Answered step by step

Verified Expert Solution

Question

1 Approved Answer

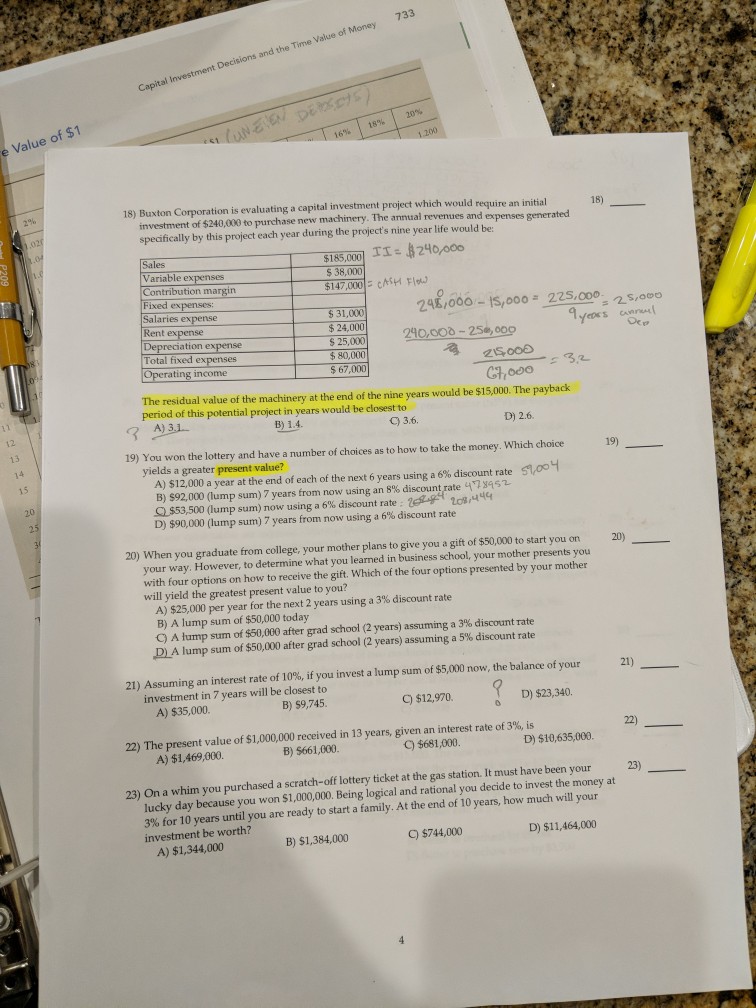

Capital Investment Decisions and the Time Vakue of Money 733 of $1 Value 1696 1896 20% 18) Buxton Corporation is evaluating a capital investment project

Capital Investment Decisions and the Time Vakue of Money 733 of $1 Value 1696 1896 20% 18) Buxton Corporation is evaluating a capital investment project which would require an initial 18) investment of $240,000 to purchase new machinery. The annual revenues and specifically by this project each year during the project's nine year life would be $185,000 II240,00 $ 38,000 ariable ex ontribution margin $147,001: CASH Flow Fixed ex Salaries ex Rent 248/000-IS,o00 225.000 2s,ooo 31,000 $ 24,000 $ 25,000 ation ex 240,00-256,000 Total fixed ex ating income $ 67,000 : 32 , o0o The residual value of the machinery at the end of the nine years would be $15,00. The payback period of this potential project in years would be closest to A) 3 C) 3.6. D) 2.6. 13 19) You won the lottery and have a number of choices as to how to take the money. Which choice 19) yields a greater present value? A) $12,000 a year at the end of each of the next 6 years using a 6% discount rate B) $92,000 (lump sum) 7 years from now using an 8% discount,rate 47xq5z ?$53,500 (lump sum) now using a 6% discount rate, aseg ts,444 D) $90,000 (lump sum) 7 years from now using a 6% discount rate tpoy 15 20) When you graduate from college, your mother plans to give you a gift of $50,000 to start you on20) your way. However, to determine what you learned in business school, your mother presents you with four options on how to receive the gift. Which of the four options presented by your mother will yield the greatest present value to you? A) $25,000 per year for the next 2 years using a 3% discount rate B) A lump sum of $50,000 today C) A lump sum of $50,000 after grad school (2 years) assuming a 3% discount rate A lump sum of $50,000 after grad school (2 years) assuming a 5% discount rate 21) Assuming an interest rate of 10%, if you invest a lump sum of $5,000 now, the balance of your 21) investment in 7 years will be closest to B) 59,745. A) $35,000. C) $12,970. D) $23,340. 22) The present value of $1,000,000 received in 13 years, given an interest rate of 3%, is 22) A) $1,469,000. B) $661,000. C) 5681,000. D) $10,635,000. 23) On a whim you purchased a scratch-off lottery ticket at the gas station. It must have been your 23) lucky day because you won $1,000,000. Being logical and rational you decide to invest the money at 3% for 10 years investment be worth? until you are ready to start a family. At the end of 10 years, how much will your A) $1,344,000 B) $1,384,000 C) $744,000 D) S11,464,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started