Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Capstone Turbine Corporation is the world's leading provider of micro-turbine based MicroCHP (combined heat and power) systems for clean, continuous, distributed generation electricity. The MicroCHP

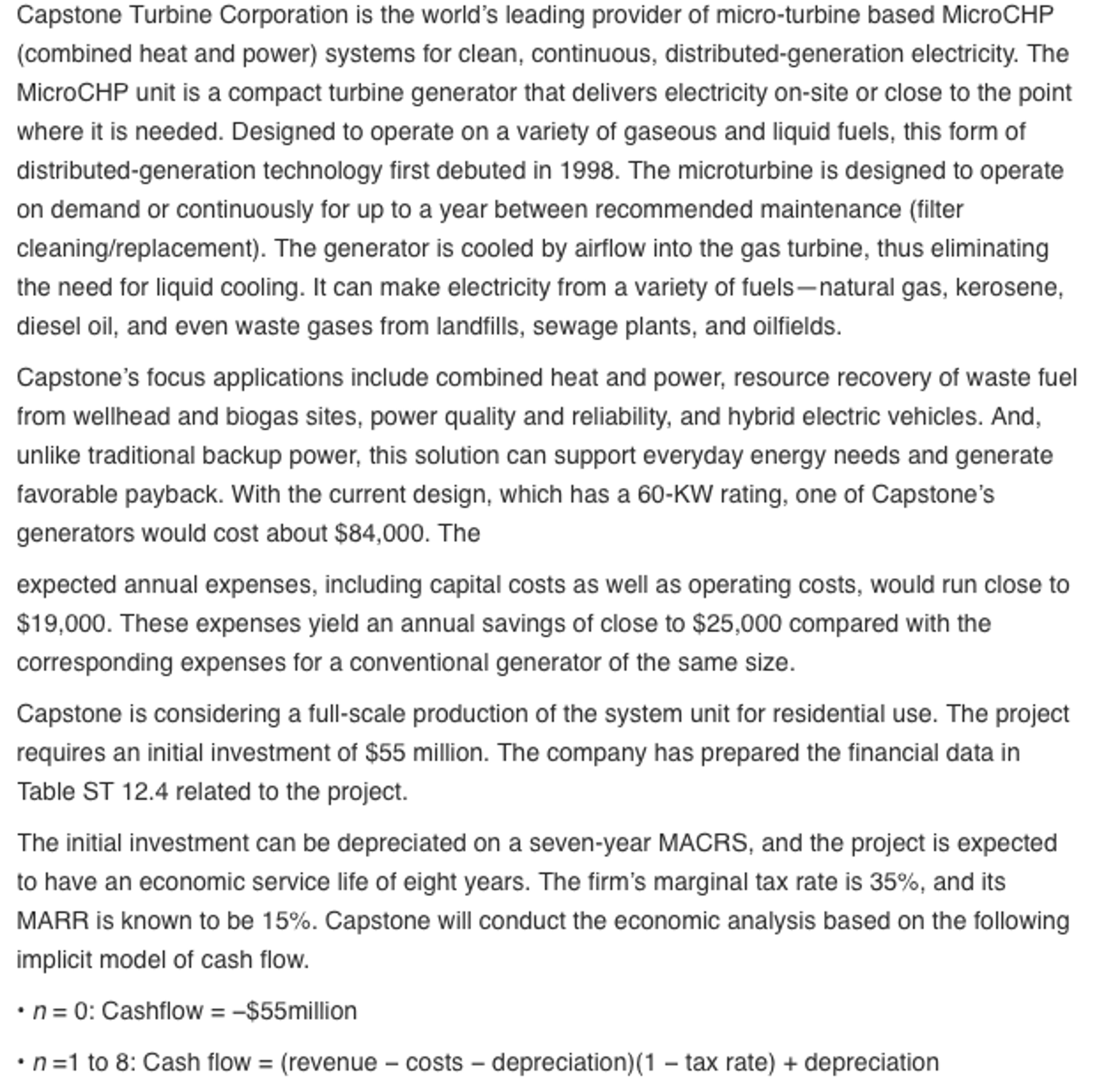

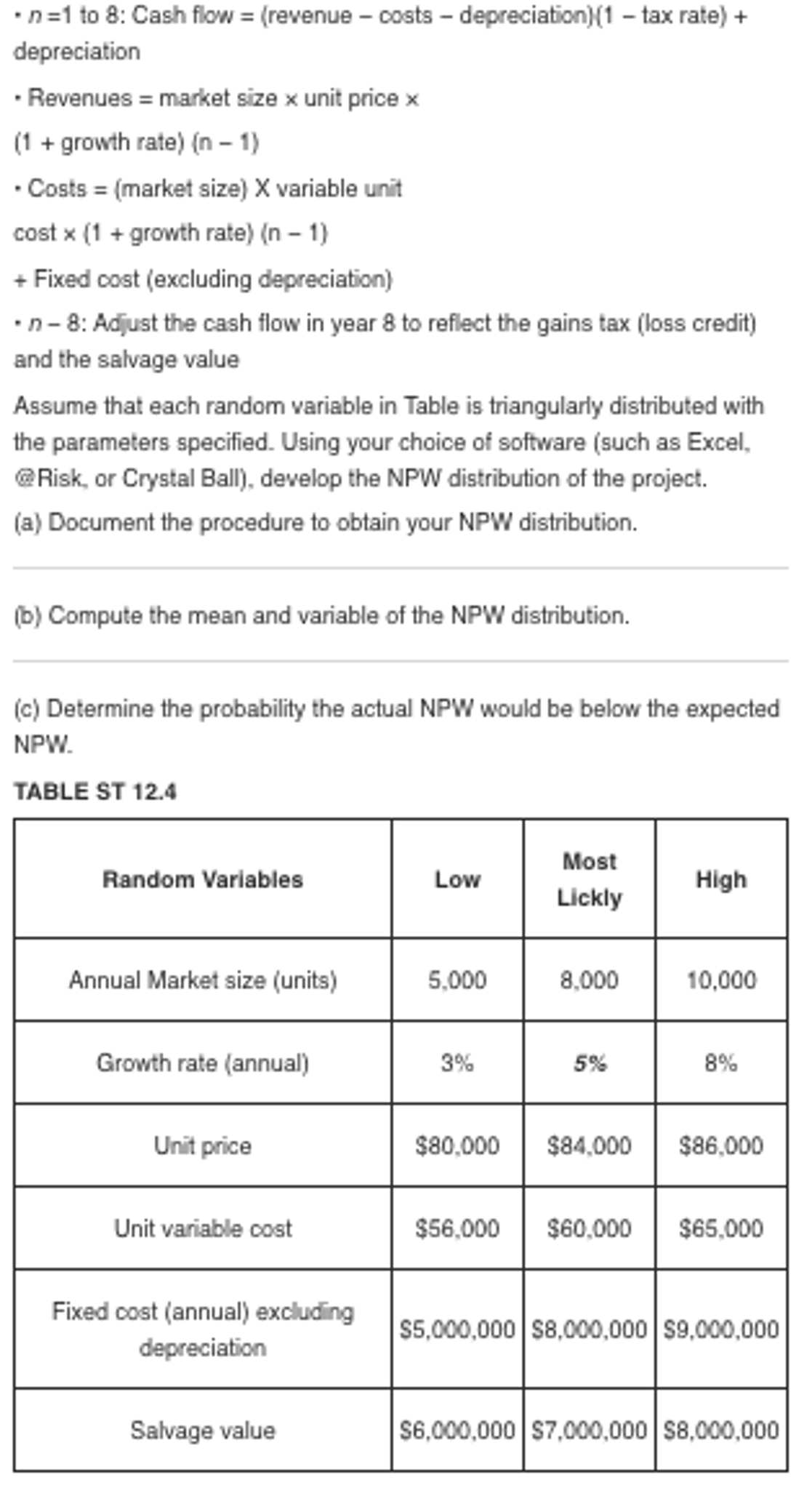

Capstone Turbine Corporation is the world's leading provider of micro-turbine based MicroCHP (combined heat and power) systems for clean, continuous, distributed generation electricity. The MicroCHP unit is a compact turbine generator that delivers electricity on-site or close to the point where it is needed. Designed to operate on a variety of gaseous and liquid fuels, this form of distributed-generation technology first debuted in 1998. The microturbine is designed to operate on demand or continuously for up to a year between recommended maintenance (filter cleaning/replacement). The generator is cooled by airflow into the gas turbine, thus eliminating the need for liquid cooling. It can make electricity from a variety of fuels natural gas, kerosene diesel oil, and even waste gases from landfills, sewage plants, and oilfields Capstone's focus applications include combined heat and power, resource recovery of waste fuel from wellhead and biogas sites, power quality and reliability, and hybrid electric vehicles. And unlike traditional backup power, this solution can support everyday energy needs and generate favorable payback. With the current design, which has a 60-KW rating, one of Capstone's generators would cost about $84,000. The expected annual expenses, including capital costs as well as operating costs, would run close to $19,000. These expenses yield an annual savings of close to $25,000 compared with the corresponding expenses for a conventional generator of the same size Capstone is considering a full-scale production of the system unit for residential use. The project requires an initial investment of $55 million. The company has prepared the financial data in Table ST 12.4 related to the project The initial investment can be depreciated on a seven-year MACRS, and the project is expected to have an economic service life of eight years. The firm's marginal tax rate is 35%, and its MARR is known to be 15%. Capstone will conduct the economic analysis based on the following implicit model of cash flow n 0: Cashflow $55million n-1 to 8: Cash flow (revenue costs -depreciation) (1 tax rate) depreciation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started