capsim help!

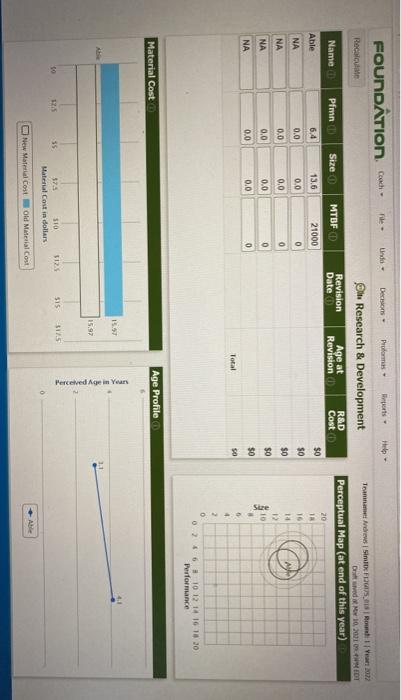

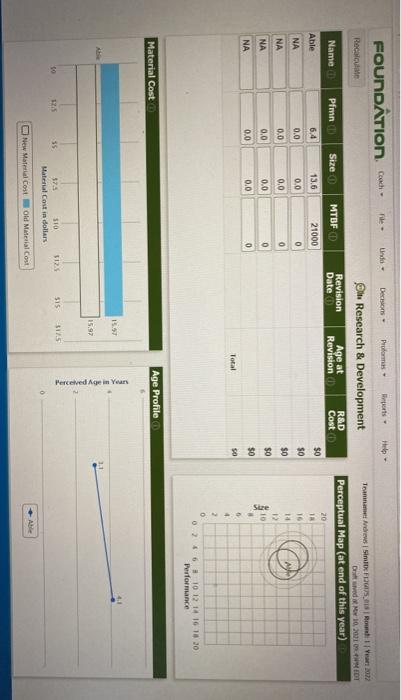

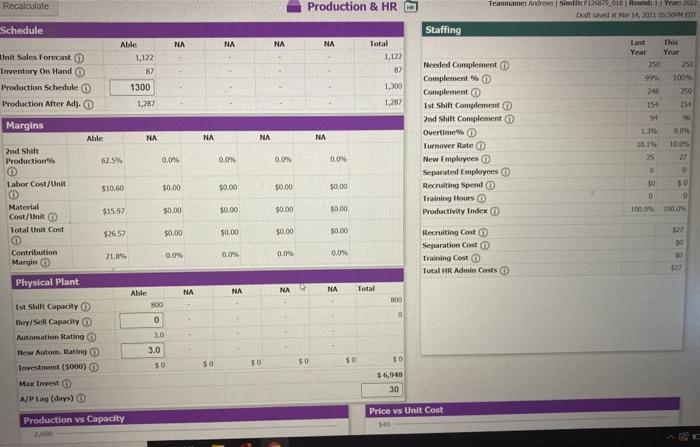

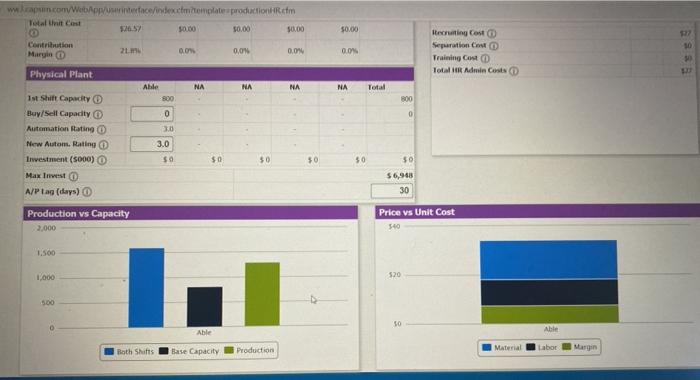

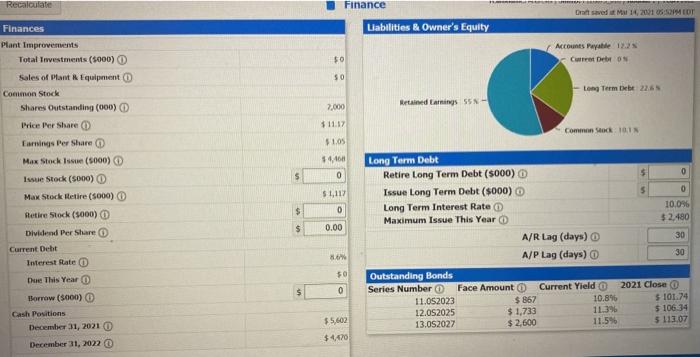

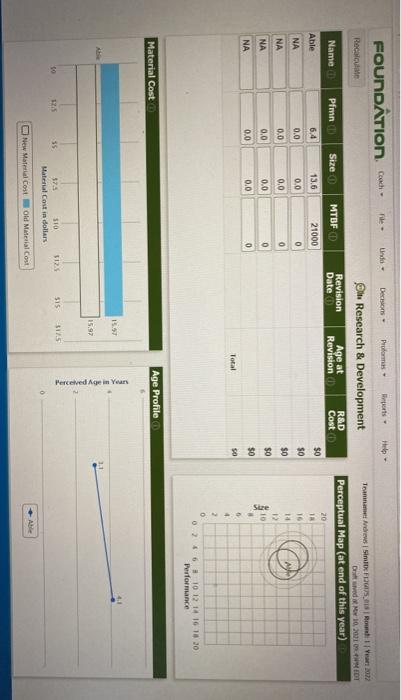

Lindo- Decisions FOUNDATION Cooch os Prolom Help Recalcul Om Research & Development Revision Age at R&D Date Revision Cost Toamme des SIFIR Y Z De wed 10,00DT Perceptual Map (at end of this year) 20 TA Name Pimn Size MTBFD Able 6.4 21000 0 TE NA 13.6 0.0 0.0 0.0 NA 0.0 0 $0 50 $0 $0 50 50 NA 0.0 0 12 10 0.0 0.0 Sure NA 0.0 0 # Total 4 2 0.246 10 12 14 16 18 30 Performance Material Cost Age Profile 15.97 Perceived Age in Years 1125 $15 $17.5 37.5 Material Cost in dollars New Material Cost Old Material Cost Name Price Promo Budget Sales Budget Benchmark Prediction 1,122 Your Forecast Able de M 1 02 03 Contrib Less Margin Promo/sales $ 8,333 $ 6,333 1000 Gross Revenue $ 38,138 $0 34,00 0 Variable Costs $ 29,805 50 1000 $0 NA $0.0 0 $0 $0 $0 50 $0 0 $0 $0 NA NA $0.0 $0.0 $0 $0 0 $0 $0 $0 $0 $0 $ 8,333 NA $0.0 $0 0 $0 $0 $ 38,138 $0 $1,000 $0 $0 $0 $ 6,333 Total $1,000 1,122 0 $ 29,805 AlR las dan 30 NP LA 30 Revenue Forecast Unit Sales Forecast 50 1.121 10 538,13 evenue forecautin 0000 Unit Sales forecast lin ) Low: 816 20 High: 305 Ale Ve Cast Marketing Margin Alter Marketing Bagh Recalculate Production & HR U Teamnamer Andrew Smood Year Dave 14, 2011 Schedule Staffing NA NA NA NA This Able 1,122 Total 1,127 87 Year Last Year 250 99 B7 250 100% Init Sales Forecast Tnventory On Hand Production Schedule Production After Md. 1300 1,300 1,287 1,287 248 151 94 250 154 90 Margins Able NA NA NA NA Needed Complement Complement Complement Ist Shift Complement 2nd Shift Complement Overtime Turnover Hate New Employees O Separated Employees Recruiting Spend Training Hours Productivity Index 0.01 10.0 2nd Shift Production 22 62.5% 0.0 0.0% 0.0 25 0.0 0 0 $10.60 $0.00 $0.00 $0.00 $0.00 50 0 Labor Cost/Unit O Material Cost/Unit Total Unit Cost $15.97 $0.00 $0.00 $0.00 $0.00 1000 TOUS $26.57 $0.00 $0.00 $0.00 $0.00 21.8% 0.09 0.04 Contribution Margin 0.0% 0.0% Recruiting Cost Separation Cost Training Cost Total HR Admin Costs 10 30 22 Physical Plant NA NA NA NA Able Total B00 800 D 0 30 Ist Shift Capacity Buy/Sell Capacity Automation Rating New Autom. Rating Investment (5000) Ma invest N/Plag(days) 3.0 50 $0 50 50 50 50 56,968 30 Production vs Capacity 2.000 Price vs Unit Cost 140 50.00 ww.capsun.com Website face/index.com/template production.com Total tinit Cast 50.00 30.00 Contribution Margin 2m 0.0 0.01 0.04 0.0% Itecruiting Cost Seuration Training Cost Total HR Admin Costs 30 Physical Plant Ahle NA NA NA NA Total 500 00 0 0 1st Shift Capacity Buy/Sell Capacity Automation Rating New Autom. Rating Investment (5000) Max Invest A/PEag (days) 3.0 3.0 sa $0 50 50 50 $0 $ 6,945 30 Production vs Capacity Price vs Unit Cost 540 2.000 1.500 1,000 520 500 10 Ahle Able Material Labor Roth Shifts Production Base Capacity Margin Recalculate Finance Crat saved M 14201 MET Liabilities & Owner's Equity Accounts Payable 1 Cure Debt ON $0 SO Long Term De 226 2.000 Retained Lang SSN- $11.17 $1.05 Common Stock 101 4460 $ 0 Finances Plant Improvements Total Investments (5000) Sales of Plant Equipment Common Stock Shares Outstanding (000) Price Per Share Earnings Per Share o Max Stock Issue (5000) Issue Stock (5000) Max Stock Retire (5000) Retire Stock (5000) Dividend Per Share Current Debt Interest Rate Due This Year o Borrow (5000) Cash Positions December 31, 20210 December 31, 2022 $1,117 $ 0 $ 0.00 Long Term Debt Retire Long Term Debt (5000) g Issue Long Term Debt ($000) O $ 0 Long Term Interest Rate 10.096 Maximum Issue This Year $2.480 A/R Lag (days) 30 A/P Lag (days) 30 Outstanding Bonds Series Number Face Amount Current Yield 2021 Close 11.052023 $ 867 10.89 $ 101.74 12.052025 $1,733 11.396 5 106:34 13.052027 $ 2,600 11.5% 5 113.07 8. 50 $ 0 $5.602 $4470 Lindo- Decisions FOUNDATION Cooch os Prolom Help Recalcul Om Research & Development Revision Age at R&D Date Revision Cost Toamme des SIFIR Y Z De wed 10,00DT Perceptual Map (at end of this year) 20 TA Name Pimn Size MTBFD Able 6.4 21000 0 TE NA 13.6 0.0 0.0 0.0 NA 0.0 0 $0 50 $0 $0 50 50 NA 0.0 0 12 10 0.0 0.0 Sure NA 0.0 0 # Total 4 2 0.246 10 12 14 16 18 30 Performance Material Cost Age Profile 15.97 Perceived Age in Years 1125 $15 $17.5 37.5 Material Cost in dollars New Material Cost Old Material Cost Name Price Promo Budget Sales Budget Benchmark Prediction 1,122 Your Forecast Able de M 1 02 03 Contrib Less Margin Promo/sales $ 8,333 $ 6,333 1000 Gross Revenue $ 38,138 $0 34,00 0 Variable Costs $ 29,805 50 1000 $0 NA $0.0 0 $0 $0 $0 50 $0 0 $0 $0 NA NA $0.0 $0.0 $0 $0 0 $0 $0 $0 $0 $0 $ 8,333 NA $0.0 $0 0 $0 $0 $ 38,138 $0 $1,000 $0 $0 $0 $ 6,333 Total $1,000 1,122 0 $ 29,805 AlR las dan 30 NP LA 30 Revenue Forecast Unit Sales Forecast 50 1.121 10 538,13 evenue forecautin 0000 Unit Sales forecast lin ) Low: 816 20 High: 305 Ale Ve Cast Marketing Margin Alter Marketing Bagh Recalculate Production & HR U Teamnamer Andrew Smood Year Dave 14, 2011 Schedule Staffing NA NA NA NA This Able 1,122 Total 1,127 87 Year Last Year 250 99 B7 250 100% Init Sales Forecast Tnventory On Hand Production Schedule Production After Md. 1300 1,300 1,287 1,287 248 151 94 250 154 90 Margins Able NA NA NA NA Needed Complement Complement Complement Ist Shift Complement 2nd Shift Complement Overtime Turnover Hate New Employees O Separated Employees Recruiting Spend Training Hours Productivity Index 0.01 10.0 2nd Shift Production 22 62.5% 0.0 0.0% 0.0 25 0.0 0 0 $10.60 $0.00 $0.00 $0.00 $0.00 50 0 Labor Cost/Unit O Material Cost/Unit Total Unit Cost $15.97 $0.00 $0.00 $0.00 $0.00 1000 TOUS $26.57 $0.00 $0.00 $0.00 $0.00 21.8% 0.09 0.04 Contribution Margin 0.0% 0.0% Recruiting Cost Separation Cost Training Cost Total HR Admin Costs 10 30 22 Physical Plant NA NA NA NA Able Total B00 800 D 0 30 Ist Shift Capacity Buy/Sell Capacity Automation Rating New Autom. Rating Investment (5000) Ma invest N/Plag(days) 3.0 50 $0 50 50 50 50 56,968 30 Production vs Capacity 2.000 Price vs Unit Cost 140 50.00 ww.capsun.com Website face/index.com/template production.com Total tinit Cast 50.00 30.00 Contribution Margin 2m 0.0 0.01 0.04 0.0% Itecruiting Cost Seuration Training Cost Total HR Admin Costs 30 Physical Plant Ahle NA NA NA NA Total 500 00 0 0 1st Shift Capacity Buy/Sell Capacity Automation Rating New Autom. Rating Investment (5000) Max Invest A/PEag (days) 3.0 3.0 sa $0 50 50 50 $0 $ 6,945 30 Production vs Capacity Price vs Unit Cost 540 2.000 1.500 1,000 520 500 10 Ahle Able Material Labor Roth Shifts Production Base Capacity Margin Recalculate Finance Crat saved M 14201 MET Liabilities & Owner's Equity Accounts Payable 1 Cure Debt ON $0 SO Long Term De 226 2.000 Retained Lang SSN- $11.17 $1.05 Common Stock 101 4460 $ 0 Finances Plant Improvements Total Investments (5000) Sales of Plant Equipment Common Stock Shares Outstanding (000) Price Per Share Earnings Per Share o Max Stock Issue (5000) Issue Stock (5000) Max Stock Retire (5000) Retire Stock (5000) Dividend Per Share Current Debt Interest Rate Due This Year o Borrow (5000) Cash Positions December 31, 20210 December 31, 2022 $1,117 $ 0 $ 0.00 Long Term Debt Retire Long Term Debt (5000) g Issue Long Term Debt ($000) O $ 0 Long Term Interest Rate 10.096 Maximum Issue This Year $2.480 A/R Lag (days) 30 A/P Lag (days) 30 Outstanding Bonds Series Number Face Amount Current Yield 2021 Close 11.052023 $ 867 10.89 $ 101.74 12.052025 $1,733 11.396 5 106:34 13.052027 $ 2,600 11.5% 5 113.07 8. 50 $ 0 $5.602 $4470