Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Capitol City Power Supply Company (CCPSC), a privately-held corporation, has been audited by your firm since 2015. CCPSC began constructing a nuclear power plant

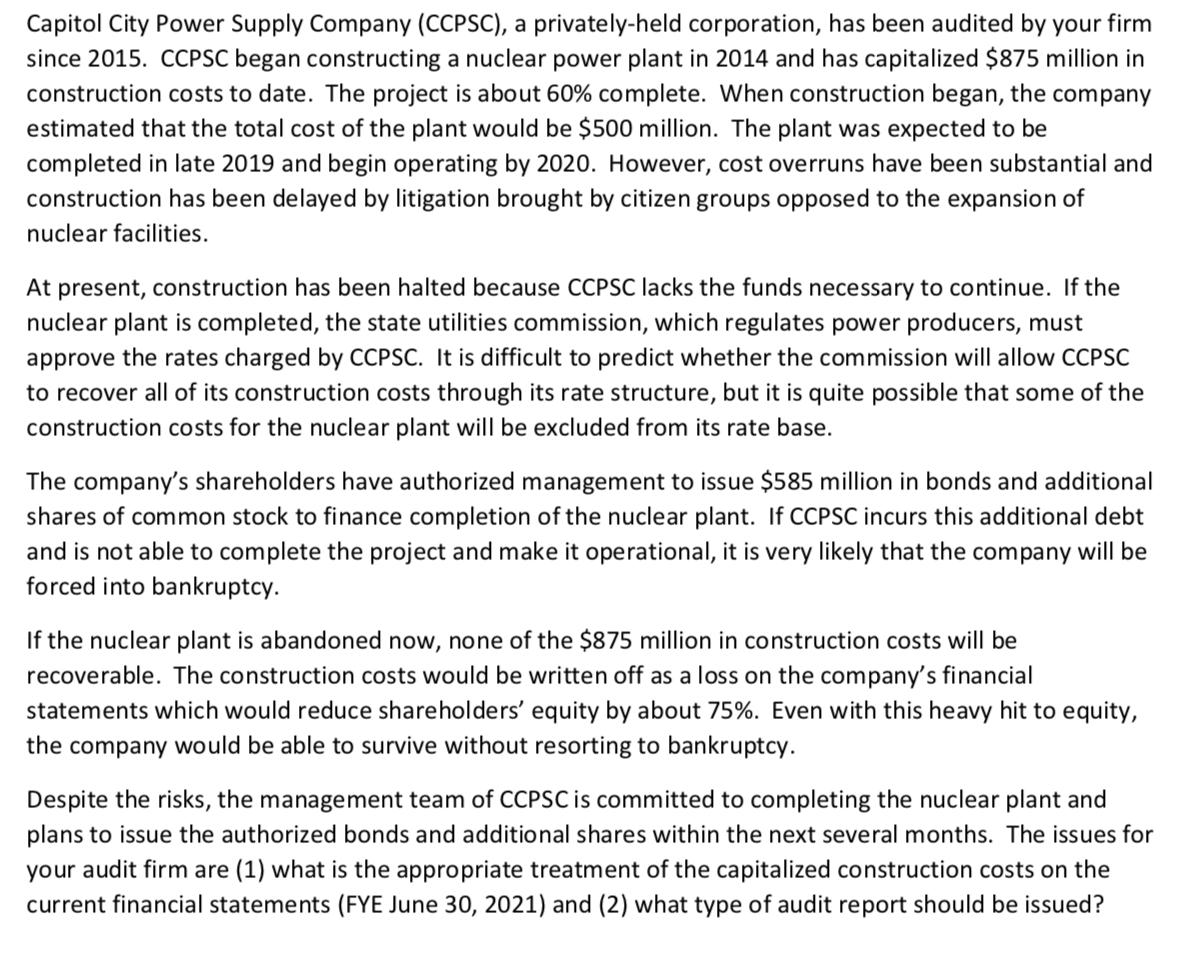

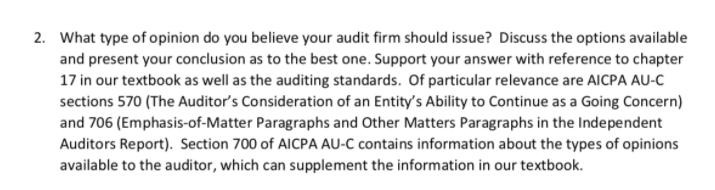

Capitol City Power Supply Company (CCPSC), a privately-held corporation, has been audited by your firm since 2015. CCPSC began constructing a nuclear power plant in 2014 and has capitalized $875 million in construction costs to date. The project is about 60% complete. When construction began, the company estimated that the total cost of the plant would be $500 million. The plant was expected to be completed in late 2019 and begin operating by 2020. However, cost overruns have been substantial and construction has been delayed by litigation brought by citizen groups opposed to the expansion of nuclear facilities. At present, construction has been halted because CCPSC lacks the funds necessary to continue. If the nuclear plant is completed, the state utilities commission, which regulates power producers, must approve the rates charged by CCPSC. It is difficult to predict whether the commission will allow CCPSC to recover all of its construction costs through its rate structure, but it is quite possible that some of the construction costs for the nuclear plant will be excluded from its rate base. The company's shareholders have authorized management to issue $585 million in bonds and additional shares of common stock to finance completion of the nuclear plant. If CCPSC incurs this additional debt and is not able to complete the project and make it operational, it is very likely that the company will be forced into bankruptcy. If the nuclear plant is abandoned now, none of the $875 million in construction costs will be recoverable. The construction costs would be written off as a loss on the company's financial statements which would reduce shareholders' equity by about 75%. Even with this heavy hit to equity, the company would be able to survive without resorting to bankruptcy. Despite the risks, the management team of CCPSC is committed to completing the nuclear plant and plans to issue the authorized bonds and additional shares within the next several months. The issues for your audit firm are (1) what is the appropriate treatment of the capitalized construction costs on the current financial statements (FYE June 30, 2021) and (2) what type of audit report should be issued? 1. As the auditor, how do you believe your client (CCPSC) should account for the construction costs of the nuclear plant? Thus far, they have been capitalizing all the costs as an asset on the balance sheet. Discuss the options available and present your conclusion as to the best one. Support your answer with reference to generally accepted accounting standards found in the FASB Codification. These can be accessed on Blackboard under "External Links". Especially applicable are portions of FASB Accounting Standards Codification section 360-10 (Property, Plant, and Equipment) and section 450-20-25-2 (recognition of estimated loss from a loss contingency). 2. What type of opinion do you believe your audit firm should issue? Discuss the options available and present your conclusion as to the best one. Support your answer with reference to chapter 17 in our textbook as well as the auditing standards. Of particular relevance are AICPA AU-C sections 570 (The Auditor's Consideration of an Entity's Ability to Continue as a Going Concern) and 706 (Emphasis-of-Matter Paragraphs and Other Matters Paragraphs in the Independent Auditors Report). Section 700 of AICPA AU-C contains information about the types of opinions available to the auditor, which can supplement the information in our textbook.

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

1 What is the treatment of capitalised construction cost on the current financial statement Ans Any asset which is under construction must be recorded ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started