Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Discuss three advantages and three disadvantages of electing to be taxed as an S corporation over a C corporation or a partnership. When appropriate

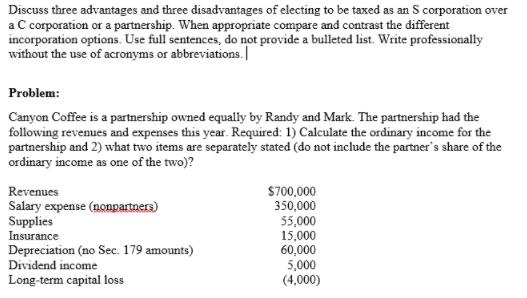

Discuss three advantages and three disadvantages of electing to be taxed as an S corporation over a C corporation or a partnership. When appropriate compare and contrast the different incorporation options. Use full sentences, do not provide a bulleted list. Write professionally without the use of acronyms or abbreviations. Problem: Canyon Coffee is a partnership owned equally by Randy and Mark. The partnership had the following revenues and expenses this year. Required: 1) Calculate the ordinary income for the partnership and 2) what two items are separately stated (do not include the partner's share of the ordinary income as one of the two)? Revenues $700,000 350,000 55,000 15,000 60,000 5,000 (4,000) Salary expense (nonpartners) Supplies Insurance Depreciation (no Sec. 179 amounts) Dividend income Long-term capital loss

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Solution Essay S corporation is a corporation that is treated for federal tax purposes as a pass through entity through an election made with the inte...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started