Answered step by step

Verified Expert Solution

Question

1 Approved Answer

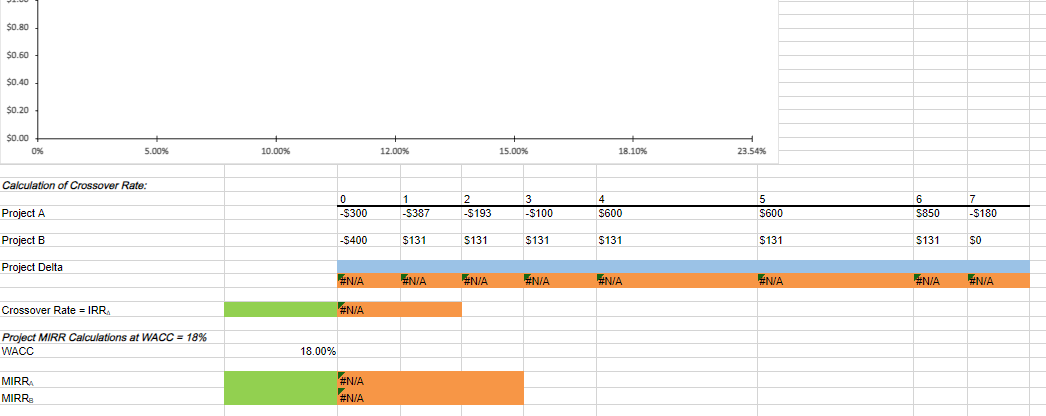

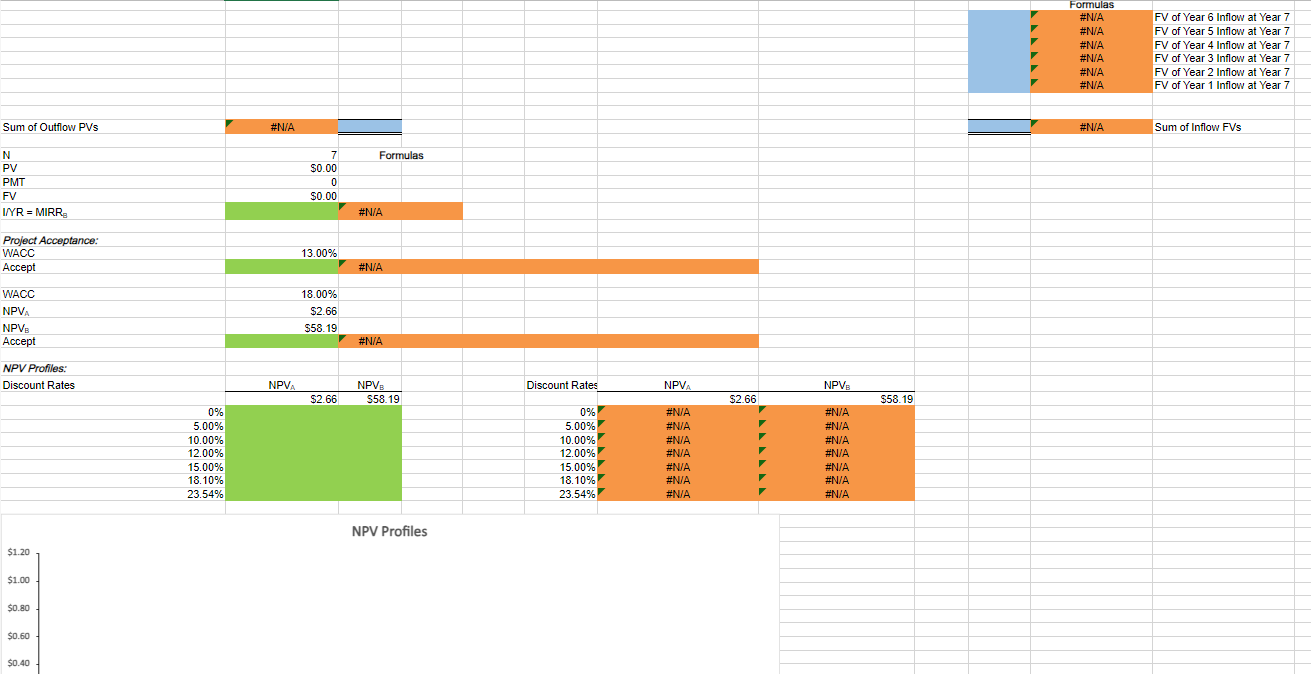

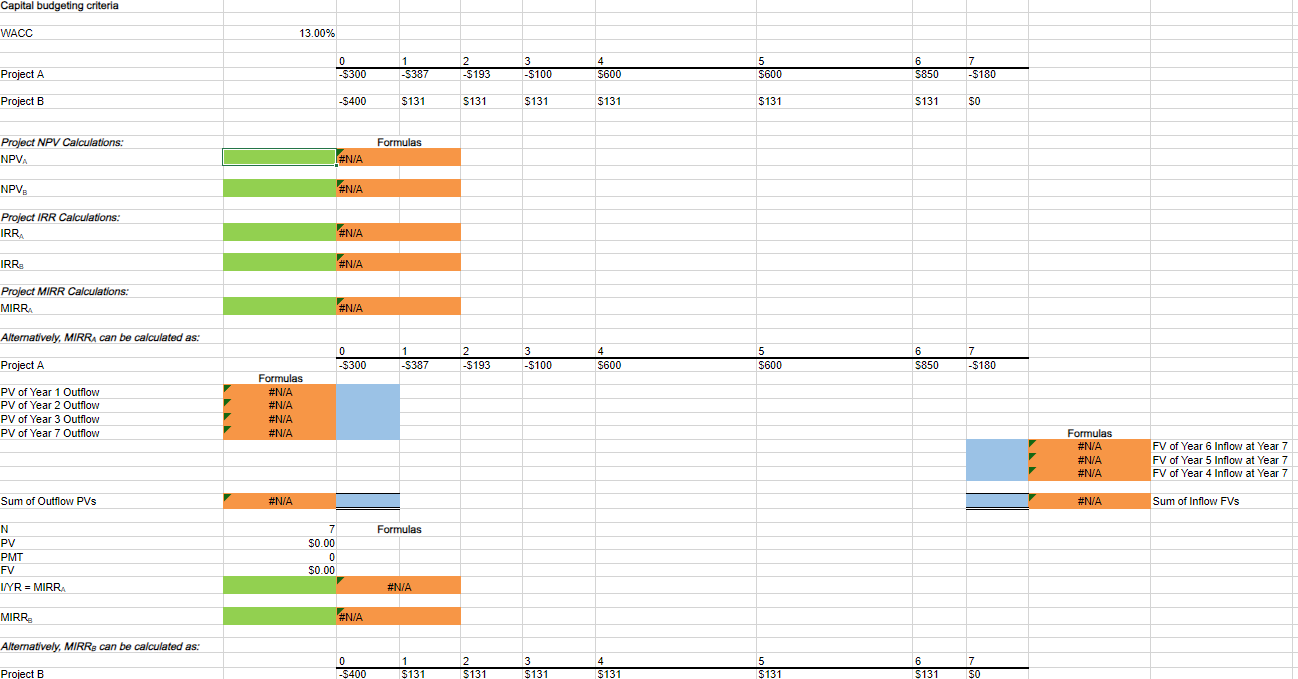

Capital budgeting criteria WACC 13.00% Project A 53000 2 $1003 $6004 6 $1807 Project B $400 $131 $131 $131 $131 $131 $131 $0 Project NPV

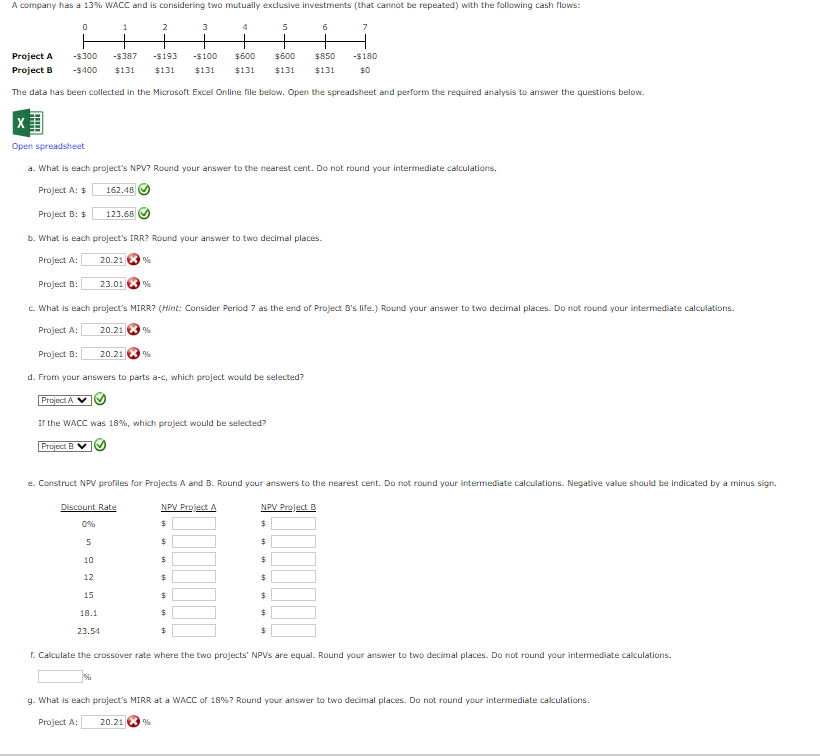

Capital budgeting criteria WACC 13.00% Project A 53000 2 $1003 $6004 6 $1807 Project B $400 $131 $131 $131 $131 $131 $131 $0 Project NPV Calculations: NPVA NPVB Project IRR Calculations: IRRA IRRa Project MIRR Calculations: MIRR Alternatively, MIRRA can be calculated as: Project A PV of Year 1 Outflow PV of Year 2 Outflow PV of Year 3 Outflow PV of Year 7 Outflow Sum of Outflow PVs NPVPMTFVI/YR=MIRRa MIRRB Alternatively, MIRR can be calculated as: Project B \begin{tabular}{lllll} \hline$400 & $131 & 2 & 3 & 4 \\ \hline 131 & $131 & $131 \end{tabular} $131 $131 S0 a. What is each project's NPV? Round your answer to the nearest cent. Do not round your intermediate calculations. Project A: $ Project B: $ b. What is each project's IRR? Round your answer to two decimal places. Project A: (3) 8 Project B: (3) % Project A: 49 Project B: 8 \% d. From your answers to parts a-c, which project would be selected? (4) If the WACC was 18%, which project would be selected? Y 9. What is each project's MIRR at a WACC of 18% ? Round your answer to two decimal places. Do not round your intermediate calculations. Project A: (3)

Capital budgeting criteria WACC 13.00% Project A 53000 2 $1003 $6004 6 $1807 Project B $400 $131 $131 $131 $131 $131 $131 $0 Project NPV Calculations: NPVA NPVB Project IRR Calculations: IRRA IRRa Project MIRR Calculations: MIRR Alternatively, MIRRA can be calculated as: Project A PV of Year 1 Outflow PV of Year 2 Outflow PV of Year 3 Outflow PV of Year 7 Outflow Sum of Outflow PVs NPVPMTFVI/YR=MIRRa MIRRB Alternatively, MIRR can be calculated as: Project B \begin{tabular}{lllll} \hline$400 & $131 & 2 & 3 & 4 \\ \hline 131 & $131 & $131 \end{tabular} $131 $131 S0 a. What is each project's NPV? Round your answer to the nearest cent. Do not round your intermediate calculations. Project A: $ Project B: $ b. What is each project's IRR? Round your answer to two decimal places. Project A: (3) 8 Project B: (3) % Project A: 49 Project B: 8 \% d. From your answers to parts a-c, which project would be selected? (4) If the WACC was 18%, which project would be selected? Y 9. What is each project's MIRR at a WACC of 18% ? Round your answer to two decimal places. Do not round your intermediate calculations. Project A: (3) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started