Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Capital Maintenance and Alternatives to Historical Cost Accounting Question 1 On 1 January, Saia Ltd started a business which buys and sells chairs. He

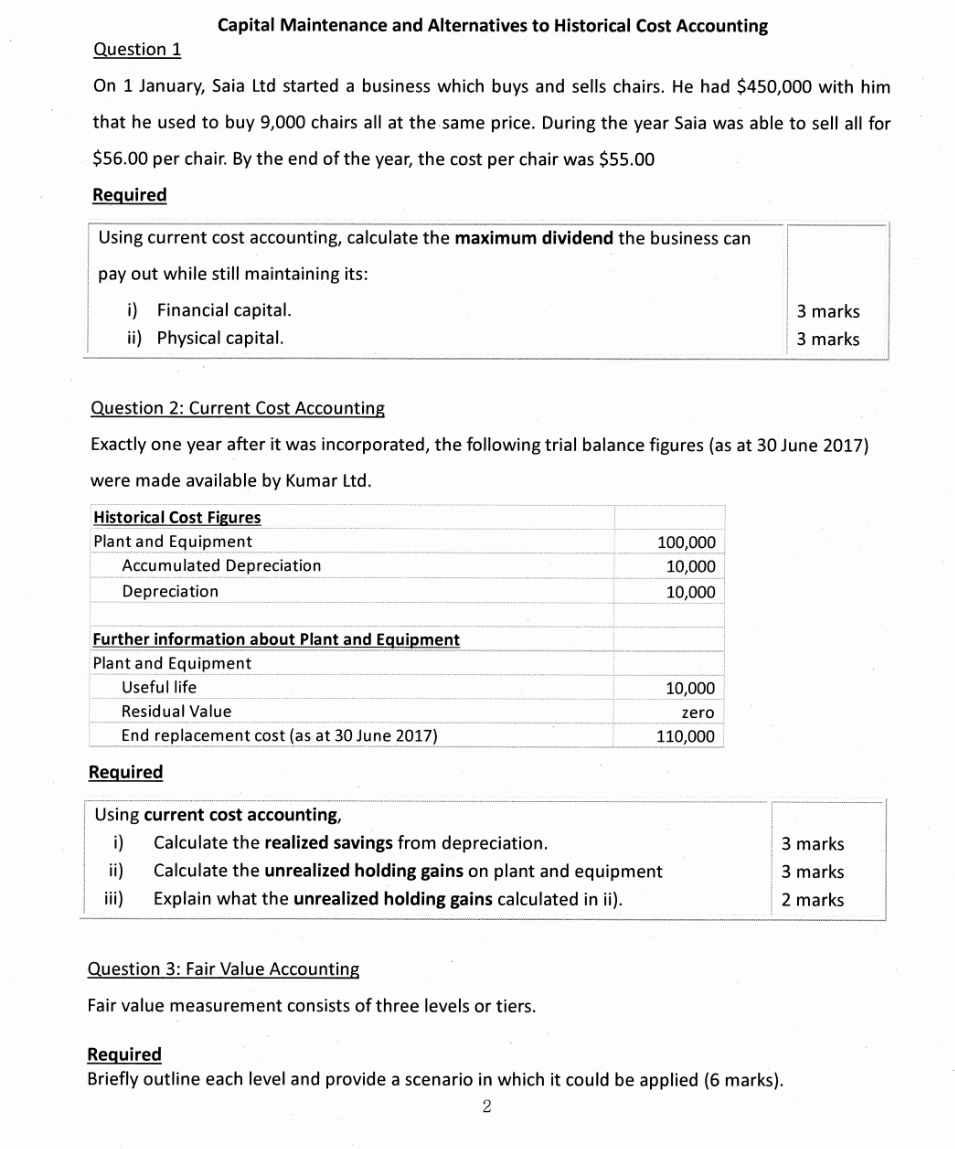

Capital Maintenance and Alternatives to Historical Cost Accounting Question 1 On 1 January, Saia Ltd started a business which buys and sells chairs. He had $450,000 with him that he used to buy 9,000 chairs all at the same price. During the year Saia was able to sell all for $56.00 per chair. By the end of the year, the cost per chair was $55.00 Required Using current cost accounting, calculate the maximum dividend the business can pay out while still maintaining its: i) Financial capital. ii) Physical capital. 3 marks 3 marks Question 2: Current Cost Accounting Exactly one year after it was incorporated, the following trial balance figures (as at 30 June 2017) were made available by Kumar Ltd. Historical Cost Figures Plant and Equipment Accumulated Depreciation Depreciation Further information about Plant and Equipment 100,000 10,000 10,000 Plant and Equipment Useful life Residual Value End replacement cost (as at 30 June 2017) 10,000 zero 110,000 Required Using current cost accounting, i) Calculate the realized savings from depreciation. 3 marks ii) Calculate the unrealized holding gains on plant and equipment 3 marks iii) Explain what the unrealized holding gains calculated in ii). 2 marks Question 3: Fair Value Accounting Fair value measurement consists of three levels or tiers. Required Briefly outline each level and provide a scenario in which it could be applied (6 marks). 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started