After graduating from college in May 2018, Ryan Crews started his career in finance at the W&T Corporation, a small- to medium-sized warehouse distributor

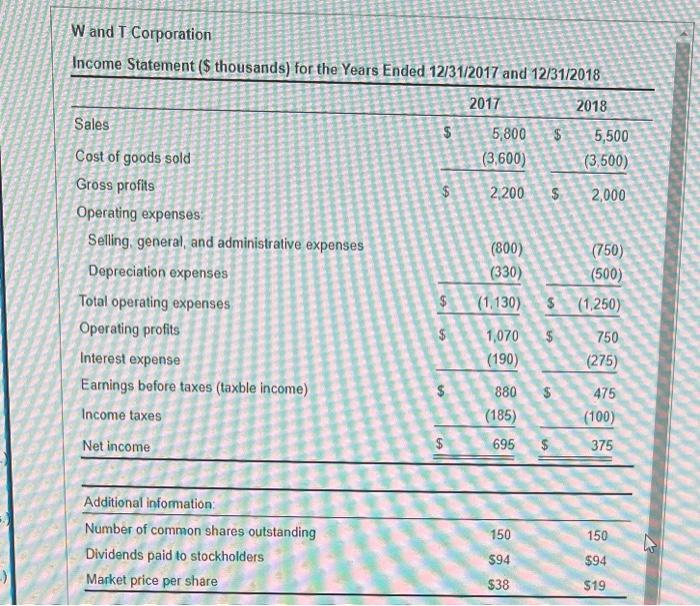

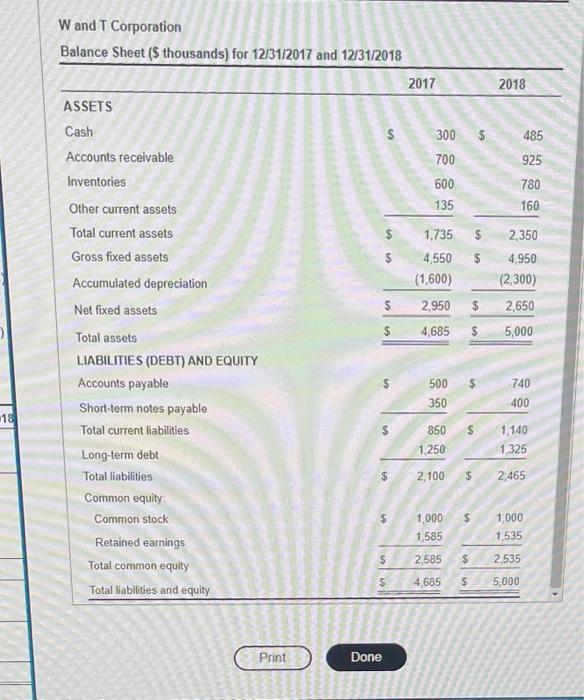

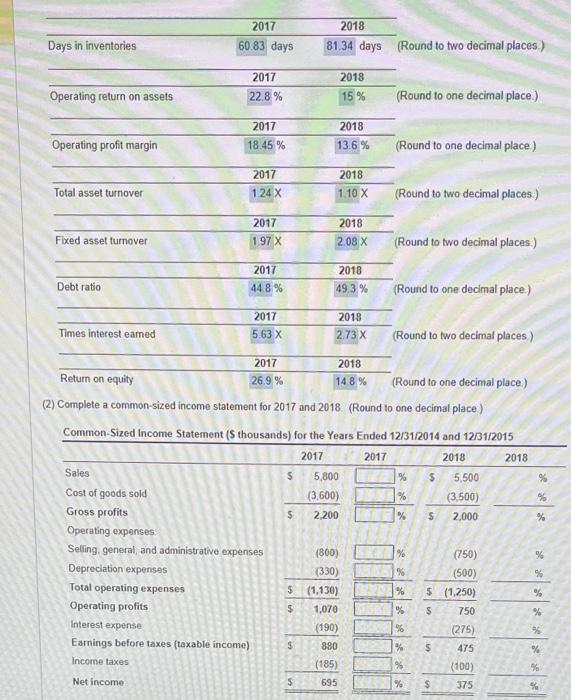

After graduating from college in May 2018, Ryan Crews started his career in finance at the W&T Corporation, a small- to medium-sized warehouse distributor in Nashville, Tennessee. The company was founded by David Winston and Colin Tabor in 2005, after they have worked together in management at Walmart. Although Crews had an offer from Sam's Club, he became excited about the opportunity with W&T For W&T, 2017 tumed out to be a good financial year. But in 2018, the company experienced a 5.3 percent sales reduction, where sales declined from $5.8 million to $5.5 million. The downturn then led to other financial problems, including a 50 percent reduction in the company's stock price. The share price went from $38 per share at the end of 2017 to $19 per share at the end of 2018! David Winston and Colin Tabor want to understand what may have happened. Financial information for W&T for both years is shown in the popup window, for per-share data, are shown in thousands. 4 where all the numbers, except W and T Corporation Income Statement ($ thousands) for the Years Ended 12/31/2017 and 12/31/2018 2017 Sales Cost of goods sold Gross profits Operating expenses Selling, general, and administrative expenses Depreciation expenses Total operating expenses Operating profits Interest expense Earnings before taxes (taxble income) Income taxes Net income Additional information: Number of common shares outstanding Dividends paid to stockholders Market price per share $ $ $ $ $ 5,800 $ (3.600) 2,200 $ (800) (330) (1.130) 1,070 (190) 880 (185) 695 150 $94 $38 2018 5,500 (3,500) 2,000 (750) (500) $ (1,250) $ 750 (275) 475 (100) 375 150 $94 $19 18 W and T Corporation Balance Sheet($ thousands) for 12/31/2017 and 12/31/2018 ASSETS Cash Accounts receivable Inventories Other current assets Total current assets Gross fixed assets Accumulated depreciation Net fixed assets Total assets LIABILITIES (DEBT) AND EQUITY Accounts payable Short-term notes payable Total current liabilities Long-term debt Total liabilities Common equity Common stock Retained earnings Total common equity Total liabilities and equity Print MA SAM $ $ S GA $ $ Done 1,735 2,350 4,550 4,950 (1,600) (2,300) 2,950 2,650 $ 4,685 $ 5,000 $ $ 2017 300 700 600 135 500 350 850 1,250 2,100 $ $ $ S 2018 485 925 780 160 740 400 1,140 1,325 2,465 1,000 1,585 2,585 $ 2,535 4,685 $ 5,000 1,000 1,535 Days in inventories Operating return on assets Operating profit margin Total asset turnover Fixed asset turnover Debt ratio Times interest earned 2017 60.83 days Sales Cost of goods sold Gross profits 2017 22.8% 2017 18.45 % 2017 1.24 X 2017 1.97 X 2017 44.8% 2017 5.63 X 2017 26.9 % Operating expenses Selling, general, and administrative expenses Depreciation expenses Total operating expenses Operating profits Interest expense Earnings before taxes (taxable income) Income taxes Net income S $ 2018 81.34 days $ 2018 15% $ 2018 13.6% 2018 1.10 X 2018 2.08 X 2018 49.3 % 2018 2.73 X 2018 14.8 % (800) (330) S (1,130) $ 1,070 (190) 880 (185) 695 Return on equity (Round to one decimal place.) (2) Complete a common-sized income statement for 2017 and 2018. (Round to one decimal place.) Common-Sized Income Statement ($ thousands) for the Years Ended 12/31/2014 and 12/31/2015 2017 2017 2018 5,800 (3,600) 2,200 (Round to two decimal places.) (Round to one decimal place.) (Round to one decimal place.) (Round to two decimal places.) (Round to two decimal places.) (Round to one decimal place.) (Round to two decimal places) $ 5,500 % (3,500) % $ 2,000 % %. se je a je % % % % % 4 % (750) (500) $ (1,250) $ 750 (275) 475 (100) 375 $ 2018 je je je % % % % % %

Step by Step Solution

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

To complete the commonsized income statement for 2017 and 2018 we must express each li...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started