CAPITAL REDUCTION/RECONSTRUCTION

Malaysia accounting standard

required: question a and b

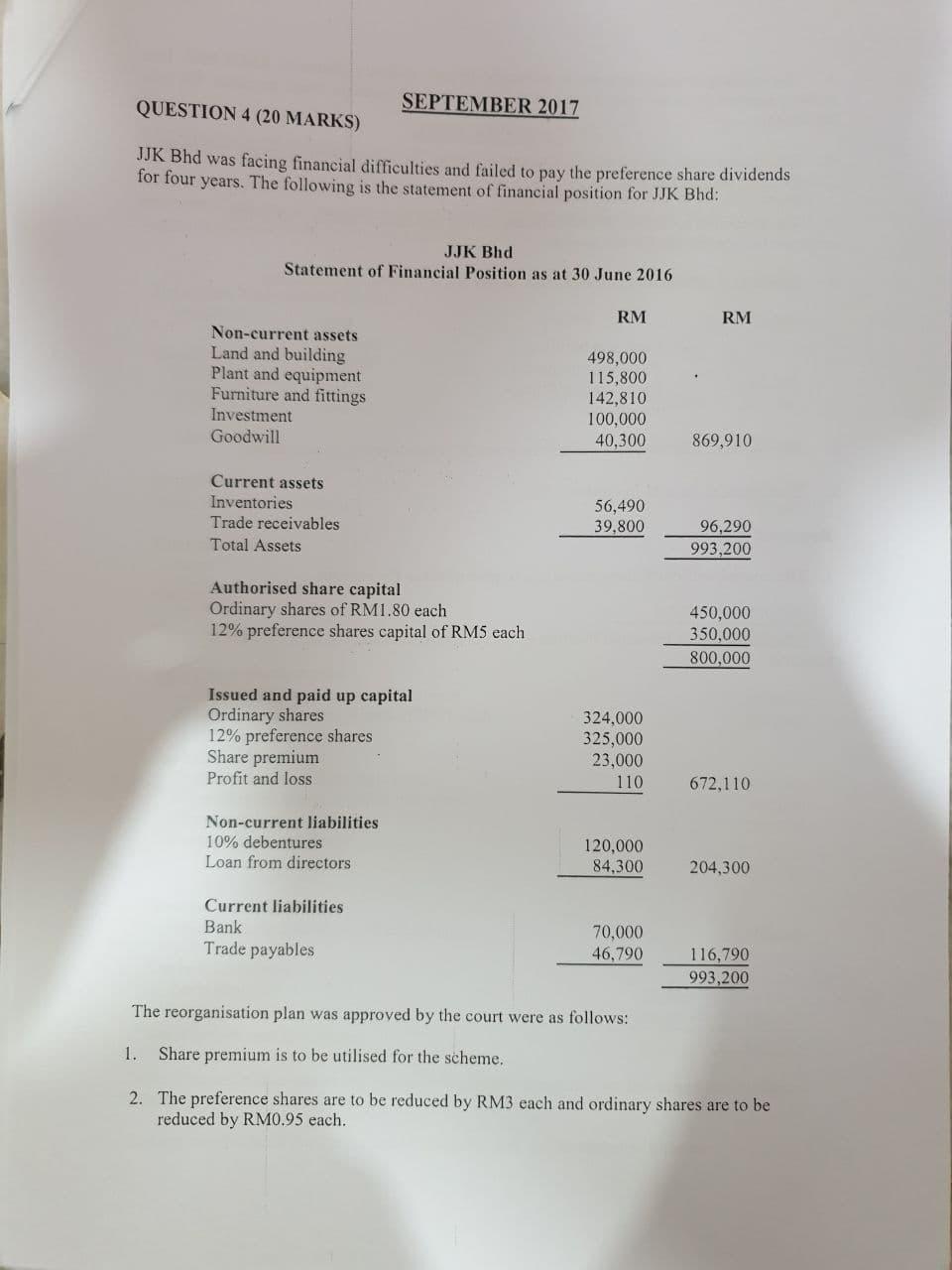

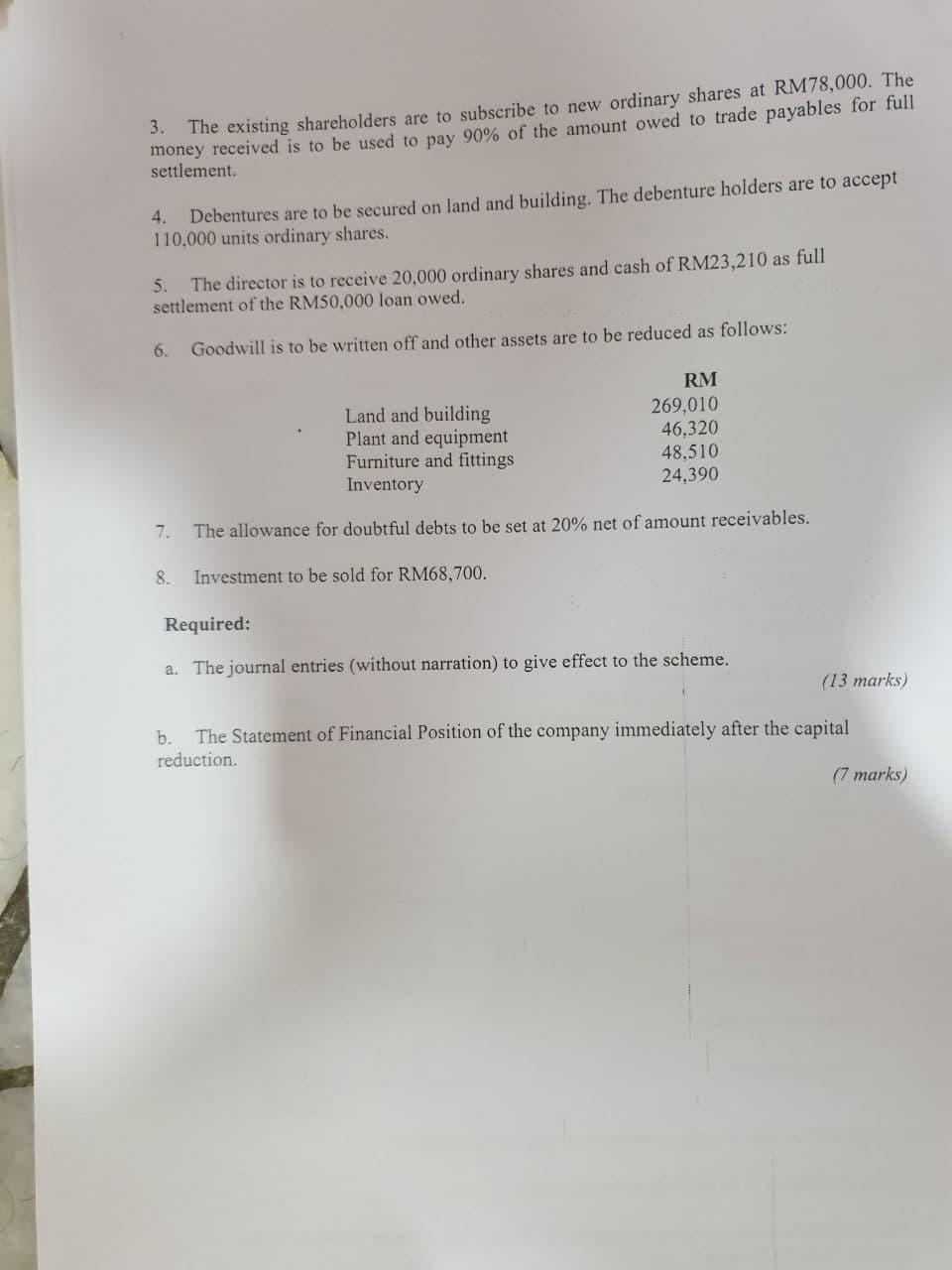

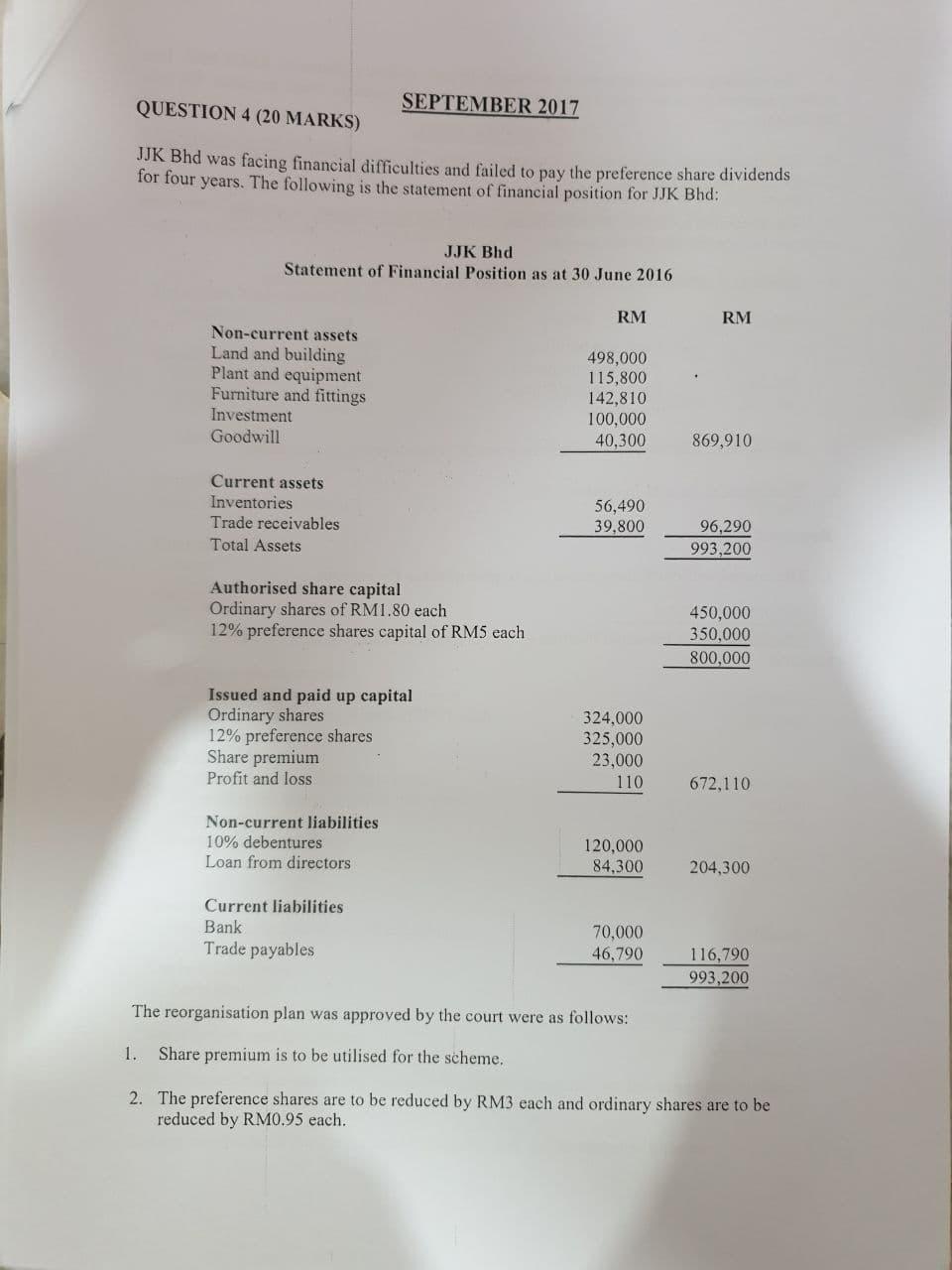

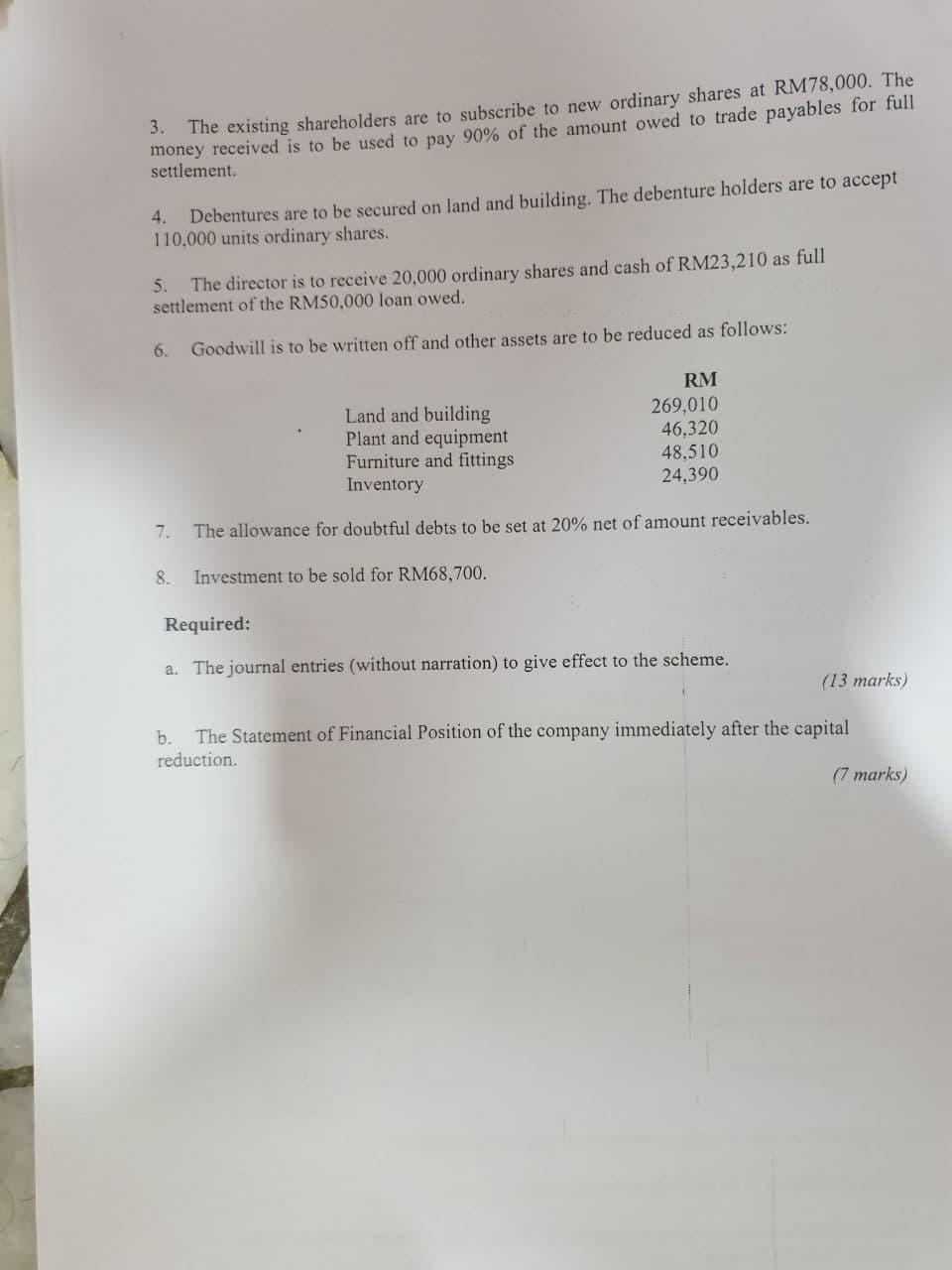

QUESTION 4 (20 MARKS) SEPTEMBER 2017 JJK Bhd was facing financial difficulties and failed to pay the preference share dividends for four years. The following is the statement of financial position for JJK Bhd: JJK Bhd Statement of Financial Position as at 30 June 2016 RM RM Non-current assets Land and building Plant and equipment Furniture and fittings Investment Goodwill 498,000 115,800 142,810 100,000 40,300 869,910 Current assets Inventories Trade receivables Total Assets 56,490 39,800 96,290 993.200 Authorised share capital Ordinary shares of RM1.80 each 12% preference shares capital of RM5 each 450,000 350,000 800,000 Issued and paid up capital Ordinary shares 12% preference shares Share premium Profit and loss 324,000 325,000 23,000 110 672.110 Non-current liabilities 10% debentures Loan from directors 120,000 84,300 204,300 Current liabilities Bank Trade payables 70,000 46,790 116,790 993,200 The reorganisation plan was approved by the court were as follows: 1. Share premium is to be utilised for the scheme. 2. The preference shares are to be reduced by RM3 each and ordinary shares are to be reduced by RM0.95 each. 3. The existing shareholders are to subscribe to new ordinary shares at RM78,000. The money received is to be used to pay 90% of the amount owed to trade payables for full settlement. 4. Debentures are to be secured on land and building. The debenture holders are to accept 110,000 units ordinary shares. 5. The director is to receive 20,000 ordinary shares and cash of RM23,210 as full settlement of the RM50,000 loan owed. 6. Goodwill is to be written off and other assets are to be reduced as follows: Land and building Plant and equipment Furniture and fittings Inventory RM 269,010 46,320 48,510 24,390 7. The allowance for doubtful debts to be set at 20% net of amount receivables. 8. Investment to be sold for RM68,700. Required: a. The journal entries (without narration) to give effect to the scheme. (13 marks b. The Statement of Financial Position of the company immediately after the capital reduction (7 marks) QUESTION 4 (20 MARKS) SEPTEMBER 2017 JJK Bhd was facing financial difficulties and failed to pay the preference share dividends for four years. The following is the statement of financial position for JJK Bhd: JJK Bhd Statement of Financial Position as at 30 June 2016 RM RM Non-current assets Land and building Plant and equipment Furniture and fittings Investment Goodwill 498,000 115,800 142,810 100,000 40,300 869,910 Current assets Inventories Trade receivables Total Assets 56,490 39,800 96,290 993.200 Authorised share capital Ordinary shares of RM1.80 each 12% preference shares capital of RM5 each 450,000 350,000 800,000 Issued and paid up capital Ordinary shares 12% preference shares Share premium Profit and loss 324,000 325,000 23,000 110 672.110 Non-current liabilities 10% debentures Loan from directors 120,000 84,300 204,300 Current liabilities Bank Trade payables 70,000 46,790 116,790 993,200 The reorganisation plan was approved by the court were as follows: 1. Share premium is to be utilised for the scheme. 2. The preference shares are to be reduced by RM3 each and ordinary shares are to be reduced by RM0.95 each. 3. The existing shareholders are to subscribe to new ordinary shares at RM78,000. The money received is to be used to pay 90% of the amount owed to trade payables for full settlement. 4. Debentures are to be secured on land and building. The debenture holders are to accept 110,000 units ordinary shares. 5. The director is to receive 20,000 ordinary shares and cash of RM23,210 as full settlement of the RM50,000 loan owed. 6. Goodwill is to be written off and other assets are to be reduced as follows: Land and building Plant and equipment Furniture and fittings Inventory RM 269,010 46,320 48,510 24,390 7. The allowance for doubtful debts to be set at 20% net of amount receivables. 8. Investment to be sold for RM68,700. Required: a. The journal entries (without narration) to give effect to the scheme. (13 marks b. The Statement of Financial Position of the company immediately after the capital reduction (7 marks)