Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Capital Weightings and WACC Calculation The market values of KO's common stock and preferred stock are $211,296 million and $101 million, respectively. Coca-Cola has

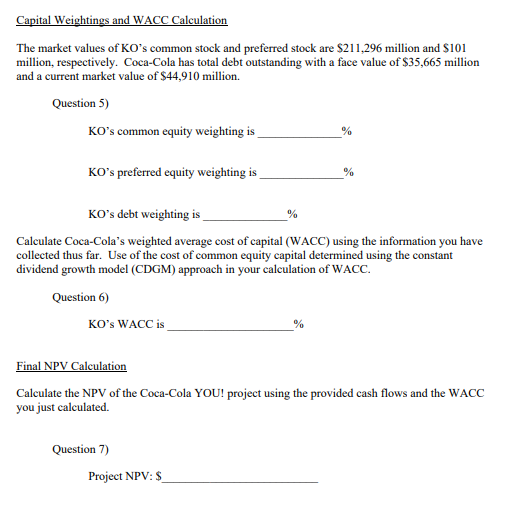

Capital Weightings and WACC Calculation The market values of KO's common stock and preferred stock are $211,296 million and $101 million, respectively. Coca-Cola has total debt outstanding with a face value of $35,665 million and a current market value of $44,910 million. Question 5) KO's common equity weighting is KO's preferred equity weighting is KO's debt weighting is % % Calculate Coca-Cola's weighted average cost of capital (WACC) using the information you have collected thus far. Use of the cost of common equity capital determined using the constant dividend growth model (CDGM) approach in your calculation of WACC. Question 6) KO's WACC is Final NPV Calculation Calculate the NPV of the Coca-Cola YOU! project using the provided cash flows and the WACC you just calculated. Question 7) Project NPV: $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Alright lets work through the WACC calculation and NPV for the CocaCola YOU project Question 5 Capit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started