Answered step by step

Verified Expert Solution

Question

1 Approved Answer

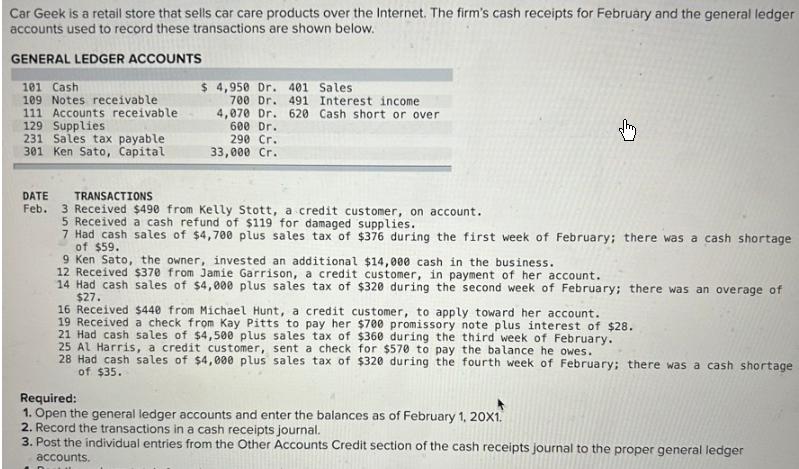

Car Geek is a retail store that sells car care products over the Internet. The firm's cash receipts for February and the general ledger

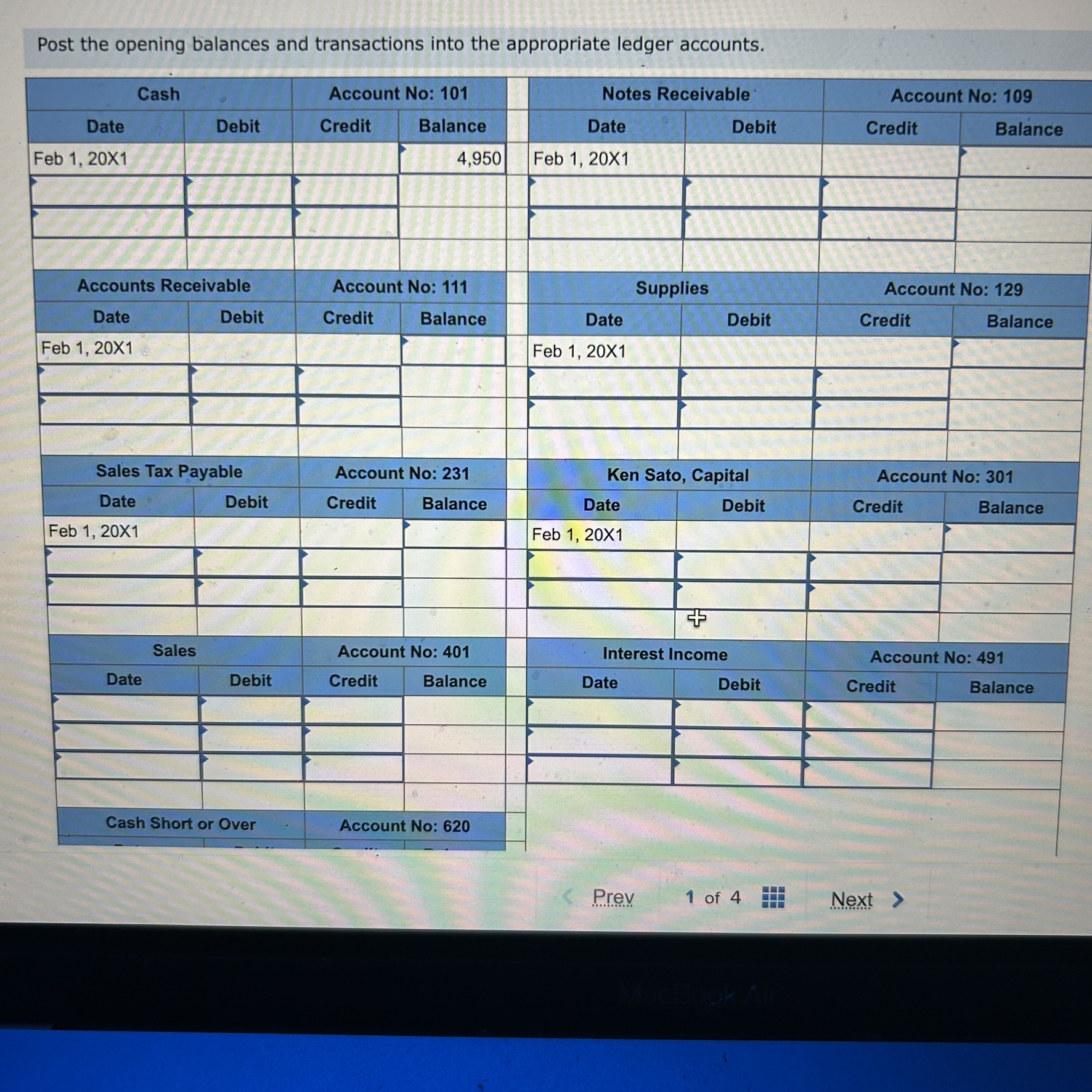

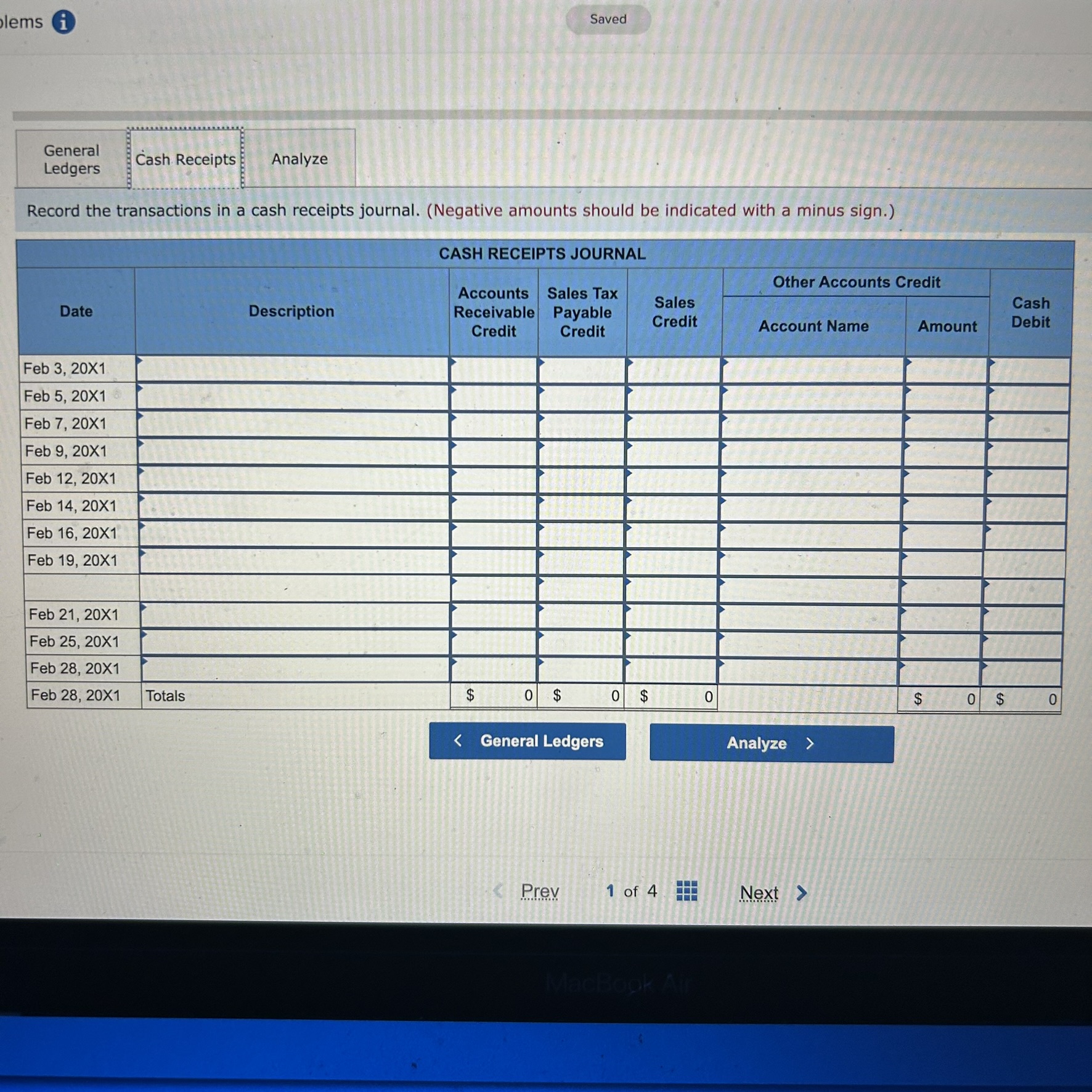

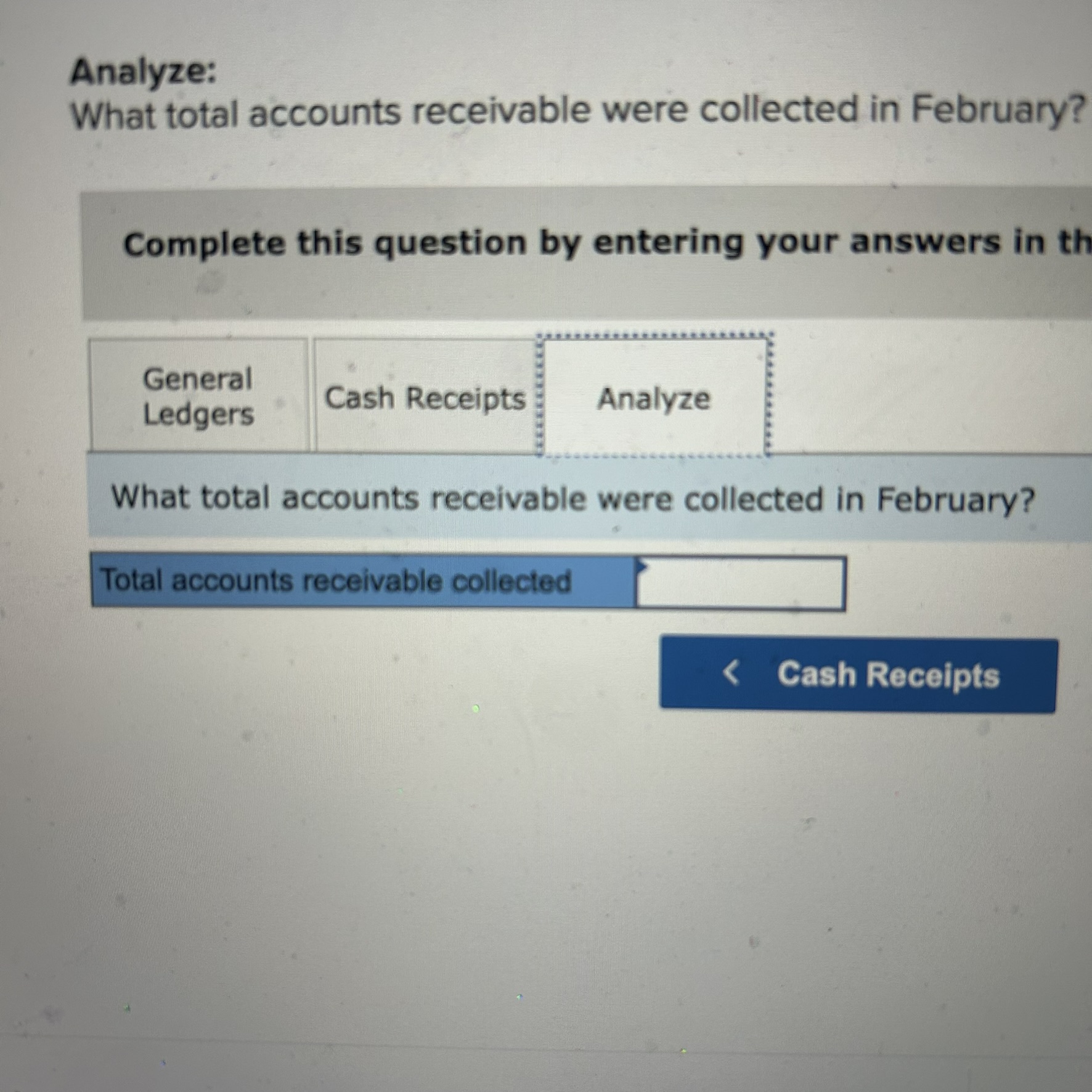

Car Geek is a retail store that sells car care products over the Internet. The firm's cash receipts for February and the general ledger accounts used to record these transactions are shown below. GENERAL LEDGER ACCOUNTS 101 Cash 109 Notes receivable 111 Accounts receivable 129 Supplies 231 Sales tax payable 301 Ken Sato, Capital $ 4,950 Dr. 401 Sales 700 Dr. 491 Interest income 4,070 Dr. 620 Cash short or over 600 Dr. 290 Cr. 33,000 Cr. DATE TRANSACTIONS Feb. 3 Received $490 from Kelly Stott, a credit customer, on account. 5 Received a cash refund of $119 for damaged supplies. 7 Had cash sales of $4,700 plus sales tax of $376 during the first week of February; there was a cash shortage of $59. 9 Ken Sato, the owner, invested an additional $14,000 cash in the business. 12 Received $370 from Jamie Garrison, a credit customer, in payment of her account. 14 Had cash sales of $4,000 plus sales tax of $320 during the second week of February; there was an overage of $27. 16 Received $440 from Michael Hunt, a credit customer, to apply toward her account. 19 Received a check from Kay Pitts to pay her $700 promissory note plus interest of $28. 21 Had cash sales of $4,500 plus sales tax of $360 during the third week of February. 25 Al Harris, a credit customer, sent a check for $570 to pay the balance he owes. 28 Had cash sales of $4,000 plus sales tax of $320 during the fourth week of February; there was a cash shortage of $35. Required: 1. Open the general ledger accounts and enter the balances as of February 1, 20X1. 2. Record the transactions in a cash receipts journal. 3. Post the individual entries from the Other Accounts Credit section of the cash receipts journal to the proper general ledger accounts. Post the opening balances and transactions into the appropriate ledger accounts. Cash Account No: 101 Notes Receivable Account No: 109 Date Debit Credit Balance Date Debit Credit Balance Feb 1, 20X1 4,950 Feb 1, 20X1 Accounts Receivable Date Feb 1, 20X1 Account No: 111 Supplies Account No: 129 Debit Credit Balance Date Debit Credit Balance Feb 1, 20X1 Sales Tax Payable Date Feb 1, 20X1 Date Sales Account No: 231 Debit Credit Balance Ken Sato, Capital Date Feb 1, 20X1 Account No: 301 Debit Credit Balance Account No: 401 Interest Income Account No: 491 Debit Credit Balance Date Debit Credit Balance Cash Short or Over Account No: 620 Prev 1 of 4 Next MacBook Air blems i General Ledgers Cash Receipts Analyze Saved Record the transactions in a cash receipts journal. (Negative amounts should be indicated with a minus sign.) Date Feb 3, 20X1 Feb 5, 20X1 Feb 7, 20X1 Feb 9, 20X1 Feb 12, 20X1 Feb 14, 20X1 Feb 16, 20X1 Feb 19, 20X1 Description CASH RECEIPTS JOURNAL Other Accounts Credit Accounts Sales Tax Sales Receivable Credit Payable Credit Credit Account Name Feb 21, 20X1 Feb 25, 20X1 Feb 28, 20X1 Feb 28, 20X1 Totals $ 0 $ 0 $ 0 < General Ledgers Amount Cash Debit $ 0 $ 0 Analyze > MacBook Air Analyze: What total accounts receivable were collected in February? Complete this question by entering your answers in th General Ledgers Cash Receipts Analyze What total accounts receivable were collected in February? Total accounts receivable collected < Cash Receipts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started