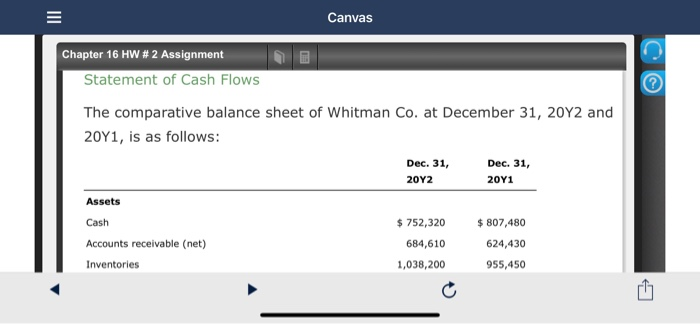

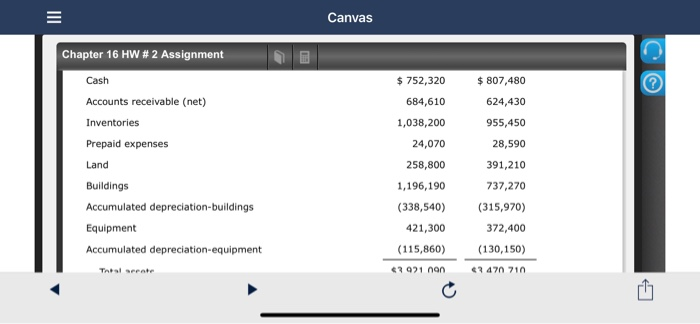

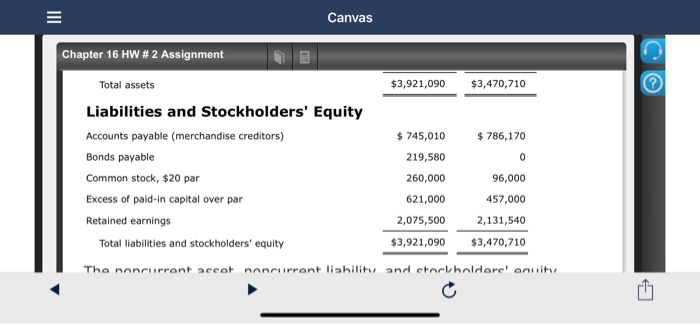

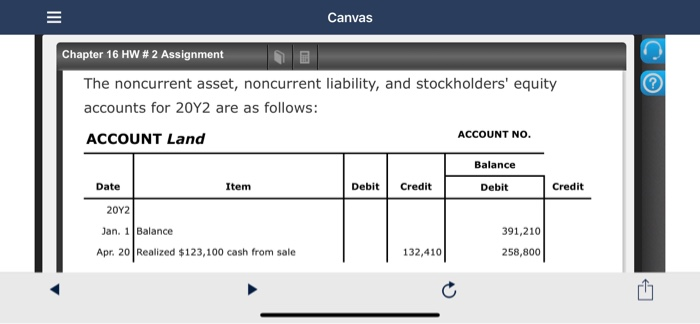

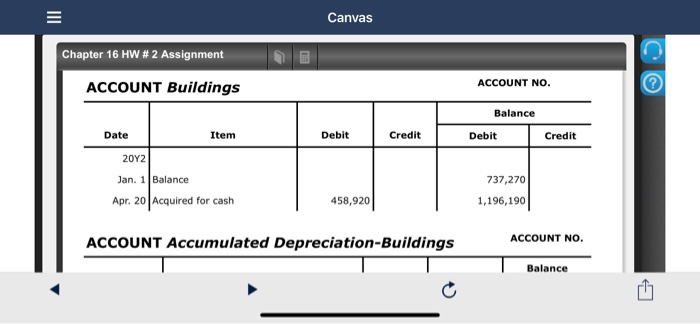

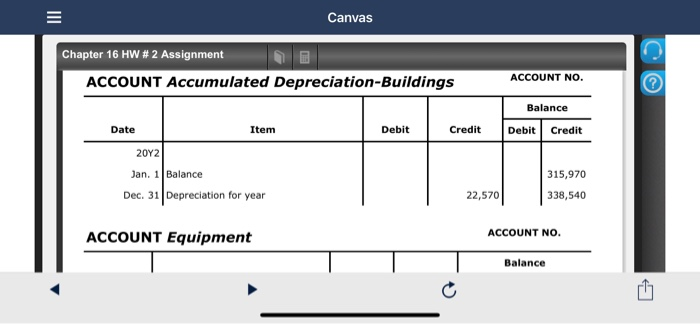

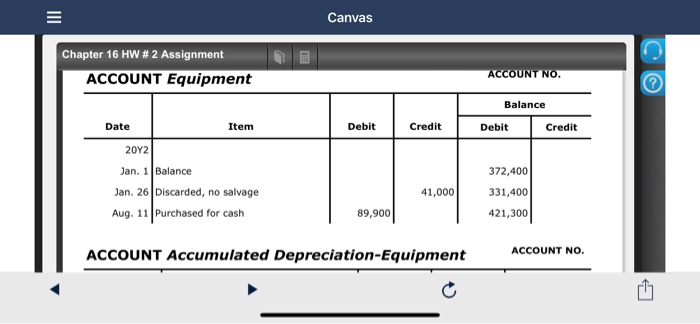

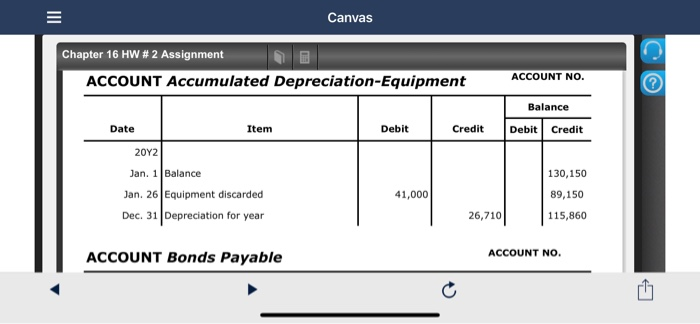

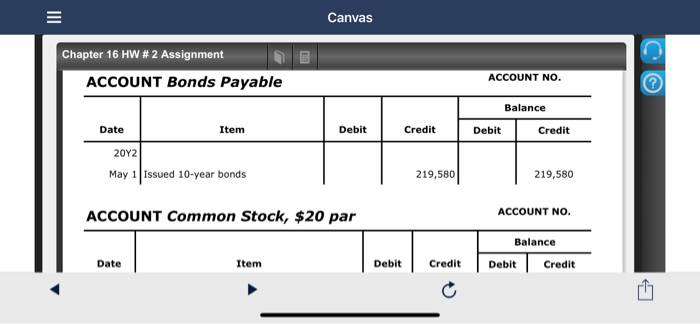

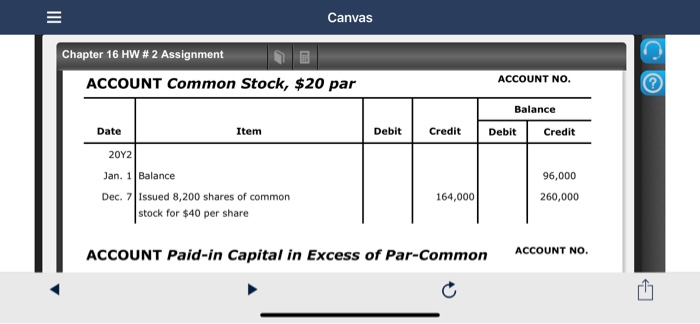

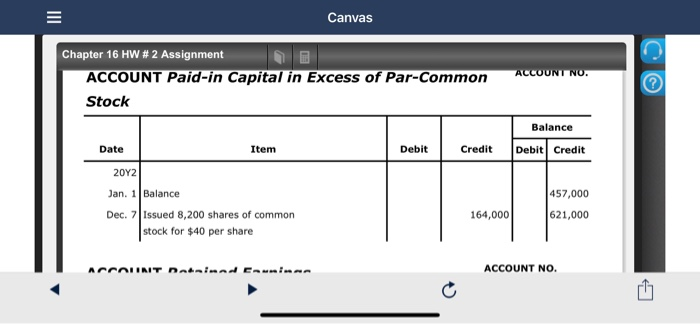

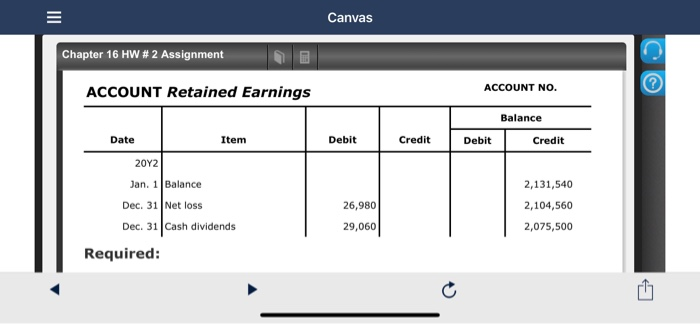

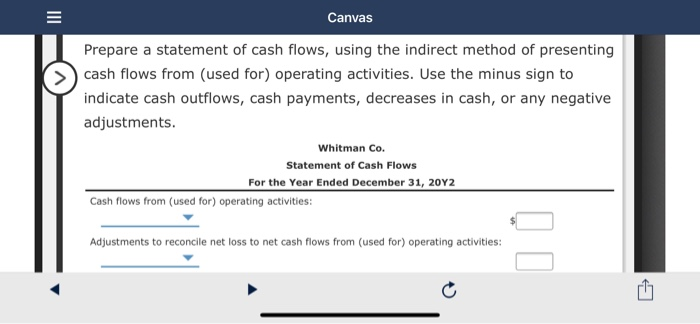

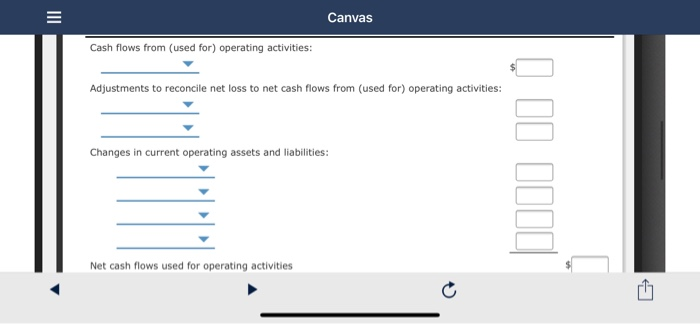

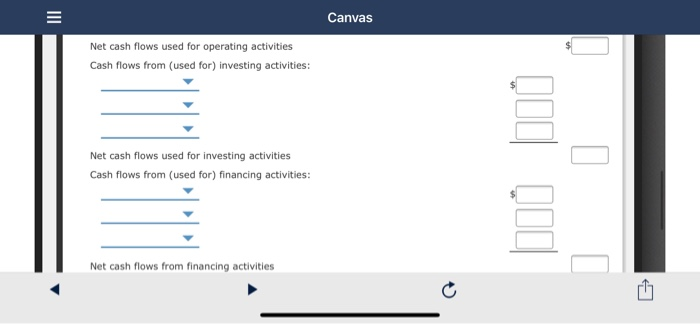

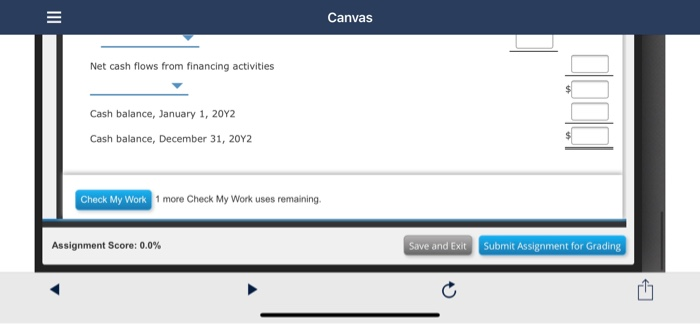

Canvas o Chapter 16 HW #2 Assignment Statement of Cash Flows The comparative balance sheet of Whitman Co. at December 31, 20Y2 and 2001, is as follows: Dec. 31, Dec. 31, 2012 2011 Assets Cash Accounts receivable (net) Inventories $ 752,320 684,610 1,038,200 $ 807,480 624,430 955,450 Canvas 0 @ Chapter 16 HW # 2 Assignment Cash Accounts receivable (net) Inventories Prepaid expenses Land $ 752,320 684,610 1,038,200 24,070 258,800 1,196,190 (338,540) 421,300 (115,860) $ 807,480 624,430 955,450 28,590 391,210 737,270 (315,970) 372,400 (130,150) Buildings Accumulated depreciation buildings Equipment Accumulated depreciation-equipment Tata Seat 43921 non 247 710 Canvas 0 0 Chapter 16 HW # 2 Assignment Total assets $3,921,090 $3,470,710 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) $ 745,010 $ 786,170 Bonds payable 219,580 Common stock, $20 par 260,000 96,000 Excess of paid-in capital over par 621,000 457,000 Retained earnings 2,075,500 2,131,540 Total liabilities and stockholders' equity $3,921,090 $3,470,710 The noncurrent accot noncurrent liability and stor holdere anni Canvas 0 Chapter 16 HW #2 Assignment The noncurrent asset, noncurrent liability, and stockholders' equity accounts for 20Y2 are as follows: ACCOUNT Land ACCOUNT NO. Balance Date Debit Credit 2012 1 Balance 391,210 Apr. 20 Realized $123,100 cash from sale Item Debit Credit 132,410 258,800 Canvas Chapter 16 HW #2 Assignment o ACCOUNT Buildings ACCOUNT NO. Balance Debit Date Debit Credit Credit Item 2012 Jan. 1 Balance Apr. 20 Acquired for cash 737,270 1,196,190 458,920 ACCOUNT Accumulated Depreciation-Buildings ACCOUNT NO. Balance Canvas 0 Chapter 16 HW #2 Assignment ACCOUNT Accumulated Depreciation-Buildings ACCOUNT NO. Balance Debit Credit Debit Credit Date Item 2012 Jan. 1 Balance Dec. 31 Depreciation for year 315,970 22,570 338,540 ACCOUNT Equipment ACCOUNT NO. Balance Canvas o Chapter 16 HW #2 Assignment ACCOUNT Equipment ACCOUNT NO. Balance Debit Credit Item Debit Credit Date 2092 Jan. 1 Balance Jan. 26 Discarded, no salvage Aug. 11 Purchased for cash 372,400 331,400 41,000 89,900 421,300 ACCOUNT Accumulated Depreciation-Equipment ACCOUNT NO. Canvas 0 Chapter 16 HW # 2 Assignment ACCOUNT Accumulated Depreciation Equipment ACCOUNT NO. Balance Debit Credit Date Debit Credit Item 2012 Jan. 1 Balance Jan. 26 Equipment discarded Dec. 31 Depreciation for year 130,150 41,000 89,150 26,7101 115,860 ACCOUNT NO. ACCOUNT Bonds Payable Canvas 0 Chapter 16 HW #2 Assignment ACCOUNT Bonds Payable ACCOUNT NO. Balance Debit Credit Date Item Debit Credit 2012 May 1 Issued 10-year bonds 219,580 219,580 ACCOUNT Common Stock, $20 par ACCOUNT NO. Balance Debit Credit Date Item Debit Credit Canvas 0 Chapter 16 HW # 2 Assignment ACCOUNT Common Stock, $20 par ACCOUNT NO. Balance Debit Credit Debit Credit Date Item 2012 Jan. 1 Balance Dec. 7 issued 8,200 shares of common stock for $40 per share 96,000 164,000 260,000 ACCOUNT Paid-in Capital in Excess of Par-Common ACCOUNT NO. Canvas o Chapter 16 HW #2 Assignment ACCOUNT Paid-in Capital in Excess of Par-Common Stock ACCOUNT NO. Balance Debit Credit Date Item Debit Credit 2012 Jan. 1 Balance Dec. 7 Issued 8,200 shares of common stock for $40 per share 457,000 621,000 164,000 ACCAIINIT Detained in ACCOUNT NO. Canvas Chapter 16 HW # 2 Assignment o ACCOUNT Retained Earnings ACCOUNT NO. Balance Credit Debit Credit Debit Date Item 20Y2 Jan. 1 Balance Dec. 31 Net loss Dec. 31 Cash dividends Required: 26,980 2,131,540 2,104,560 2,075,500 29,060 III Canvas Prepare a statement of cash flows, using the indirect method of presenting cash flows from (used for) operating activities. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Whitman Co. Statement of Cash Flows For the Year Ended December 31, 2012 Cash flows from (used for) operating activities: Adjustments to reconcile net loss to net cash flows from (used for) operating activities: Canvas Cash flows from (used for) operating activities: Adjustments to reconcile net loss to net cash flows from (used for) operating activities: Changes in current operating assets and liabilities: Net cash flows used for operating activities Canvas o Net cash flows used for operating activities Cash flows from (used for) investing activities: Net cash flows used for investing activities Cash flows from (used for) financing activities: Net cash flows from financing activities Canvas Net cash flows from financing activities Cash balance, January 1, 2012 Cash balance, December 31, 2012 Check My Work 1 more Check My Work uses remaining. Assignment Score: 0.0% Save and Exit Submit Assignment for Grading