Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Capello & Sons Ltd. purchased a truck on January 1, 2015 for $60 000. It is estimated that the truck will have a $5

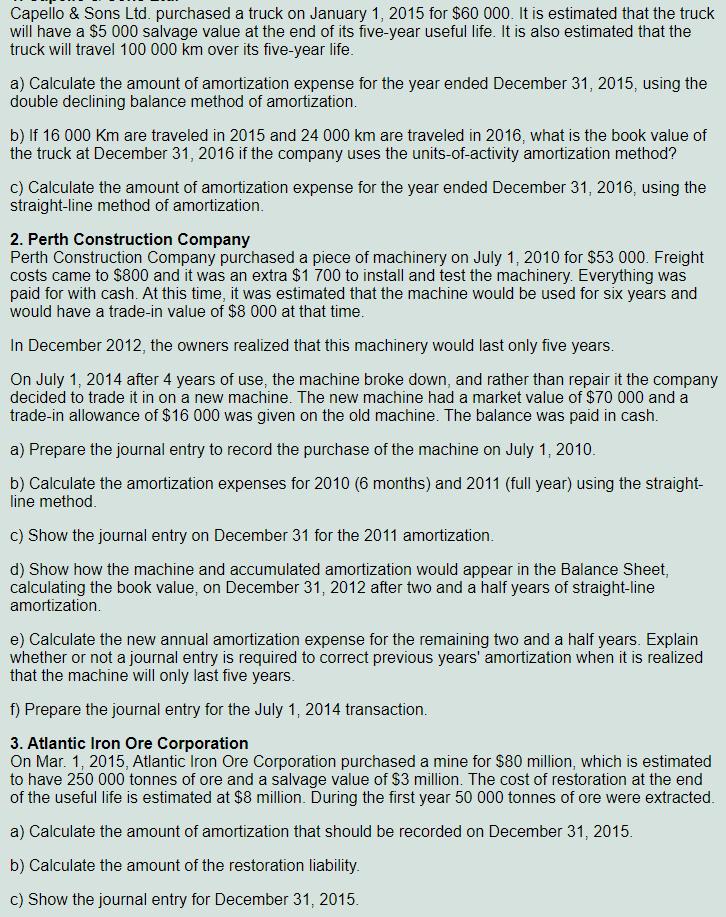

Capello & Sons Ltd. purchased a truck on January 1, 2015 for $60 000. It is estimated that the truck will have a $5 000 salvage value at the end of its five-year useful life. It is also estimated that the truck will travel 100 000 km over its five-year life. a) Calculate the amount of amortization expense for the year ended December 31, 2015, using the double declining balance method of amortization. b) If 16 000 Km are traveled in 2015 and 24 000 km are traveled in 2016, what is the book value of the truck at December 31, 2016 if the company uses the units-of-activity amortization method? c) Calculate the amount of amortization expense for the year ended December 31, 2016, using the straight-line method of amortization. 2. Perth Construction Company Perth Construction Company purchased a piece of machinery on July 1, 2010 for $53 000. Freight costs came to $800 and it was an extra $1 700 to install and test the machinery. Everything was paid for with cash. At this time, it was estimated that the machine would be used for six years and would have a trade-in value of $8 000 at that time. In December 2012, the owners realized that this machinery would last only five years. On July 1, 2014 after 4 years of use, the machine broke down, and rather than repair it the company decided to trade it in on a new machine. The new machine had a market value of $70 000 and a trade-in allowance of $16 000 was given on the old machine. The balance was paid in cash. a) Prepare the journal entry to record the purchase of the machine on July 1, 2010. b) Calculate the amortization expenses for 2010 (6 months) and 2011 (full year) using the straight- line method. c) Show the journal entry on December 31 for the 2011 amortization. d) Show how the machine and accumulated amortization would appear in the Balance Sheet, calculating the book value, on December 31, 2012 after two and a half years of straight-line amortization. e) Calculate the new annual amortization expense for the remaining two and a half years. Explain whether or not a journal entry is required to correct previous years' amortization when it is realized that the machine will only last five years. f) Prepare the journal entry for the July 1, 2014 transaction. 3. Atlantic Iron Ore Corporation On Mar. 1, 2015, Atlantic Iron Ore Corporation purchased a mine for $80 million, which is estimated to have 250 000 tonnes of ore and a salvage value of $3 million. The cost of restoration at the end of the useful life is estimated at $8 million. During the first year 50 000 tonnes of ore were extracted. a) Calculate the amount of amortization that should be recorded on December 31, 2015. b) Calculate the amount of the restoration liability. c) Show the journal entry for December 31, 2015.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the amount of amortization expense for the year ended December 31 2015 using the double declining balance method of amortization we nee...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e428a473ce_959003.pdf

180 KBs PDF File

663e428a473ce_959003.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started