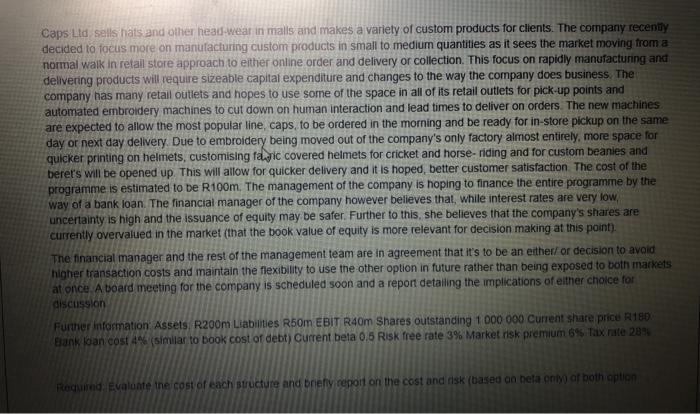

Caps Ltd sells hats and other head-wear in malls and makes a variety of custom products for clients. The company recently decided to focus more on manufacturing custom products in small to medium quantities as it sees the market moving from a normal walk in retail store approach to either online order and delivery or collection. This focus on rapidly manufacturing and delivering products will require sizeable capital expenditure and changes to the way the company does business. The company has many retail outlets and hopes to use some of the space in all of its retail outlets for pick-up points and automated embroidery machines to cut down on human interaction and lead times to deliver on orders. The new machines are expected to allow the most popular line, caps, to be ordered in the morning and be ready for in-store pickup on the same day or next day delivery. Due to embroidery being moved out of the company's only factory almost entirely, more space for quicker printing on helmets, customising fac covered helmets for cricket and horse-riding and for custom beanies and berer's will be opened up. This will allow for quicker delivery and it is hoped, better customer satisfaction. The cost of the programme is estimated to be R100m. The management of the company is hoping to finance the entire programme by the way of a bank loan. The financial manager of the company however believes that, while interest rates are very low, uncertainty is high and the issuance of equity may be safer. Further to this, she believes that the company's shares are currently overvalued in the market that the book value of equity is more relevant for decision making at this point). The financial manager and the rest of the management team are in agreement that it's to be an either/ or decision to avoid higher transaction costs and maintain the flexibility to use the other option in future rather than being exposed to both markets at once. A board meeting for the company is scheduled soon and a report detailing the implications of either choice for discussion Further information Assels R200m Liabilities R50m EBIT R4Om Shares outstanding 1 000 000 Current share price R180 Bank loan cost similar to book cost of debt) Current beta 0.5 Risk free rate 3% Market risk premium 6% Tax rate 289 Required Evaluate the cost of each structure and briefly report on the cost and disk (based on beta only of both option Caps Ltd sells hats and other head-wear in malls and makes a variety of custom products for clients. The company recently decided to focus more on manufacturing custom products in small to medium quantities as it sees the market moving from a normal walk in retail store approach to either online order and delivery or collection. This focus on rapidly manufacturing and delivering products will require sizeable capital expenditure and changes to the way the company does business. The company has many retail outlets and hopes to use some of the space in all of its retail outlets for pick-up points and automated embroidery machines to cut down on human interaction and lead times to deliver on orders. The new machines are expected to allow the most popular line, caps, to be ordered in the morning and be ready for in-store pickup on the same day or next day delivery. Due to embroidery being moved out of the company's only factory almost entirely, more space for quicker printing on helmets, customising fac covered helmets for cricket and horse-riding and for custom beanies and berer's will be opened up. This will allow for quicker delivery and it is hoped, better customer satisfaction. The cost of the programme is estimated to be R100m. The management of the company is hoping to finance the entire programme by the way of a bank loan. The financial manager of the company however believes that, while interest rates are very low, uncertainty is high and the issuance of equity may be safer. Further to this, she believes that the company's shares are currently overvalued in the market that the book value of equity is more relevant for decision making at this point). The financial manager and the rest of the management team are in agreement that it's to be an either/ or decision to avoid higher transaction costs and maintain the flexibility to use the other option in future rather than being exposed to both markets at once. A board meeting for the company is scheduled soon and a report detailing the implications of either choice for discussion Further information Assels R200m Liabilities R50m EBIT R4Om Shares outstanding 1 000 000 Current share price R180 Bank loan cost similar to book cost of debt) Current beta 0.5 Risk free rate 3% Market risk premium 6% Tax rate 289 Required Evaluate the cost of each structure and briefly report on the cost and disk (based on beta only of both option