Answered step by step

Verified Expert Solution

Question

1 Approved Answer

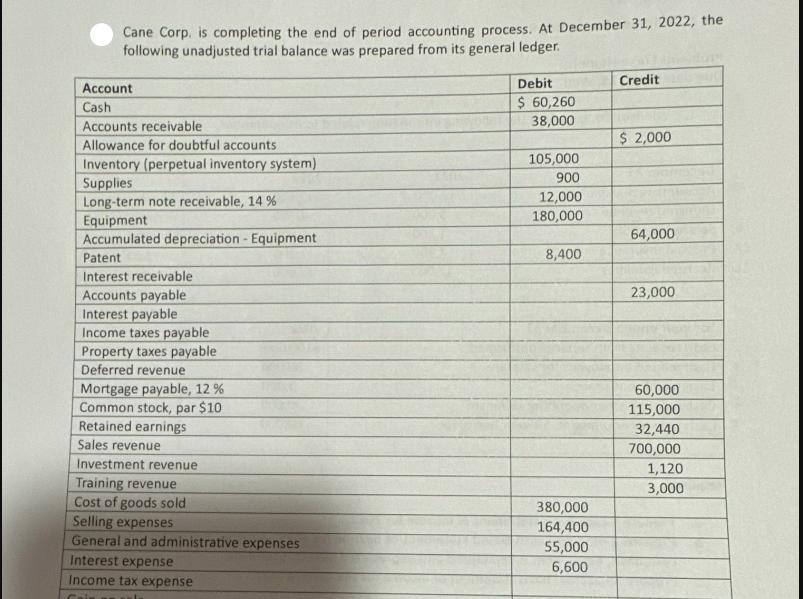

Cane Corp. is completing the end of period accounting process. At December 31, 2022, the following unadjusted trial balance was prepared from its general

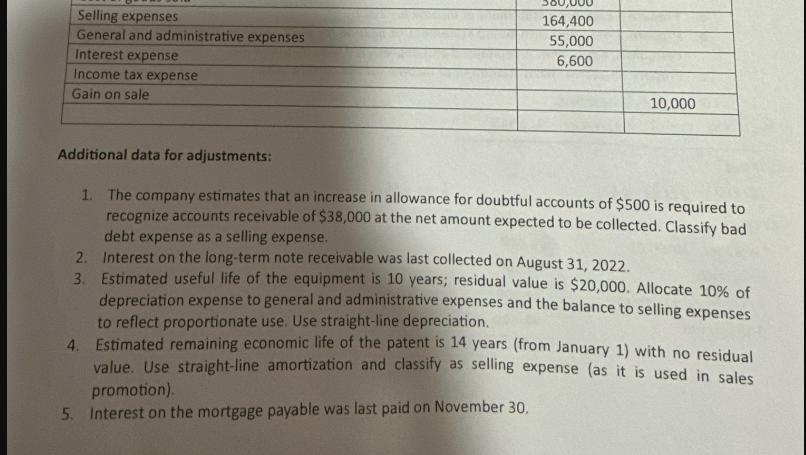

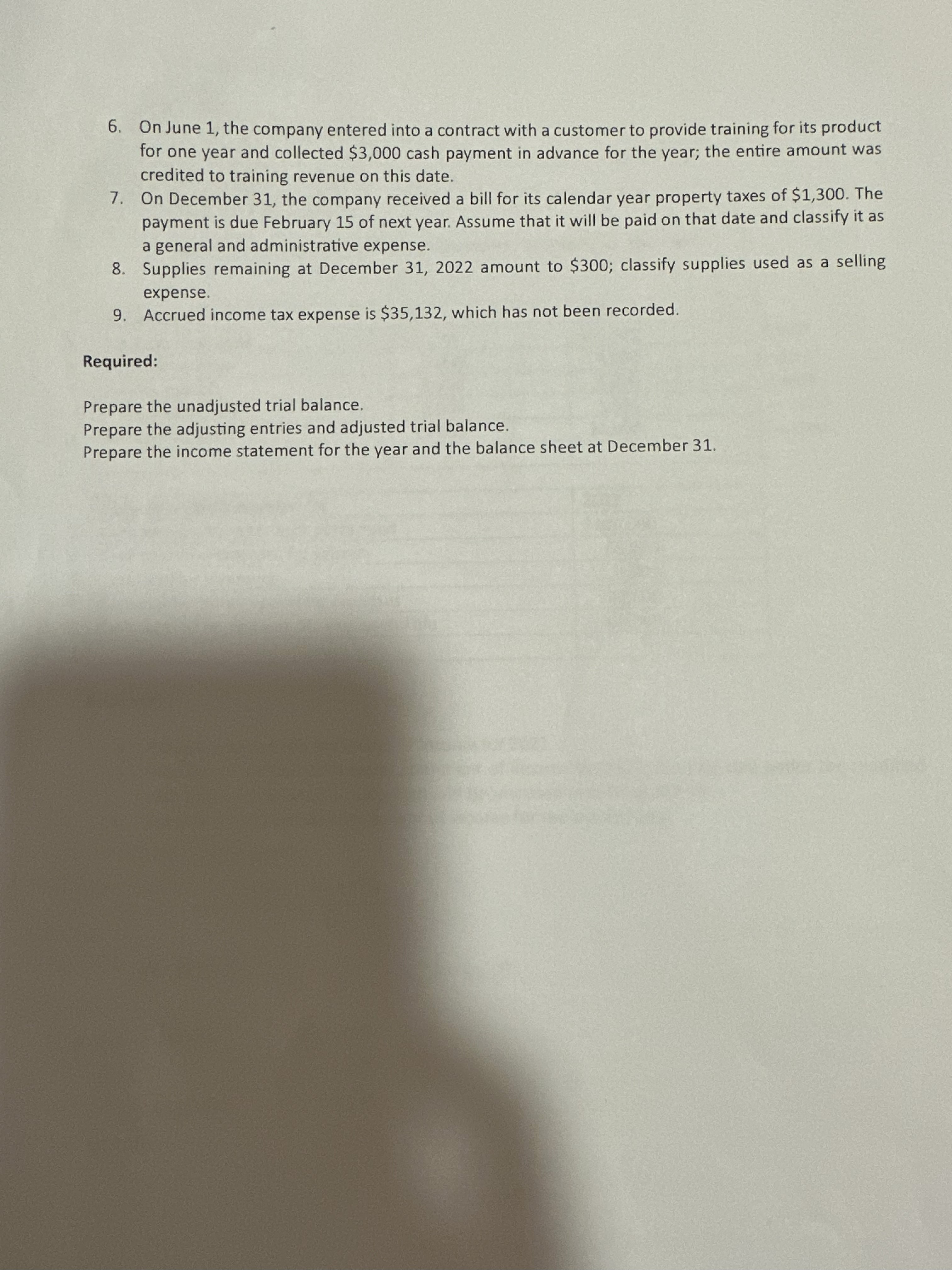

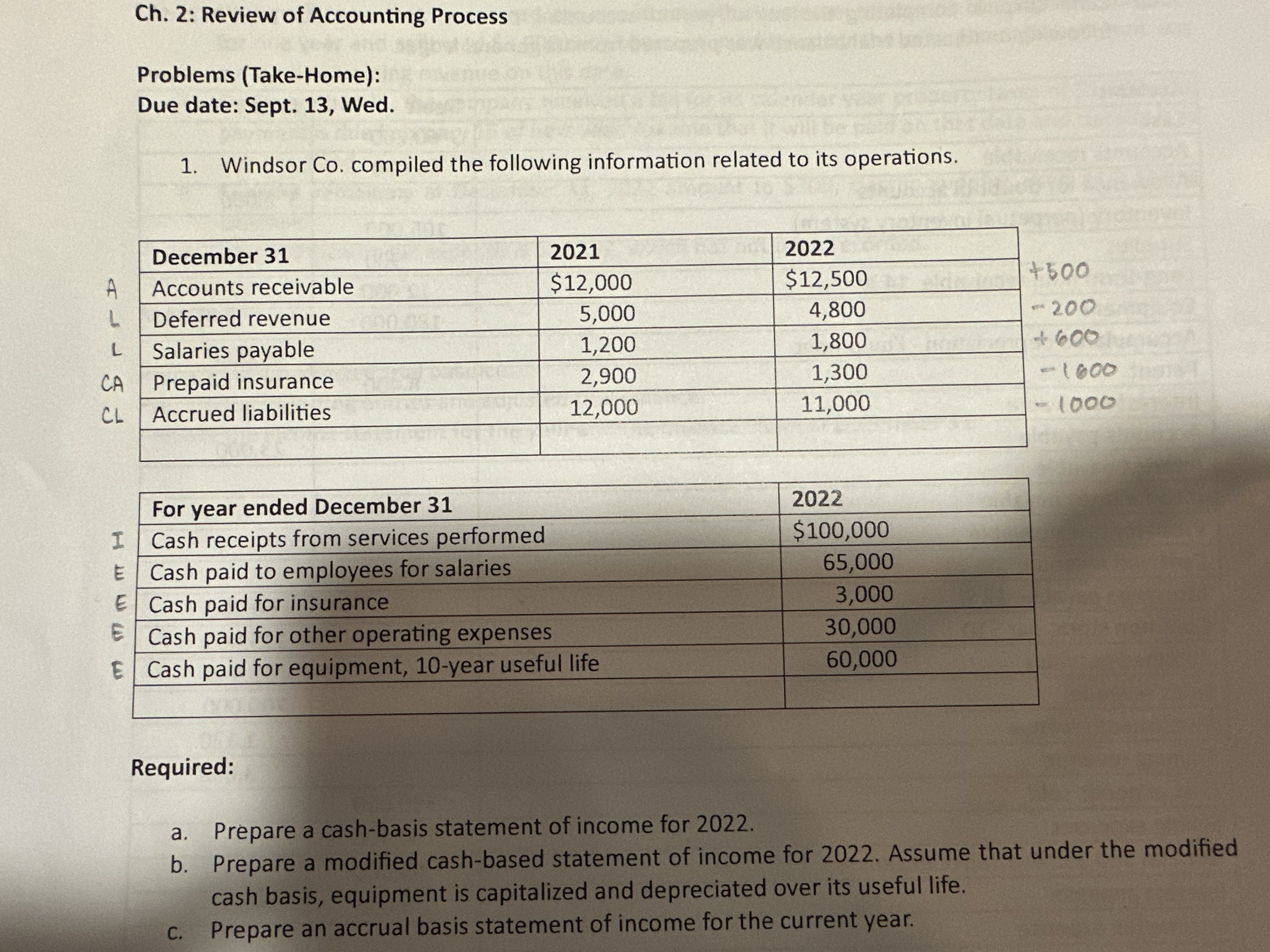

Cane Corp. is completing the end of period accounting process. At December 31, 2022, the following unadjusted trial balance was prepared from its general ledger. Account Cash Accounts receivable Allowance for doubtful accounts. Inventory (perpetual inventory system) Debit Credit $ 60,260 38,000 $ 2,000 105,000 Supplies 900 Long-term note receivable, 14 % 12,000 Equipment 180,000 Accumulated depreciation - Equipment 64,000 Patent 8,400 Interest receivable Accounts payable 23,000 Interest payable Income taxes payable Property taxes payable Deferred revenue Mortgage payable, 12% Common stock, par $10 Retained earnings Sales revenue 60,000 115,000 32,440 700,000 Investment revenue 1,120 Training revenue 3,000 Cost of goods sold 380,000 Selling expenses 164,400 General and administrative expenses 55,000 Interest expense 6,600 Income tax expense Selling expenses 164,400 General and administrative expenses 55,000 Interest expense 6,600 Income tax expense Gain on sale 10,000 Additional data for adjustments: 1. The company estimates that an increase in allowance for doubtful accounts of $500 is required to recognize accounts receivable of $38,000 at the net amount expected to be collected. Classify bad debt expense as a selling expense. 2. Interest on the long-term note receivable was last collected on August 31, 2022. 3. Estimated useful life of the equipment is 10 years; residual value is $20,000. Allocate 10% of depreciation expense to general and administrative expenses and the balance to selling expenses to reflect proportionate use. Use straight-line depreciation. 4. Estimated remaining economic life of the patent is 14 years (from January 1) with no residual value. Use straight-line amortization and classify as selling expense (as it is used in sales promotion). 5. Interest on the mortgage payable was last paid on November 30, 6. On June 1, the company entered into a contract with a customer to provide training for its product for one year and collected $3,000 cash payment in advance for the year; the entire amount was credited to training revenue on this date. 7. On December 31, the company received a bill for its calendar year property taxes of $1,300. The payment is due February 15 of next year. Assume that it will be paid on that date and classify it as a general and administrative expense. 8. Supplies remaining at December 31, 2022 amount to $300; classify supplies used as a selling expense. 9. Accrued income tax expense is $35,132, which has not been recorded. Required: Prepare the unadjusted trial balance. Prepare the adjusting entries and adjusted trial balance. Prepare the income statement for the year and the balance sheet at December 31. Ch. 2: Review of Accounting Process Problems (Take-Home): Due date: Sept. 13, Wed. 1. Windsor Co. compiled the following information related to its operations. December 31 A Accounts receivable L Deferred revenue L Salaries payable CA Prepaid insurance CL Accrued liabilities 2021 $12,000 2022 $12,500 +500 5,000 4,800 200 1,200 1,800 +600 2,900 1,300 -1000 12,000 11,000 1000 For year ended December 31 2022 I Cash receipts from services performed $100,000 E Cash paid to employees for salaries 65,000 E Cash paid for insurance 3,000 Cash paid for other operating expenses 30,000 E Cash paid for equipment, 10-year useful life 60,000 Required: a. Prepare a cash-basis statement of income for 2022. b. Prepare a modified cash-based statement of income for 2022. Assume that under the modified cash basis, equipment is capitalized and depreciated over its useful life. C. Prepare an accrual basis statement of income for the current year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started