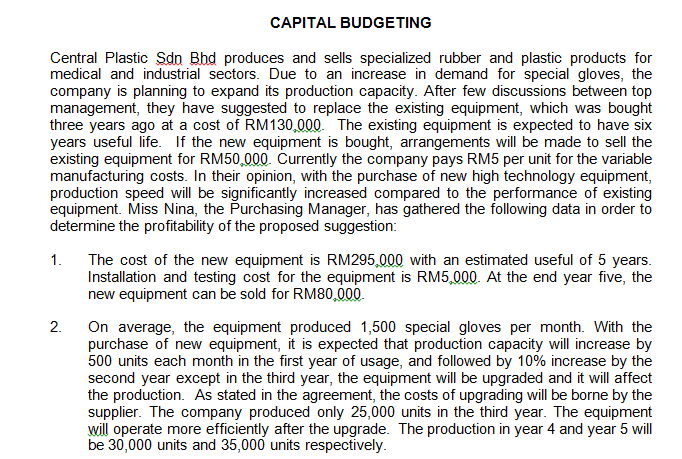

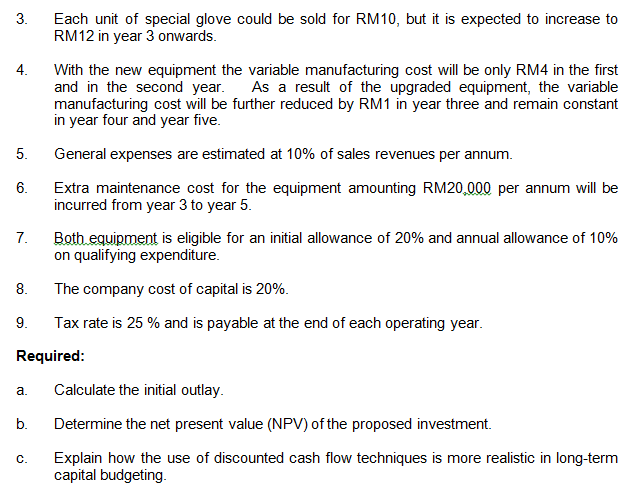

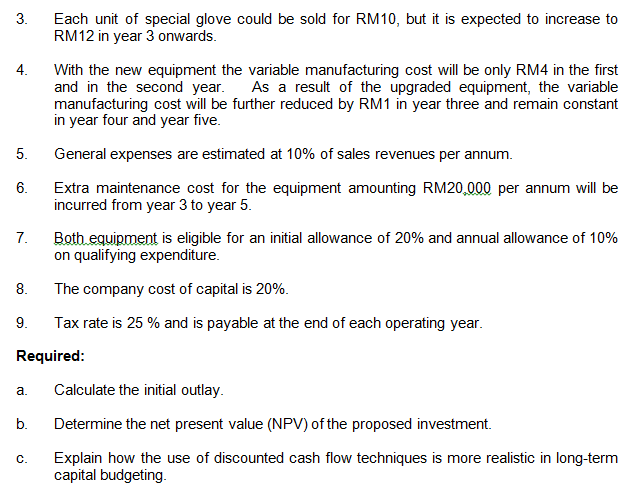

CAPITAL BUDGETING medical and industrial sectors. Due to an increase in demand for special gloves, the company is planning to expand its production capacity. After few discussions between top management, they have suggested to replace the existing equipment, which was bought three years ago at a cost of RM130,000. The existing equipment is expected to have six years useful life. If the new equipment is bought, arrangements will be made to sell the existing equipment for RM50,000. Currently the company pays RM5 per unit for the variable manufacturing costs. In their opinion, with the purchase of new high technology equipment, production speed will be significantly increased compared to the performance of existing equipment. Miss Nina, the Purchasing Manager, has gathered the following data in order to determine the profitability of the proposed suggestion: 1. The cost of the new equipment is RM295,000 with an estimated useful of 5 years. Installation and testing cost for the equipment is RM5,000. At the end year five, the new equipment can be sold for RM80,000 2. On average, the equipment produced 1,500 special gloves per month. With the purchase of new equipment, it is expected that production capacity will increase by 500 units each month in the first year of usage, and followed by 10% increase by the second year except in the third year, the equipment will be upgraded and it will affect the production. As stated in the agreement, the costs of upgrading will be borne by the supplier. The company produced only 25,000 units in the third year. The equipment will operate more efficiently after the upgrade. The production in year 4 and year 5 will be 30,000 units and 35,000 units respectively. 3. 4. 5. Each unit of special glove could be sold for RM10, but it is expected to increase to RM12 in year 3 onwards. With the new equipment the variable manufacturing cost will be only RM4 in the first and in the second year. As a result of the upgraded equipment, the variable manufacturing cost will be further reduced by RM1 in year three and remain constant in year four and year five. General expenses are estimated at 10% of sales revenues per annum. Extra maintenance cost for the equipment amounting RM20,000 per annum will be incurred from year 3 to year 5. Both equipment is eligible for an initial allowance of 20% and annual allowance of 10% on qualifying expenditure. The company cost of capital is 20%. Tax rate is 25% and is payable at the end of each operating year. 6. 7. 8. 9. Required: a. Calculate the initial outlay. b. Determine the net present value (NPV) of the proposed investment. C Explain how the use of discounted cash flow techniques is more realistic in long-term capital budgeting. d. Discuss the relative importance of quantitative and qualitative information in capital expenditure decisions