Answered step by step

Verified Expert Solution

Question

1 Approved Answer

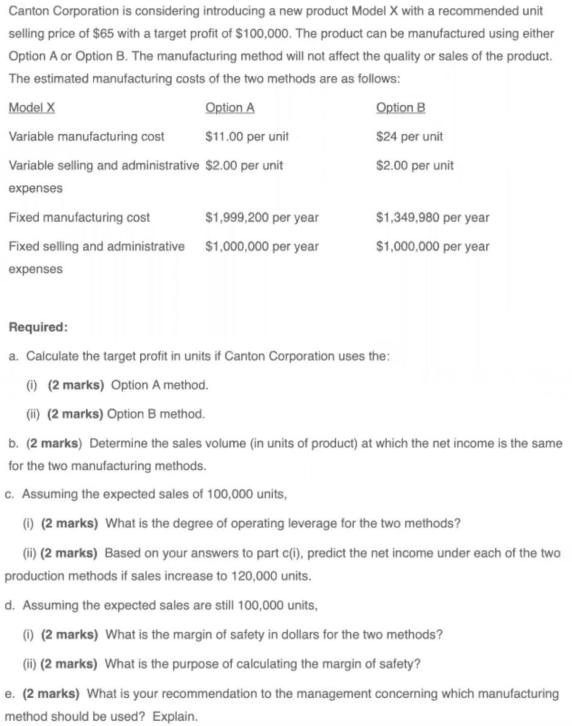

Canton Corporation is considering introducing a new product Model X with a recommended unit selling price of $65 with a target profit of $100,000.

Canton Corporation is considering introducing a new product Model X with a recommended unit selling price of $65 with a target profit of $100,000. The product can be manufactured using either Option A or Option B. The manufacturing method will not affect the quality or sales of the product. The estimated manufacturing costs of the two methods are as follows: Model X Option A Option B Variable manufacturing cost $11.00 per unit Variable selling and administrative $2.00 per unit $24 per unit $2.00 per unit expenses Fixed manufacturing cost $1,999,200 per year $1,349,980 per year Fixed selling and administrative $1,000,000 per year $1,000,000 per year expenses Required: a. Calculate the target profit in units if Canton Corporation uses the: (i) (2 marks) Option A method. (ii) (2 marks) Option B method. b. (2 marks) Determine the sales volume (in units of product) at which the net income is the same for the two manufacturing methods. c. Assuming the expected sales of 100,000 units, (1) (2 marks) What is the degree of operating leverage for the two methods? (ii) (2 marks) Based on your answers to part c(i), predict the net income under each of the two production methods if sales increase to 120,000 units. d. Assuming the expected sales are still 100,000 units, (i) (2 marks) What is the margin of safety in dollars for the two methods? (ii) (2 marks) What is the purpose of calculating the margin of safety? e. (2 marks) What is your recommendation to the management concerning which manufacturing method should be used? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Target profit in units i Option A method Target Profit Unit Selling Price Variable Cost per unit Quantity Fixed Costs 100000 65 11 Quantity 1000000 1999200 100000 54 Quantity 2999200 54 Quantity 299...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started