Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Capital Budgeting Data I ONLY NEED THE ANALYSIS Prompt: Provide your recommendation on a potential investment project for your selected company based on the net

Capital Budgeting Data

I ONLY NEED THE ANALYSIS

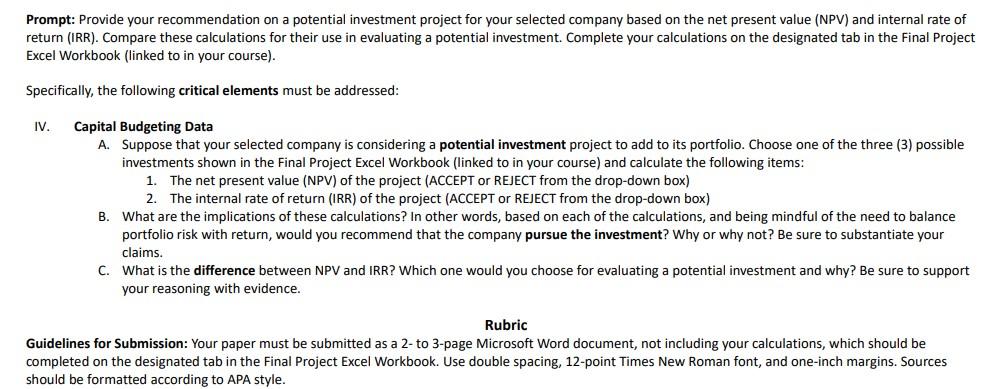

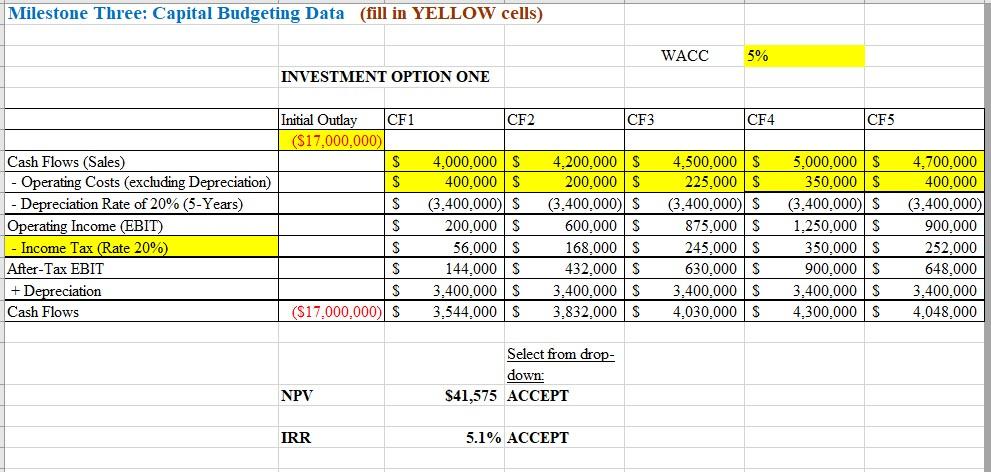

Prompt: Provide your recommendation on a potential investment project for your selected company based on the net present value (NPV) and internal rate of return (IRR). Compare these calculations for their use in evaluating a potential investment. Complete your calculations on the designated tab in the Final Project Excel Workbook (linked to in your course). Specifically, the following critical elements must be addressed: IV. Capital Budgeting Data A. Suppose that your selected company is considering a potential investment project to add to its portfolio. Choose one of the three (3) possible investments shown in the Final Project Excel Workbook (linked to in your course) and calculate the following items: 1. The net present value (NPV) of the project (ACCEPT or REJECT from the drop-down box) 2. The internal rate of return (IRR) of the project (ACCEPT or REJECT from the drop-down box) B. What are the implications of these calculations? In other words, based on each of the calculations, and being mindful of the need to balance portfolio risk with return, would you recommend that the company pursue the investment? Why or why not? Be sure to substantiate your claims. C. What is the difference between NPV and IRR? Which one would you choose for evaluating a potential investment and why? Be sure to support your reasoning with evidence. Rubric Guidelines for Submission: Your paper must be submitted as a 2-to 3-page Microsoft Word document, not including your calculations, which should be completed on the designated tab in the Final Project Excel Workbook. Use double spacing, 12-point Times New Roman font, and one-inch margins. Sources should be formatted according to APA style. Milestone Three: Capital Budgeting Data (fill in YELLOW cells) WACC 5% INVESTMENT OPTION ONE Select from drop- down: NPV $41,575 ACCEPT \begin{tabular}{l|l} IRR & 5.1% ACCEPT \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started