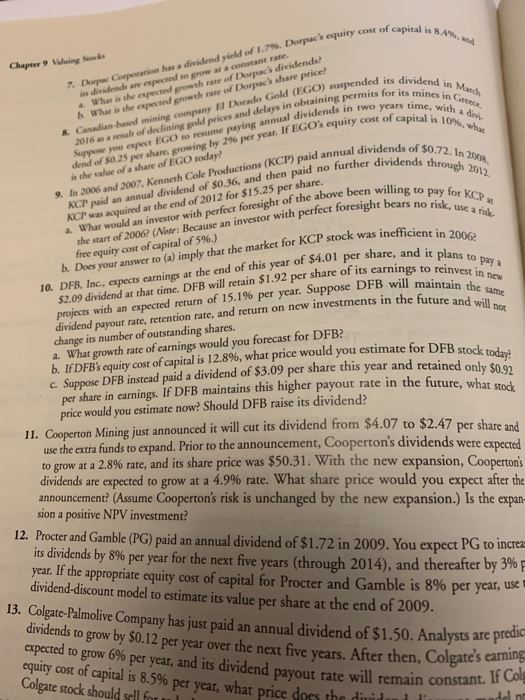

capital is 8.4%, and Chapter 9 Valuing Seo 7, Dir w Goperation has a dividend yield of 1.7%. Dorpae's equity cost of its dividend in M for its mines in ch years time, with a 2016 as a result of declining gold prices and delays in obtaining permits for Suppose you espect EG0 to resume paying annual dividends in two dend of $0.25 per share, growingby 2% per year. If EGO's equity cost of is the value of a share of EGO roday? Whar is the expected growth rate of Dorpac's dividend What is the expected growth rate of Dorpac's share price? is 10%o, wha &. Canadian based mining company El Dorado Gold (EGO) suspended In 2006 and 2007, Kenneth Cole Productions (KCP) paid annual div KCP paid an annual dividend of S0.36, and then paid no further d dividends of $0.72. In 20 dividends through 201 KCP at r share ove been wbears no risk, use a rik. 9. to pay for ight bears no risk, use a fisk ght bears no pay for Kp was acquired at the end of 2012 for $15.25 per share. KCP a. What would an investor with perfect foresight of the above been willi Note: Because an investor with perfect foresig the start of 2006? ( free equity cost of capital of 5%) market for KCP stock was inefficient in 20 plans to pay b. Does your answer to (a) imply that the $2.09 dividend at that time. DFB will retain $1.92 per share of its earnings to rei projects with an expected return of 15.1% per year. Suppose DFB will maintain dividend payout rate, retention rate, and return on new investments in the future reinvest in new I0. DFB, Inc, expects carnings at the end of this year of $4.01 per share, and it 1O. DFB, Inc., expects carnings at the en maintain the change its number of outstanding shares a. What growth rate of earnings would you forecast for DFB? b. IfDFBs equity cost ofcapital is 12.8%, what price would you estimate for DFB stod c Suppose DFB instead paid a dividend of $3.09 per share this year and retained onl today per share in earnings. If DFB maintains this higher payout rate in the future, what s rice would you estimate now? Should DFB raise its dividend? Mining just announced it will cut its dividend from $4.07 to $2.47 per share and 11. Cooperton use the extra funds to expand. Prior to the announcement, Cooperton's dividends were expected to grow at a 2.8% rate, and its share price was $50.31, with the new expansion, Cooperos dividends are expected to grow at a 4.9% rate. What share price would you expect after the announcement? (Assume Cooperton's risk is unchanged by the new expansion.) Is the expan sion a positive NPV investment? 12. Procter and Gamble (PG) paid an annual dividend of $1.72 in 2009. You expect PG to increa year. If the appropriate equity cost of capital for Procter and Gamble is 896 per year, 13. Colgate-Palmolive Company has just paid an annual dividend of $1.50. Analysts are predic its dividends by 8% per year for the next five years (through 2014), and thereafter by 3% p dividend-discount model to estimate its value per share at the end of 2009. dividend to grow by $0.12 per year over the next five years. After then, Colgates earing expected to grow 6% per year, and its dividend payout rate will remain constant. equity cost of capital is 8.5% per year, what price does the dividend Colgate stock should sell fot ul