Answered step by step

Verified Expert Solution

Question

1 Approved Answer

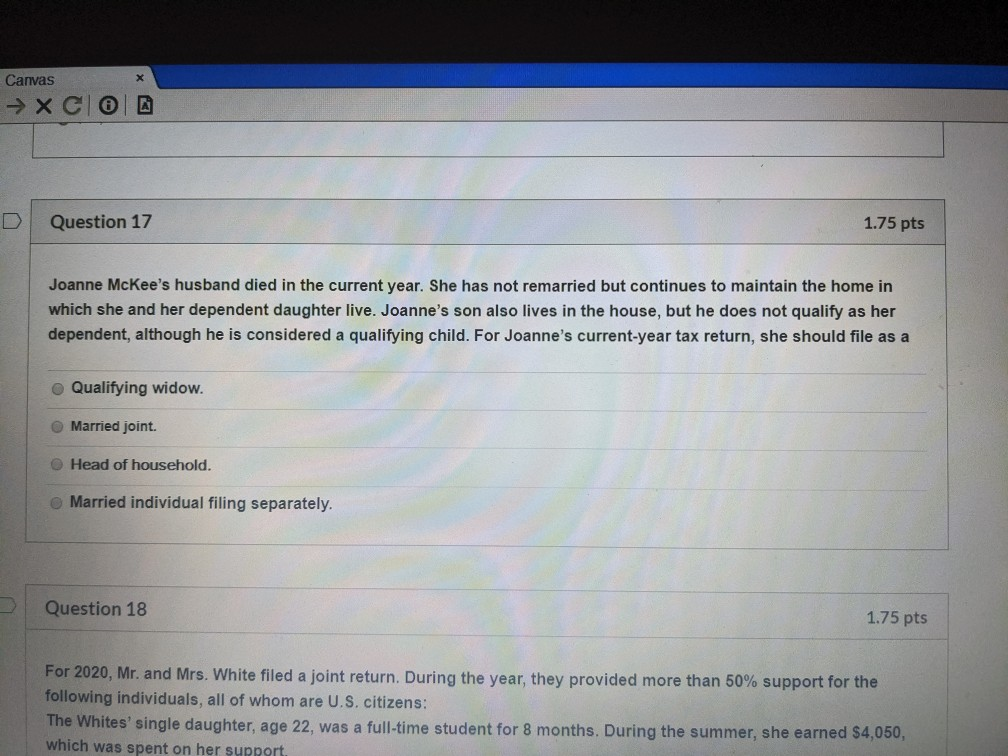

Canvas XC O Question 17 1.75 pts Joanne McKee's husband died in the current year. She has not remarried but continues to maintain the home

Canvas XC O Question 17 1.75 pts Joanne McKee's husband died in the current year. She has not remarried but continues to maintain the home in which she and her dependent daughter live. Joanne's son also lives in the house, but he does not qualify as her dependent, although he is considered a qualifying child. For Joanne's current-year tax return, she should file as a Qualifying widow. Married joint. Head of household. Married individual filing separately. Question 18 1.75 pts For 2020, Mr. and Mrs. White filed a joint return. During the year, they provided more than 50% support for the following individuals, all of whom are U.S. citizens: The Whites' single daughter, age 22, was a full-time student for 8 months. During the summer, she earned $4,050, which was spent on her support

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started