Question

Capital &diture and Depreciation; Parital-Year Depreciation Willow Creek Company purchased and installed carpet in its new general offices on April 30 for a total

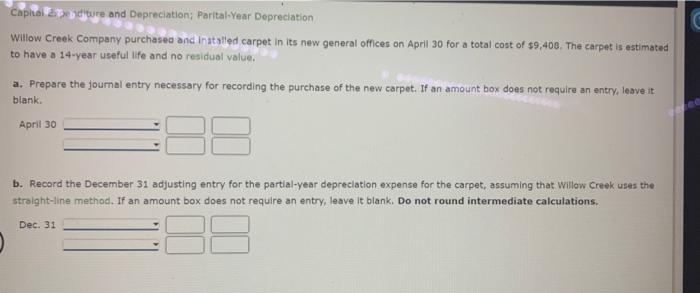

Capital &diture and Depreciation; Parital-Year Depreciation Willow Creek Company purchased and installed carpet in its new general offices on April 30 for a total cost of $9,408. The carpet is estimated to have a 14-year useful life and no residual value. a. Prepare the journal entry necessary for recording the purchase of the new carpet. If an amount box does not require an entry, leave it blank. April 30 b. Record the December 31 adjusting entry for the partial-year depreciation expense for the carpet, assuming that Willow Creek uses the straight-line method. If an amount box does not require an entry, leave it blank. Do not round intermediate calculations. Dec. 31 C

Step by Step Solution

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Journal entries Date Description Post ref Debit credit As...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Financial Accounting

Authors: Carl S. Warren, James M. Reeve, Jonathan E. Duchac

12th edition

1305041399, 1285078586, 978-1-133-9524, 9781133952428, 978-1305041394, 9781285078588, 1-133-95241-0, 978-1133952411

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App