Answered step by step

Verified Expert Solution

Question

1 Approved Answer

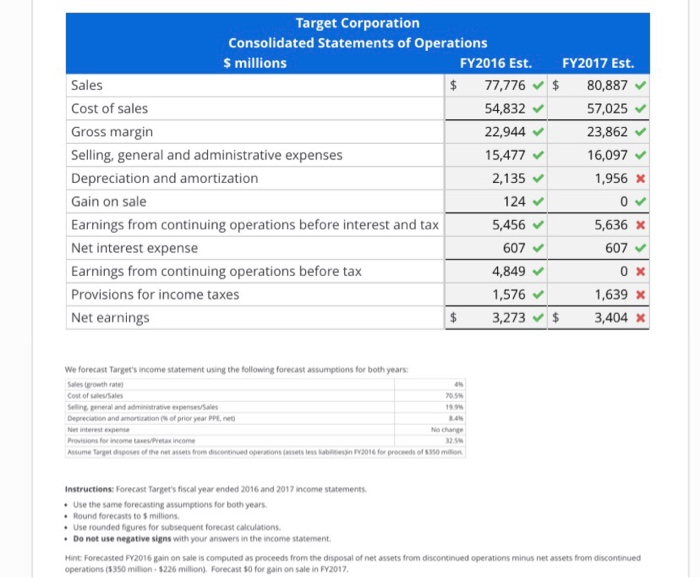

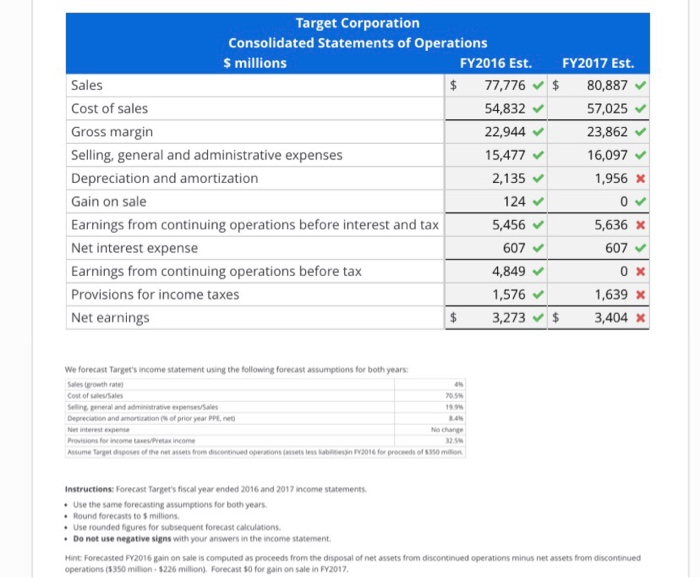

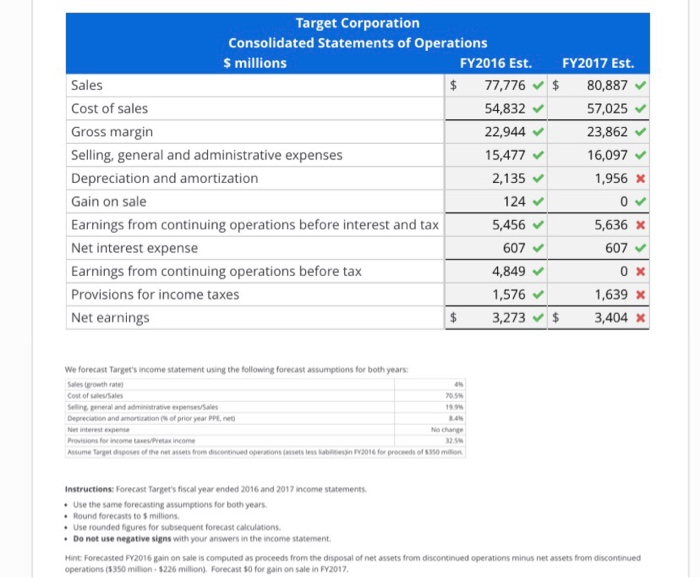

cant fugure out please help. depreciation and amortization is wrong Target Corporation Consolidated Statements of Operations $ millions FY2016 Est. Sales $ 77,776 Cost of

cant fugure out please help. depreciation and amortization is wrong

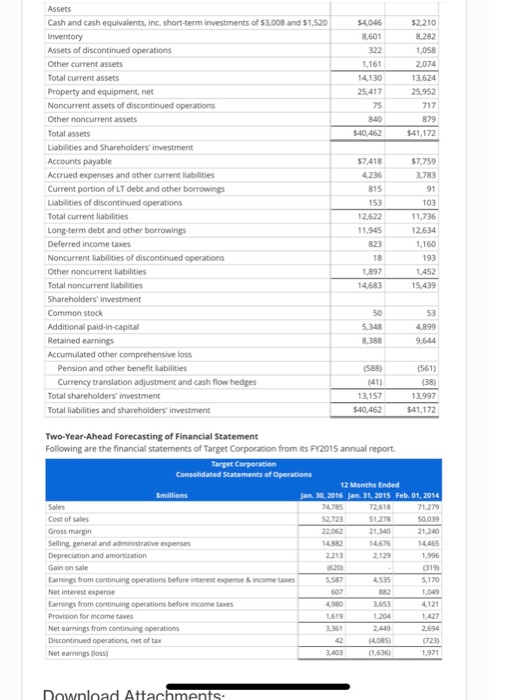

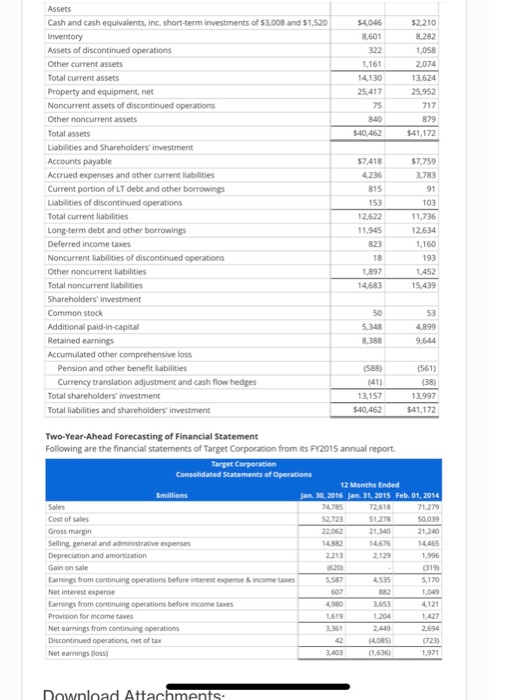

Target Corporation Consolidated Statements of Operations $ millions FY2016 Est. Sales $ 77,776 Cost of sales 54,832 Gross margin 22,944 Selling, general and administrative expenses 15,477 Depreciation and amortization 2,135 Gain on sale 124 Earnings from continuing operations before interest and tax 5,456 Net interest expense 607 Earnings from continuing operations before tax 4,849 Provisions for income taxes 1,576 Net earnings $ 3,273 FY2017 Est. $ 80,887 57,025 23,862 16,097 1,956 x 0 5,636 x 607 0 x 1,639 $ 3,404 X 1.9 We forecast Target's income statement using the following forecast assumptions for both years 20:5 Sale rowth rate Cost of Sales Sen general and intrative penseuses Depreciation and amortization of prior year PPE. Net interest expense Provision for wometeret income Assumere poses of the nessere d Nechance ine persons in 2016 for procesom Instructions: Forecast Target's fiscal year ended 2016 and 2017 income statements Use the same forecasting assumptions for both years Round forecasts to 5 millions Use rounded figures for subsequent forecast calculations. Do not use negative signs with your answers in the income statement Hint Forecasted FY2016 gain on sale is computed as proceeds from the disposal of net assets from discontinued operations minus net assets from discontinued operations ($350 milion $226 million). Forecast 50 for gain on sale in FY2017. Assets Cash and cash equivalents, inc. short-term investments of $3.008 and 51 520 Inventory $4,046 52210 501 Assets of discontinued operations 1.161 14130 Other current assets Total current assets Property and equipment net Noncurrent assets of discontinued operations Other noncurrent assets 462 341,172 57.418 4235 57.759 3783 11,736 12.622 11.945 Total assets Labies and Shareholders investment Accounts payable Accrued expenses and other current liabilities Current portion of LT debt and other borrowings abities of discontinued operations Total current liabilities Long-term debt and other borrowings Deferred income taxes Noncurrent liabilities of discontinued operations Other noncurrent liabilities Total noncurrent liabilities Shareholders' investment Common stock Additional paid-in-capital Retained earnings Accumulated other comprehensive loss Pension and other benefit liabilities Currency translation adjustment and cash flow hedges Total shareholders' investment Total liabilities and shareholders' investment 15.439 4,899 9.644 (588) (561) 13.157 $40.462 13.997 $41,172 Two-Year Ahead Forecasting of Financial Statement Following are the financial statements of Target Corporation from its 2015 annual report. Target Corporation Consolidated Statements of Operations 12 Months Ended Jan 30, 2015 Jan 31, 2015 Feb. 01, 2014 22518 71279 Cost of us Sa Grow 230 Selling and expenses 14 Depreciation and more Ganon e st expense Earnings from co b orincome Provision for income taxe News from conuentions Discontinued operation of tax Nel camino 3.403 1.636) 1.971 Download Attachments

Target Corporation Consolidated Statements of Operations $ millions FY2016 Est. Sales $ 77,776 Cost of sales 54,832 Gross margin 22,944 Selling, general and administrative expenses 15,477 Depreciation and amortization 2,135 Gain on sale 124 Earnings from continuing operations before interest and tax 5,456 Net interest expense 607 Earnings from continuing operations before tax 4,849 Provisions for income taxes 1,576 Net earnings $ 3,273 FY2017 Est. $ 80,887 57,025 23,862 16,097 1,956 x 0 5,636 x 607 0 x 1,639 $ 3,404 X 1.9 We forecast Target's income statement using the following forecast assumptions for both years 20:5 Sale rowth rate Cost of Sales Sen general and intrative penseuses Depreciation and amortization of prior year PPE. Net interest expense Provision for wometeret income Assumere poses of the nessere d Nechance ine persons in 2016 for procesom Instructions: Forecast Target's fiscal year ended 2016 and 2017 income statements Use the same forecasting assumptions for both years Round forecasts to 5 millions Use rounded figures for subsequent forecast calculations. Do not use negative signs with your answers in the income statement Hint Forecasted FY2016 gain on sale is computed as proceeds from the disposal of net assets from discontinued operations minus net assets from discontinued operations ($350 milion $226 million). Forecast 50 for gain on sale in FY2017. Assets Cash and cash equivalents, inc. short-term investments of $3.008 and 51 520 Inventory $4,046 52210 501 Assets of discontinued operations 1.161 14130 Other current assets Total current assets Property and equipment net Noncurrent assets of discontinued operations Other noncurrent assets 462 341,172 57.418 4235 57.759 3783 11,736 12.622 11.945 Total assets Labies and Shareholders investment Accounts payable Accrued expenses and other current liabilities Current portion of LT debt and other borrowings abities of discontinued operations Total current liabilities Long-term debt and other borrowings Deferred income taxes Noncurrent liabilities of discontinued operations Other noncurrent liabilities Total noncurrent liabilities Shareholders' investment Common stock Additional paid-in-capital Retained earnings Accumulated other comprehensive loss Pension and other benefit liabilities Currency translation adjustment and cash flow hedges Total shareholders' investment Total liabilities and shareholders' investment 15.439 4,899 9.644 (588) (561) 13.157 $40.462 13.997 $41,172 Two-Year Ahead Forecasting of Financial Statement Following are the financial statements of Target Corporation from its 2015 annual report. Target Corporation Consolidated Statements of Operations 12 Months Ended Jan 30, 2015 Jan 31, 2015 Feb. 01, 2014 22518 71279 Cost of us Sa Grow 230 Selling and expenses 14 Depreciation and more Ganon e st expense Earnings from co b orincome Provision for income taxe News from conuentions Discontinued operation of tax Nel camino 3.403 1.636) 1.971 Download Attachments

cant fugure out please help. depreciation and amortization is wrong

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started