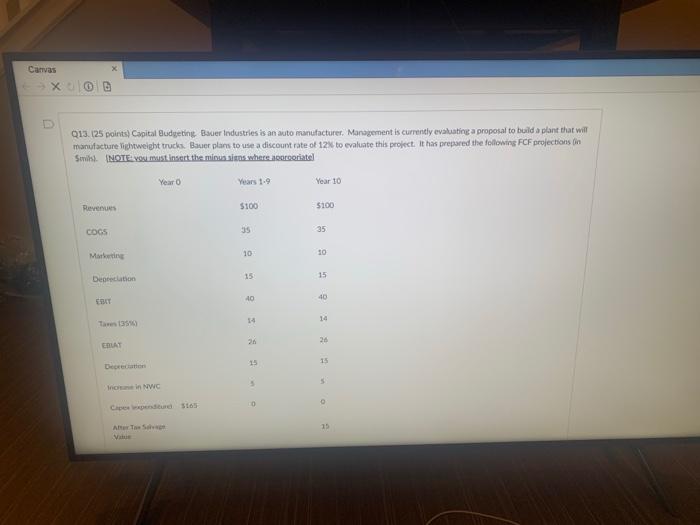

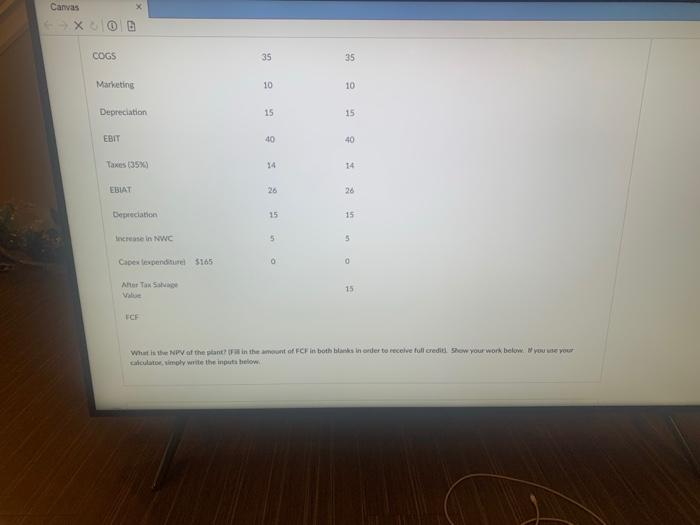

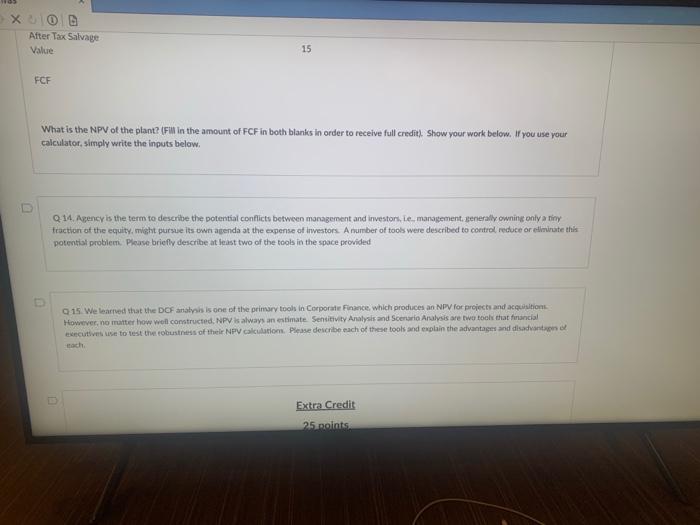

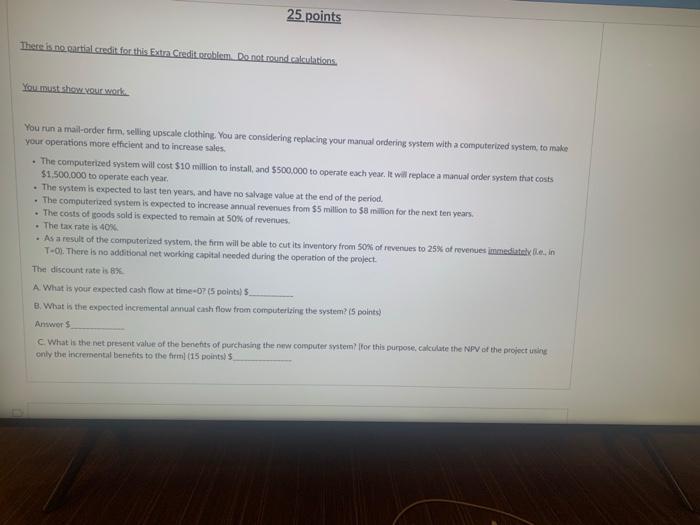

Canvas X Q13. 125 points) Capital Budgeting Bauer Industries is an auto manufacturer. Management is currently evaluating a proposal to build a plant that will manufacture lightweight trucks. Bauer plans to use a discount rate of 12 to evaluate this project. It has prepared the following FCF projections in Sevil NOTE: You must insert the minus sits where otoritel Year 0 Years 1.9 Year 10 Renes $100 5100 COGS Marketing 10 10 15 15 Deprecation 40 40 14 26 26 ERAT 15 inom in Nwo Cependiture 5165 ARTS 15 Canvas X 0 B COGS 35 35 Marketing 10 10 Depreciation 15 15 EBIT 40 40 Taxes (35%) 14 EBAT 26 26 Depreciation 15 15 increase in NWC 5 5 Capes expenditure 5165 0 0 ARTS be 15 FCF What is the NPV of the plants in the amount of FCF in both banks in order to receive tull credil Show your work below. You use your calculator simply write the inputs below X80 After Tax Salvage Value 15 FCF What is the NPV of the plant? (FM in the amount of FCF in both blandes in order to receive full credit). Show your work below. If you use your calculator, simply write the inputs below. Q 14. Agency is the term to describe the potential conflicts between management and investors, le management generally owning only a tiny fraction of the equity, might pursue its own agenda at the expense of investors. A number of tools were described to control, reduce or eliminate this potential problem. Please briefly describe at least two of the tools in the space provided 15. We learned that the DCF analysis is one of the primary tools in Corporate Finance, which produces an NPV for projects and acquisition However, no matter how well constructed. NPV is always an estimate Sensitivity Analysis and Scenario Analysis are two tools that financial executive use to test the robustness of their NPV calculation. Please describe each of these tools and explain the advantages and disadvantage cach Extra Credit 25 points 25 points There is no cartial credit for this Extra Credit.roblem. Do not round calculations. You must show our work You run a mail-order firm, selling upscale clothing. You are considering replacing your manual ordering system with a computerized system to make your operations more efficient and to increase sales The computerized system will cost $10 million to install, and $500,000 to operate each year. It will replace a manual onder system that costs $1.500.000 to operate each year. The system is expected to last ten years, and have no salvage value at the end of the period. The computerized system is expected to increase annual revenues from $5 million to $8 million for the next ten years. The costs of goods sold is expected to remain at 50% of revenues The tax rates 40% . As a result of the computerized system, the firm will be able to cut its inventory from 50% of revenues to 25% of revenues immediately, in T-01. There is no additional networking capital needed during the operation of the project The discount rate is 8 A What is your expected cash flow at time-O? (5 points) B. What is the expected incremental annual cash flow from computerizing the system is points) Answers c. What is the net present value of the benents of purchasing the new computer system for this purpose, calculate the NPV of the project using only the incremental benefits to the firm (15 points)