Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Capital Structure Forest Ltd is planning to repurchase part of its common stock by issuing debt. As a result the firm's debt-equity ratio is expected

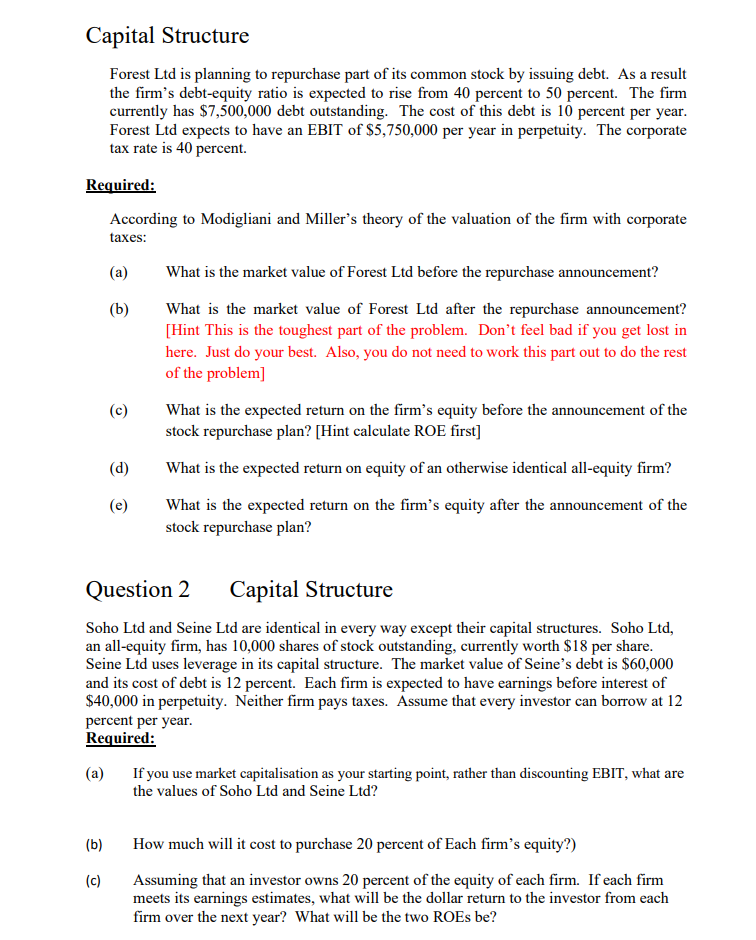

Capital Structure Forest Ltd is planning to repurchase part of its common stock by issuing debt. As a result the firm's debt-equity ratio is expected to rise from 40 percent to 50 percent. The firm currently has \\( \\$ 7,500,000 \\) debt outstanding. The cost of this debt is 10 percent per year. Forest Ltd expects to have an EBIT of \\( \\$ 5,750,000 \\) per year in perpetuity. The corporate tax rate is 40 percent. Required: According to Modigliani and Miller's theory of the valuation of the firm with corporate taxes: (a) What is the market value of Forest Ltd before the repurchase announcement? (b) What is the market value of Forest Ltd after the repurchase announcement? [Hint This is the toughest part of the problem. Don't feel bad if you get lost in here. Just do your best. Also, you do not need to work this part out to do the rest of the problem] (c) What is the expected return on the firm's equity before the announcement of the stock repurchase plan? [Hint calculate ROE first] (d) What is the expected return on equity of an otherwise identical all-equity firm? (e) What is the expected return on the firm's equity after the announcement of the stock repurchase plan? Question 2 Capital Structure Soho Ltd and Seine Ltd are identical in every way except their capital structures. Soho Ltd, an all-equity firm, has 10,000 shares of stock outstanding, currently worth \\( \\$ 18 \\) per share. Seine Ltd uses leverage in its capital structure. The market value of Seine's debt is \\( \\$ 60,000 \\) and its cost of debt is 12 percent. Each firm is expected to have earnings before interest of \\( \\$ 40,000 \\) in perpetuity. Neither firm pays taxes. Assume that every investor can borrow at 12 percent per year. Required: (a) If you use market capitalisation as your starting point, rather than discounting EBIT, what are the values of Soho Ltd and Seine Ltd? (b) How much will it cost to purchase 20 percent of Each firm's equity?) (c) Assuming that an investor owns 20 percent of the equity of each firm. If each firm meets its earnings estimates, what will be the dollar return to the investor from each firm over the next year? What will be the two ROEs be

Capital Structure Forest Ltd is planning to repurchase part of its common stock by issuing debt. As a result the firm's debt-equity ratio is expected to rise from 40 percent to 50 percent. The firm currently has \\( \\$ 7,500,000 \\) debt outstanding. The cost of this debt is 10 percent per year. Forest Ltd expects to have an EBIT of \\( \\$ 5,750,000 \\) per year in perpetuity. The corporate tax rate is 40 percent. Required: According to Modigliani and Miller's theory of the valuation of the firm with corporate taxes: (a) What is the market value of Forest Ltd before the repurchase announcement? (b) What is the market value of Forest Ltd after the repurchase announcement? [Hint This is the toughest part of the problem. Don't feel bad if you get lost in here. Just do your best. Also, you do not need to work this part out to do the rest of the problem] (c) What is the expected return on the firm's equity before the announcement of the stock repurchase plan? [Hint calculate ROE first] (d) What is the expected return on equity of an otherwise identical all-equity firm? (e) What is the expected return on the firm's equity after the announcement of the stock repurchase plan? Question 2 Capital Structure Soho Ltd and Seine Ltd are identical in every way except their capital structures. Soho Ltd, an all-equity firm, has 10,000 shares of stock outstanding, currently worth \\( \\$ 18 \\) per share. Seine Ltd uses leverage in its capital structure. The market value of Seine's debt is \\( \\$ 60,000 \\) and its cost of debt is 12 percent. Each firm is expected to have earnings before interest of \\( \\$ 40,000 \\) in perpetuity. Neither firm pays taxes. Assume that every investor can borrow at 12 percent per year. Required: (a) If you use market capitalisation as your starting point, rather than discounting EBIT, what are the values of Soho Ltd and Seine Ltd? (b) How much will it cost to purchase 20 percent of Each firm's equity?) (c) Assuming that an investor owns 20 percent of the equity of each firm. If each firm meets its earnings estimates, what will be the dollar return to the investor from each firm over the next year? What will be the two ROEs be Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started