Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Capital Rationing Decision for a Service Company Involving Four Proposals Renaissance Capital Group is considering allocating a limited amount of capital investment funds among four

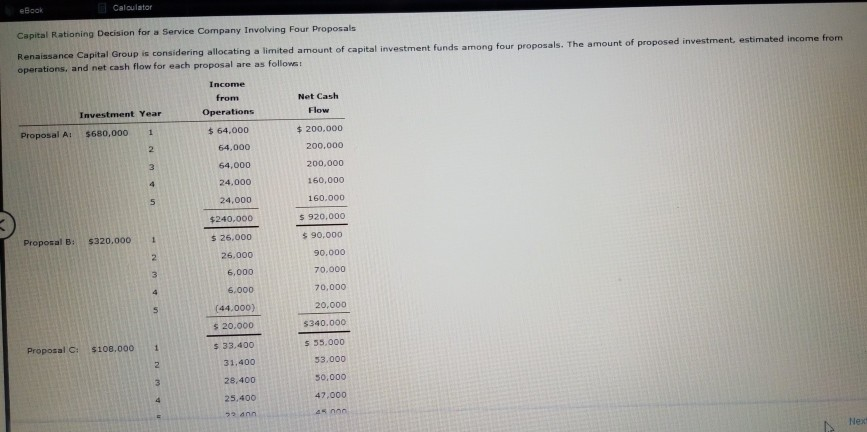

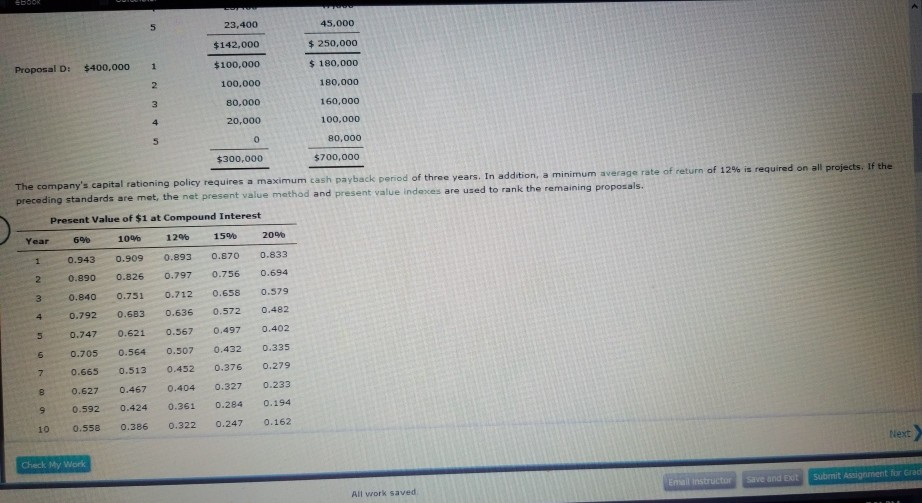

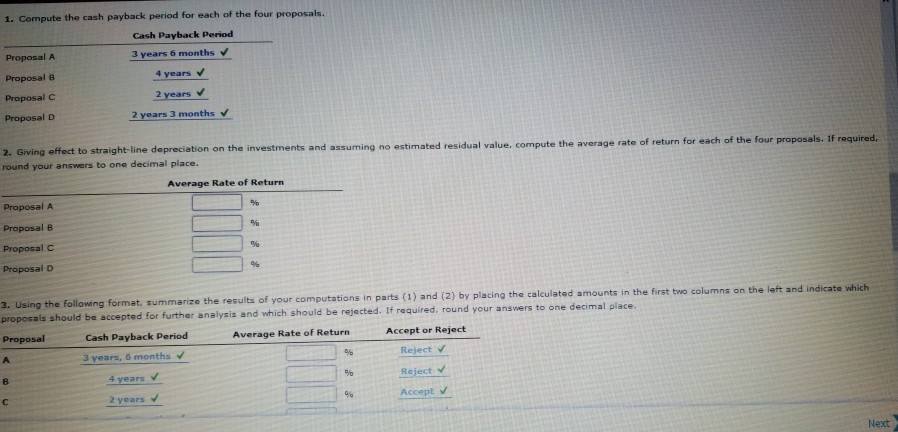

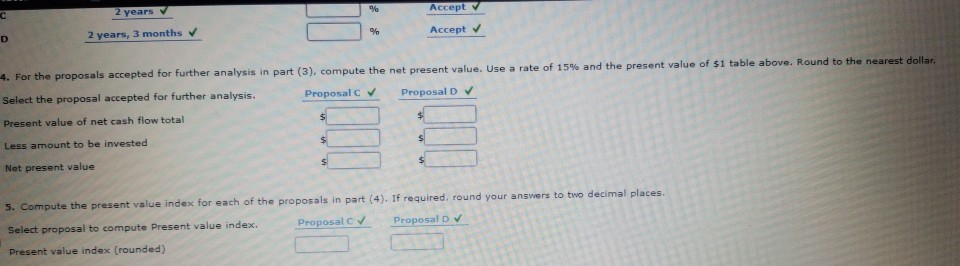

Capital Rationing Decision for a Service Company Involving Four Proposals Renaissance Capital Group is considering allocating a limited amount of capital investment funds among four proposals. The amount of proposed investment, estimated income from operations, and net cash flow for each proposal are as follows: Income from Net Cash Investment Year Operations Proposal A: $680,000 $ 64,000 64.000 $ 200,000 200.000 200,000 160,000 160.000 Proposal B: $320.000 64,000 24.000 24,000 $240,000 $26.000 26.000 6.000 6.000 (44.000) $ 20.000 $ 33,400 31.400 $ 920,000 $ 90.000 90.000 70.000 70.000 20,000 $340.000 Proposal C: $108.000 $ 35.000 53,000 50.000 47.000 28.400 25.400 23,400 45.000 $142.000 $ 250,000 Proposal D: $400,000 $100,000 100,000 WN 80,000 20,000 $ 180,000 180,000 160,000 100,000 80,000 $300,000 $700,000 The company's capital rationing policy requires a maximum cash payback period of three years. In addition, a minimum average rate of return of 12% is required on all projects. If the preceding standards are met, the nat present value method and present value indexes are used to rank the remaining proposals. Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 0.943 0.909 0.893 0.870 0.833 0.890 0.826 0.797 0.756 0.694 0.840 0.751 0.712 0.658 0.579 0.792 0.683 0.636 0.572 0.482 0.747 0.621 0.567 0.497 0.402 0.705 0.564 0.507 0.432 0.335 0.665 0.513 0.452 0.376 0.279 0.627 0.467 0.404 0.327 0.233 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162 Check My Work Email Instructor All work saved Submit Assignment for Save and et 1. Compute the cash payback period for each of the four proposals. Cash Payback Period Proposal A 3 years 6 months Proposal B 4 years Proposal 2 years V Proposal D 2 years 3 months 2. Giving effect to straight-line depreciation on the investments and assuming no estimated residual value, compute the average rate of return for each of the four proposals. If required round your answers to one decimal place. Average Rate of Return Proposal A Proposal B Proposal Proposal D 3. Using the following format summarize the results of your computations in parts (1) and (2) by placing the calculated amounts in the first two columns on the left and indicate which proposals should be accepted for further analysis and which should be rejected. If required, round your answers to one decimal place. Proposal Average Rate of Return Accept or Reject Cash Payback Period 3 years, 6 months Reject 4 years Reject v 2 years Acrepe V 2 years Accept 2 years, 3 months Accept For the proposals accepted for further analysis in part (3), compute the net present value. Use a rate of 15% and the present value of $1 table above. Round to the nearest dollar Select the proposal accepted for further analysis. Proposal C Proposal D Present value of net cash flow total Less amount to be invested Net present value 5. Compute the present value index for each of the proposals in part (4). If required, round your answers to two decimal places. Proposal Proposal Select proposal to compute Present value index. Present value index (rounded)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started