Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Capital Budgeting: A profitable firm is considering a new project that has the following projected cash flows. The capital investment in plant and property at

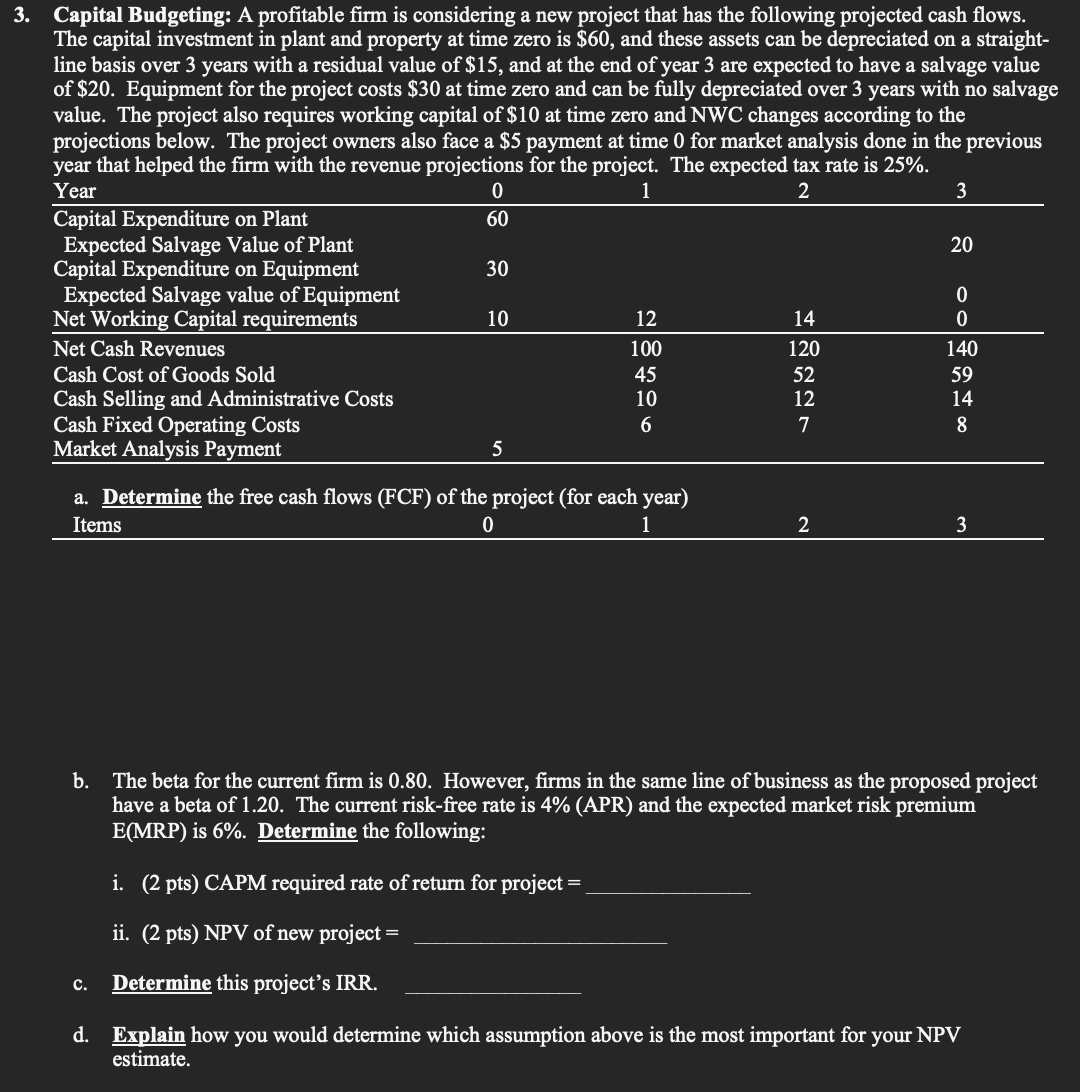

Capital Budgeting: A profitable firm is considering a new project that has the following projected cash flows. The capital investment in plant and property at time zero is \\( \\$ 60 \\), and these assets can be depreciated on a straightline basis over 3 years with a residual value of \\( \\$ 15 \\), and at the end of year 3 are expected to have a salvage value of \\( \\$ 20 \\). Equipment for the project costs \\( \\$ 30 \\) at time zero and can be fully depreciated over 3 years with no salvage value. The project also requires working capital of \\( \\$ 10 \\) at time zero and NWC changes according to the projections below. The project owners also face a \\( \\$ 5 \\) payment at time 0 for market analysis done in the previous a. Determine the free cash flows (FCF) of the project (for each year) Items 0 1 2 3 b. The beta for the current firm is \\( \\mathbf{0 . 8 0} \\). However, firms in the same line of business as the proposed project have a beta of 1.20 . The current risk-free rate is \4 (APR) and the expected market risk premium \\( \\mathrm{E}(\\mathrm{MRP}) \\) is \6. Determine the following: i. (2 pts) CAPM required rate of return for project \\( = \\) ii. \\( (2 \\mathrm{pts}) \\mathrm{NPV} \\) of new project \\( = \\) c. Determine this project's IRR. d. Explain how you would determine which assumption above is the most important for your NPV estimate

Capital Budgeting: A profitable firm is considering a new project that has the following projected cash flows. The capital investment in plant and property at time zero is \\( \\$ 60 \\), and these assets can be depreciated on a straightline basis over 3 years with a residual value of \\( \\$ 15 \\), and at the end of year 3 are expected to have a salvage value of \\( \\$ 20 \\). Equipment for the project costs \\( \\$ 30 \\) at time zero and can be fully depreciated over 3 years with no salvage value. The project also requires working capital of \\( \\$ 10 \\) at time zero and NWC changes according to the projections below. The project owners also face a \\( \\$ 5 \\) payment at time 0 for market analysis done in the previous a. Determine the free cash flows (FCF) of the project (for each year) Items 0 1 2 3 b. The beta for the current firm is \\( \\mathbf{0 . 8 0} \\). However, firms in the same line of business as the proposed project have a beta of 1.20 . The current risk-free rate is \4 (APR) and the expected market risk premium \\( \\mathrm{E}(\\mathrm{MRP}) \\) is \6. Determine the following: i. (2 pts) CAPM required rate of return for project \\( = \\) ii. \\( (2 \\mathrm{pts}) \\mathrm{NPV} \\) of new project \\( = \\) c. Determine this project's IRR. d. Explain how you would determine which assumption above is the most important for your NPV estimate Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started