Cape Climate (Pty) Ltd is a company based in Cape Town that supplies residential and commercial air conditioners. The company has a June financial

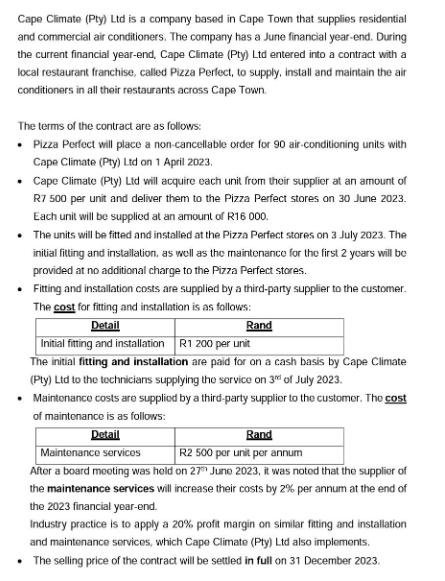

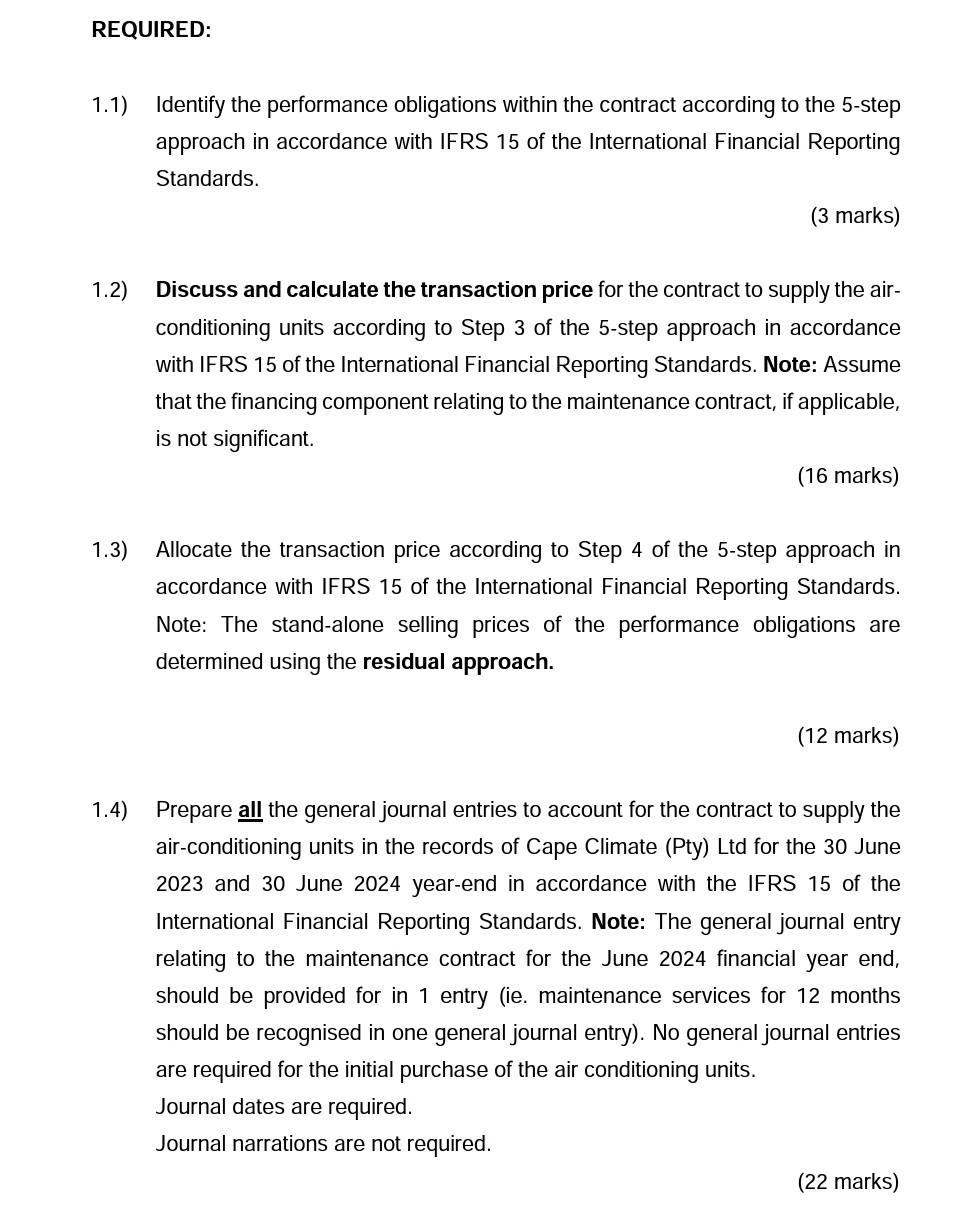

Cape Climate (Pty) Ltd is a company based in Cape Town that supplies residential and commercial air conditioners. The company has a June financial year-end. During the current financial year-end, Cape Climate (Pty) Ltd entered into a contract with a local restaurant franchise, called Pizza Perfect, to supply, install and maintain the air conditioners in all their restaurants across Cape Town. The terms of the contract are as follows: Pizza Perfect will place a non-cancellable order for 90 air-conditioning units with Cape Climate (Pty) Ltd on 1 April 2023. Cape Climate (Pty) Ltd will acquire each unit from their supplier at an amount of R7 500 per unit and deliver them to the Pizza Perfect stores on 30 June 2023. Each unit will be supplied at an amount of R16 000. The units will be fitted and installed at the Pizza Perfect stores on 3 July 2023. The initial fitting and installation, as well as the maintenance for the first 2 years will be provided at no additional charge to the Pizza Perfect stores. Fitting and installation costs are supplied by a third-party supplier to the customer. The cost for fitting and installation is as follows: Detail Rand Initial fitting and installation R1 200 per unit The initial fitting and installation are paid for on a cash basis by Cape Climate (Pty) Ltd to the technicians supplying the service on 3rd of July 2023. Maintenance costs are supplied by a third-party supplier to the customer. The cost of maintenance is as follows: Rand Detail Maintenance services R2 500 per unit per annum After a board meeting was held on 27 June 2023, it was noted that the supplier of the maintenance services will increase their costs by 2% per annum at the end of the 2023 financial year-end. Industry practice is to apply a 20% profit margin on similar fitting and installation and maintenance services, which Cape Climate (Pty) Ltd also implements. The selling price of the contract will be settled in full on 31 December 2023. REQUIRED: 1.1) 1.2) 1.3) Identify the performance obligations within the contract according to the 5-step approach in accordance with IFRS 15 of the International Financial Reporting Standards. (3 marks) Discuss and calculate the transaction price for the contract to supply the air- conditioning units according to Step 3 of the 5-step approach in accordance with IFRS 15 of the International Financial Reporting Standards. Note: Assume that the financing component relating to the maintenance contract, if applicable, is not significant. (16 marks) Allocate the transaction price according to Step 4 of the 5-step approach in accordance with IFRS 15 of the International Financial Reporting Standards. Note: The stand-alone selling prices of the performance obligations are determined using the residual approach. (12 marks) 1.4) Prepare all the general journal entries to account for the contract to supply the air-conditioning units in the records of Cape Climate (Pty) Ltd for the 30 June 2023 and 30 June 2024 year-end in accordance with the IFRS 15 of the International Financial Reporting Standards. Note: The general journal entry relating to the maintenance contract for the June 2024 financial year end, should be provided for in 1 entry (ie. maintenance services for 12 months should be recognised in one general journal entry). No general journal entries are required for the initial purchase of the air conditioning units. Journal dates are required. Journal narrations are not required. (22 marks) Note: All amounts should be rounded to the nearest Rand. Show all calculations clearly. Your answer must comply with International Financial Reporting Standards (IFRS). Ignore and value-added tax and income tax implications.

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

11 Identify the performance obligations within the contract according to the 5step approach in accordance with IFRS 15 of the International Financial Reporting Standards answer The contract has 3 perf...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started