Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CAPM Elements Value Risk-free rate (rRFrRF) 5.50% 5.00% 2.75% or 12.50% Market risk premium (RPMRPM) 4.50% 3.38% 8.10% or 5.85% Happy Corp. stocks beta 0.60

| CAPM Elements | Value |

|---|---|

| Risk-free rate (rRFrRF) | 5.50% 5.00% 2.75% or 12.50% |

| Market risk premium (RPMRPM) | 4.50% 3.38% 8.10% or 5.85% |

| Happy Corp. stocks beta | 0.60 1.2 0.96 or 1.80 |

| Required rate of return on Happy Corp. stock | 10.40% 8.84% 13.00% or 14.56% |

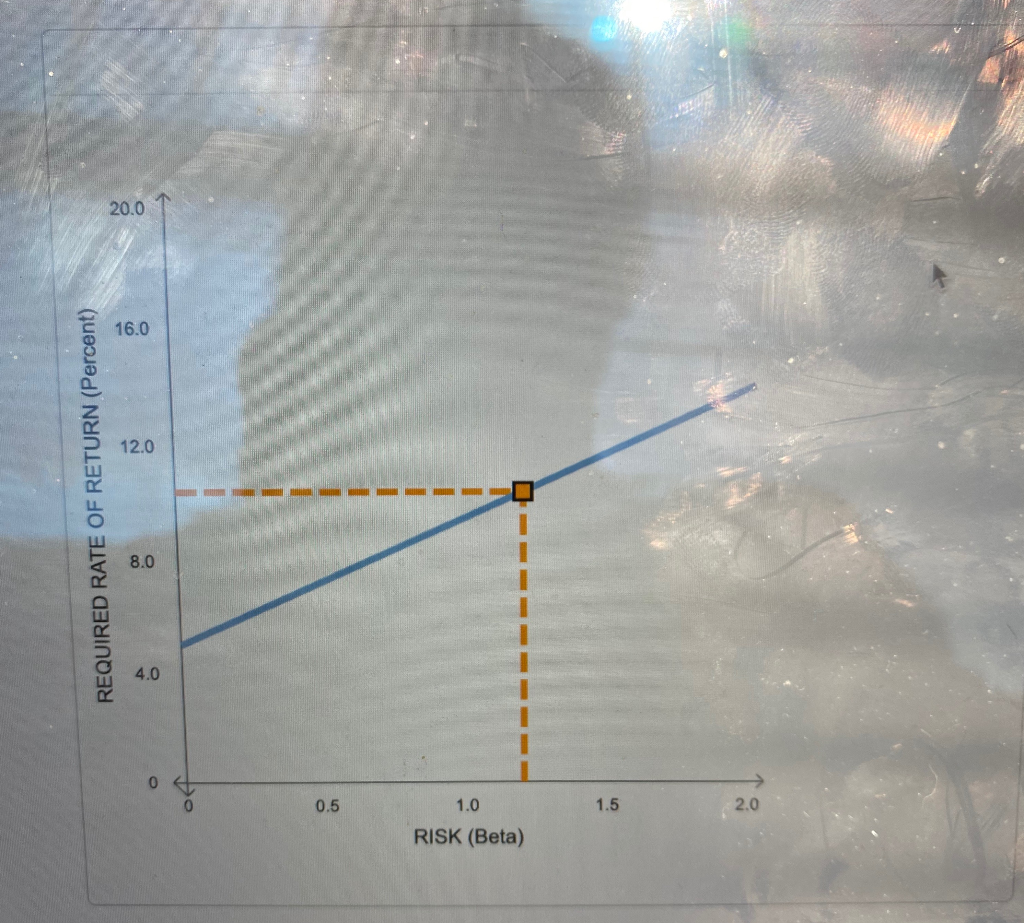

An analyst believes that inflation is going to increase by 3.20% over the next year, while the market risk premium will be unchanged. The analyst uses the Capital Asset Pricing Model (CAPM). The following graph plots the current SML.

Calculate Happy Corp.s new required return. Then, on the graph, use the rectangle symbols to plot the new SML suggested by this analysts prediction.

Happy Corp.s new required rate of return is 9.52% 14.96% 13.60% or 31.28%

20.0 16.0 12.0 REQUIRED RATE OF RETURN (Percent) 8.0 1 1 1 0.5 1.5 1.0 RISK (Beta) 20.0 16.0 12.0 REQUIRED RATE OF RETURN (Percent) 8.0 1 1 1 0.5 1.5 1.0 RISK (Beta)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started