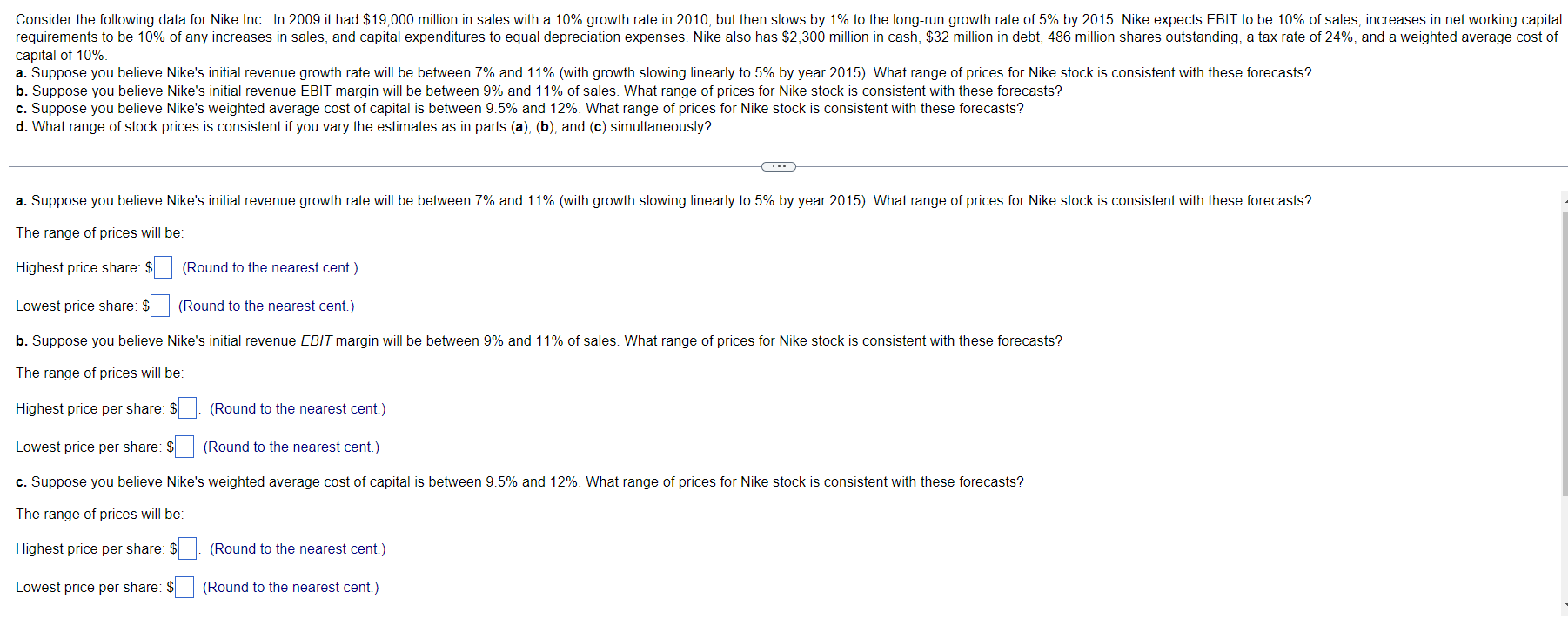

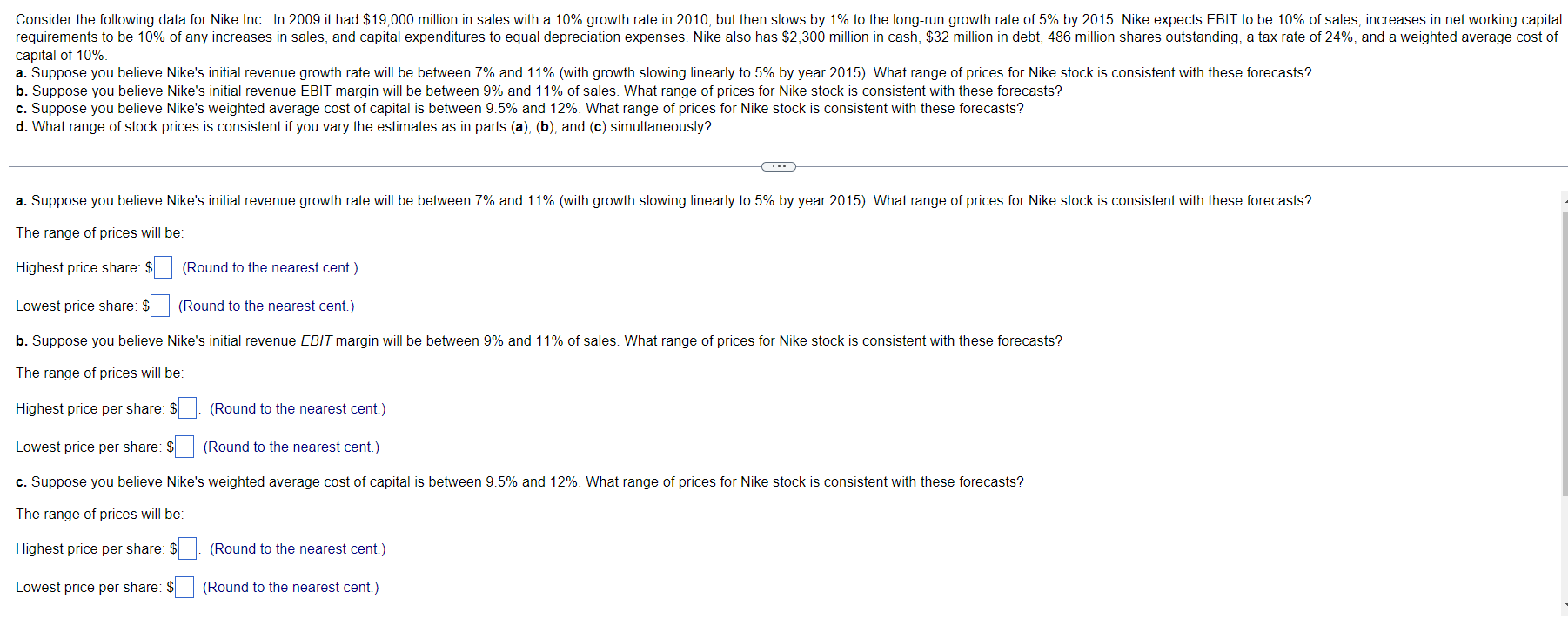

capital of 10% a. Suppose you believe Nike's initial revenue growth rate will be between 7% and 11% (with growth slowing linearly to 5% by year 2015 ). What range of prices for Nike stock is consistent with these forecasts? b. Suppose you believe Nike's initial revenue EBIT margin will be between 9% and 11% of sales. What range of prices for Nike stock is consistent with these forecasts? c. Suppose you believe Nike's weighted average cost of capital is between 9.5% and 12%. What range of prices for Nike stock is consistent with these forecasts? d. What range of stock prices is consistent if you vary the estimates as in parts (a), (b), and (c) simultaneously? a. Suppose you believe Nike's initial revenue growth rate will be between 7% and 11% (with growth slowing linearly to 5% by year 2015 ). What range of prices for Nike stock is consistent with these forecasts? The range of prices will be: Highest price share: (Round to the nearest cent.) Lowest price share: (Round to the nearest cent.) b. Suppose you believe Nike's initial revenue EBIT margin will be between 9% and 11% of sales. What range of prices for Nike stock is consistent with these forecasts? The range of prices will be: Highest price per share: (Round to the nearest cent.) Lowest price per share: 9 (Round to the nearest cent.) c. Suppose you believe Nike's weighted average cost of capital is between 9.5% and 12%. What range of prices for Nike stock is consistent with these forecasts? The range of prices will be: Highest price per share: $ (Round to the nearest cent.) Lowest price per share: $ (Round to the nearest cent.) company's WACC is 9.5%. What is the range of prices under these scenarios? The range of prices will be: Highest price per share: (Round to the nearest cent.) Lowest price per share: $ (Round to the nearest cent.) capital of 10% a. Suppose you believe Nike's initial revenue growth rate will be between 7% and 11% (with growth slowing linearly to 5% by year 2015 ). What range of prices for Nike stock is consistent with these forecasts? b. Suppose you believe Nike's initial revenue EBIT margin will be between 9% and 11% of sales. What range of prices for Nike stock is consistent with these forecasts? c. Suppose you believe Nike's weighted average cost of capital is between 9.5% and 12%. What range of prices for Nike stock is consistent with these forecasts? d. What range of stock prices is consistent if you vary the estimates as in parts (a), (b), and (c) simultaneously? a. Suppose you believe Nike's initial revenue growth rate will be between 7% and 11% (with growth slowing linearly to 5% by year 2015 ). What range of prices for Nike stock is consistent with these forecasts? The range of prices will be: Highest price share: (Round to the nearest cent.) Lowest price share: (Round to the nearest cent.) b. Suppose you believe Nike's initial revenue EBIT margin will be between 9% and 11% of sales. What range of prices for Nike stock is consistent with these forecasts? The range of prices will be: Highest price per share: (Round to the nearest cent.) Lowest price per share: 9 (Round to the nearest cent.) c. Suppose you believe Nike's weighted average cost of capital is between 9.5% and 12%. What range of prices for Nike stock is consistent with these forecasts? The range of prices will be: Highest price per share: $ (Round to the nearest cent.) Lowest price per share: $ (Round to the nearest cent.) company's WACC is 9.5%. What is the range of prices under these scenarios? The range of prices will be: Highest price per share: (Round to the nearest cent.) Lowest price per share: $ (Round to the nearest cent.)