Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Capital structure analysis) The Karson Transport Company currently has net operating income of $499,000 and pays interest expense of $194,000. The company plans to borrow

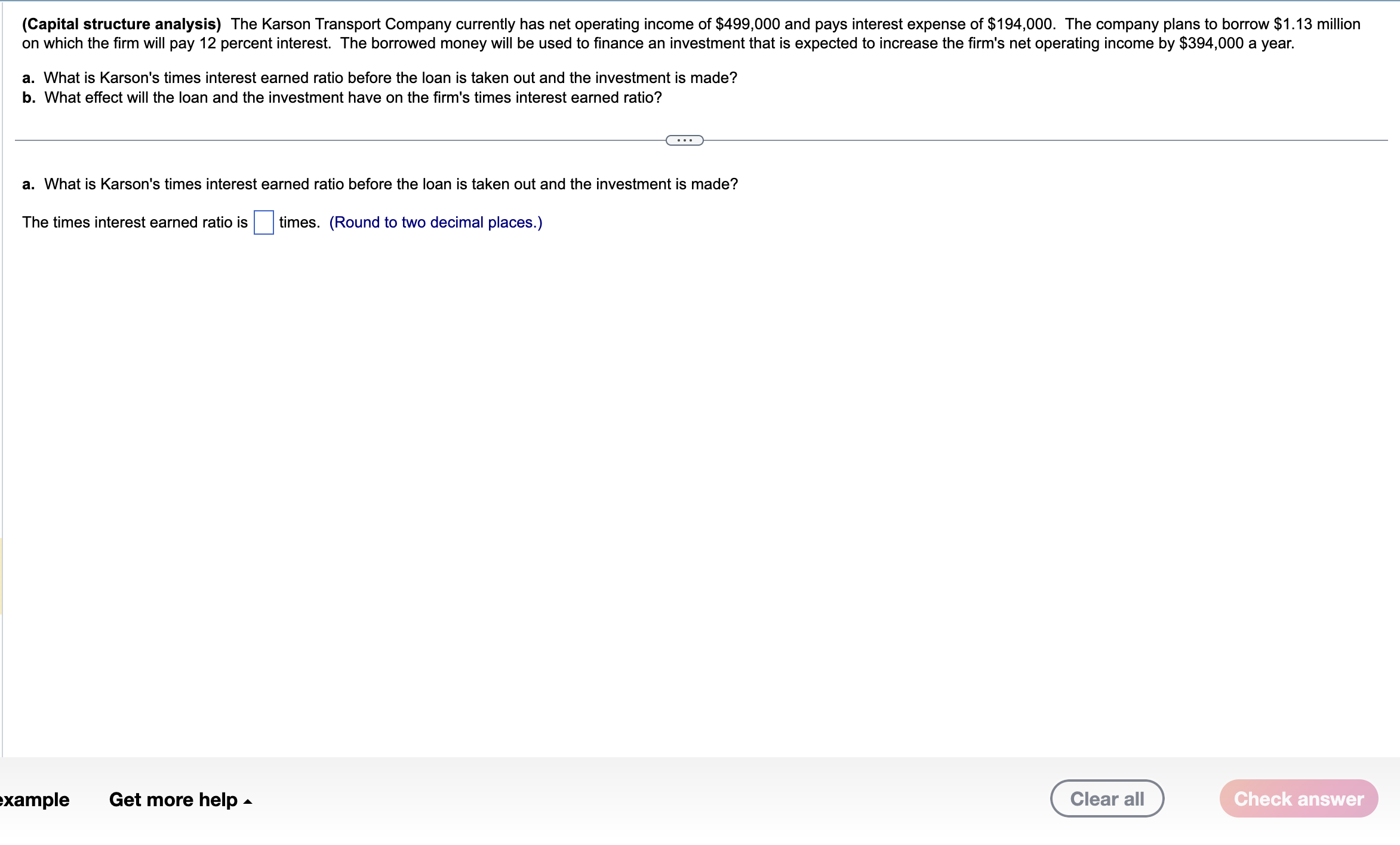

(Capital structure analysis) The Karson Transport Company currently has net operating income of $499,000 and pays interest expense of $194,000. The company plans to borrow $1.13 million on which the firm will pay 12 percent interest. The borrowed money will be used to finance an investment that is expected to increase the firm's net operating income by $394,000 a year. a. What is Karson's times interest earned ratio before the loan is taken out and the investment is made? b. What effect will the loan and the investment have on the firm's times interest earned ratio? a. What is Karson's times interest earned ratio before the loan is taken out and the investment is made? The times interest earned ratio is times. (Round to two decimal places.)

(Capital structure analysis) The Karson Transport Company currently has net operating income of $499,000 and pays interest expense of $194,000. The company plans to borrow $1.13 million on which the firm will pay 12 percent interest. The borrowed money will be used to finance an investment that is expected to increase the firm's net operating income by $394,000 a year. a. What is Karson's times interest earned ratio before the loan is taken out and the investment is made? b. What effect will the loan and the investment have on the firm's times interest earned ratio? a. What is Karson's times interest earned ratio before the loan is taken out and the investment is made? The times interest earned ratio is times. (Round to two decimal places.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started