Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CAPM is the Capital Asset Pricing Model OCC is the Opportunity Cost of Capital a) R of debt = .0333 , R of equity =

CAPM is the Capital Asset Pricing Model

OCC is the Opportunity Cost of Capital

a) R of debt = .0333 , R of equity = .0928

b) r = .0822

c) r = .0764

What are the clear steps to solving this problem? Thank you

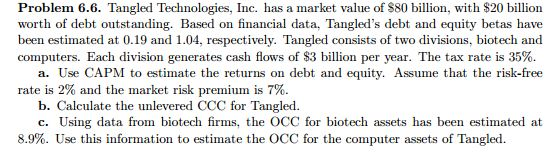

Problem 6.6. Tangled Technologies, Inc. has a market value of $80 billion, with $20 billion worth of debt outstanding. Based on financial data, Tangled's debt and equity betas have been estimated at 0.19 and 1.04, respectively. Tangled consists of two divisions, biotech and computers. Each division generates cash flows of $3 billion per year. The tax rate is 35%. a. Use CAPM to estimate the returns on debt and equity. Assume that the risk-free rate is 2% and the market risk premium is 7%. b. Calculate the unlevered CCC for Tangled. c. Using data from biotech firms, the OCC for biotech assets has been estimated at 8.9%. Use this information to estimate the OCC for the computer assets of TangledStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started