each product at this level of activity are given below: $ Direct materials Direct labour Variable manufacturing overhead Traceable fixed manufacturing overhead Variable selling expenses Common fixed expenses Total cost per unit Alpha $ 40 38 25 33 30 33 Beta 24 34 23 36 26 28 $ 171 $ 199 The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are deemed unavoidable and have been allocated to products based on sales dollars. Required: What is the company's total amount of common fixed expenses? Alpha Beta Common fixed expenses