Answered step by step

Verified Expert Solution

Question

1 Approved Answer

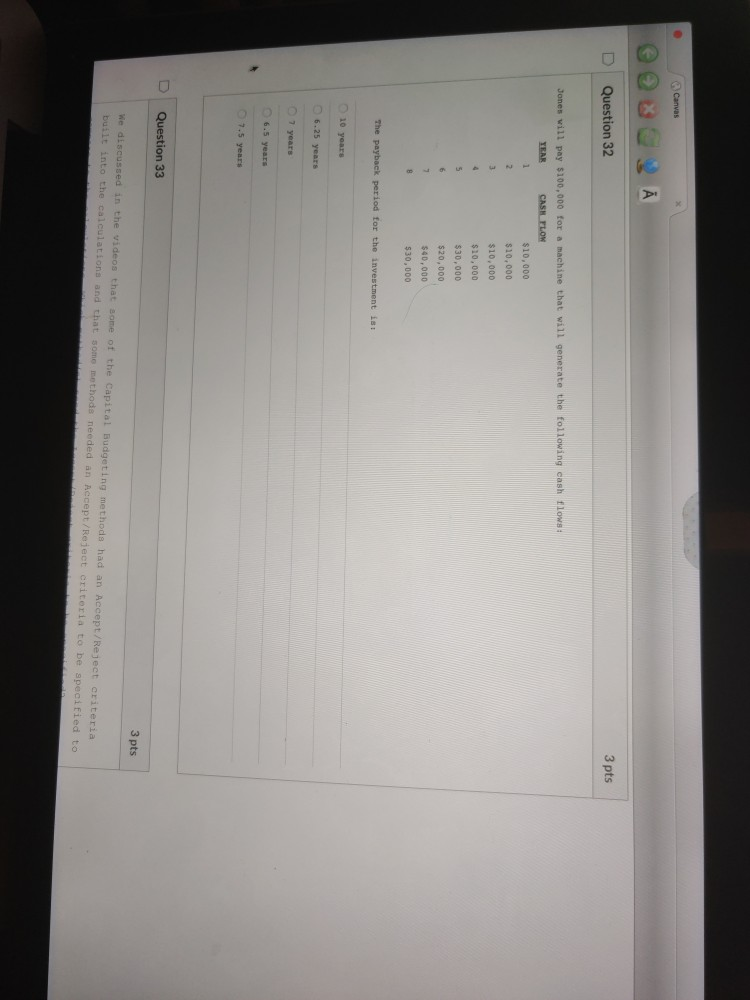

Canvas Question 32 3 pts Jones will pay $100,000 for a machine that will generate the following cash flows: YEAR CASH FLOW 1 $10,000 2

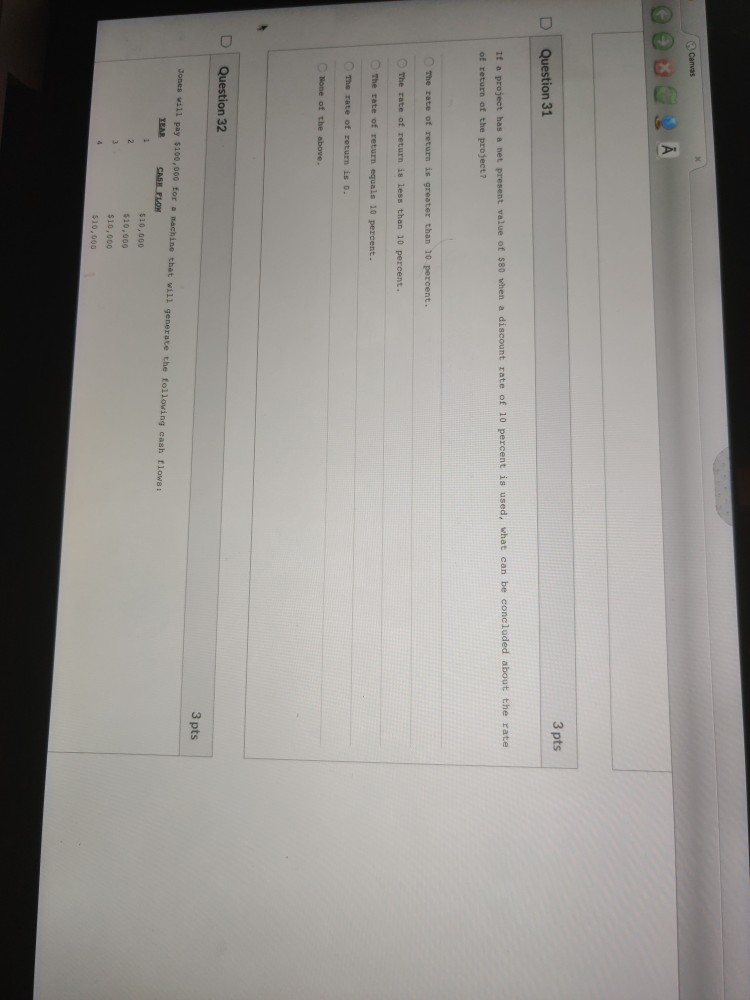

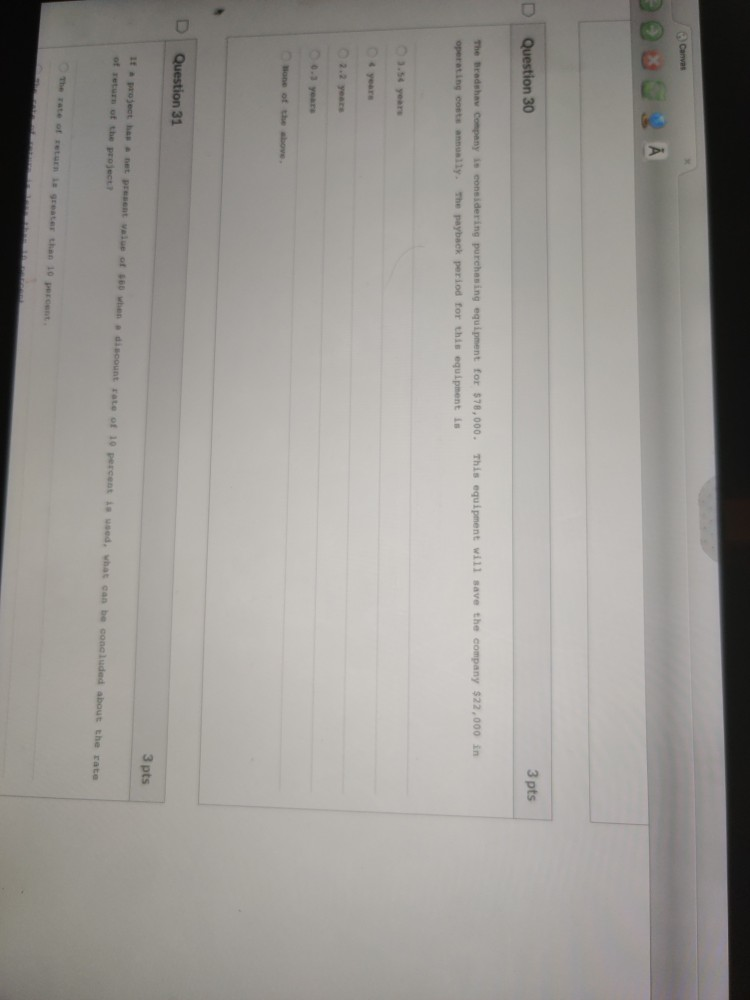

Canvas Question 32 3 pts Jones will pay $100,000 for a machine that will generate the following cash flows: YEAR CASH FLOW 1 $10,000 2 $10,000 $10,000 $10,000 $30,000 $20,000 $40,000 $30,000 The payback period for the investment is 10 years 6.25 years 7 years 7.5 years Question 33 3 pts We discussed in the videos that some of the capital Budgeting methods had an Accept/Reject criteria built into the calculations and that some methods needed an Accept/Reject criteria to be specified to Canvas 3 pts D Question 31 If a project has a net present value of $80 when a discount rate of 10 percent is used, what can be concluded about the rate of return of the project? The rate of return is greater than 10 percent. The rate of return is less than 10 percent. The rate of return equals 10 percent. The rate of return is 0. None of the above. Question 32 3 pts Jones will pay $100,000 for a machine that will generate the following cash flows: YEAR CASH FLOW 1 $10,000 2 $10,000 $10,000 $10,000 Canvas Question 30 3 pts The Bradshaw Company is considering purchasing equipment for $78,000. This equipment will save the company $22,000 in operating costs annually. The payback period for this equipment is one of the above Question 31 3 pts It project has a present value of 0 when discount rate of 10 percent is woed, what can be concluded about the rate of return of the project The rate of return is greater than 10 percent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started