Answered step by step

Verified Expert Solution

Question

1 Approved Answer

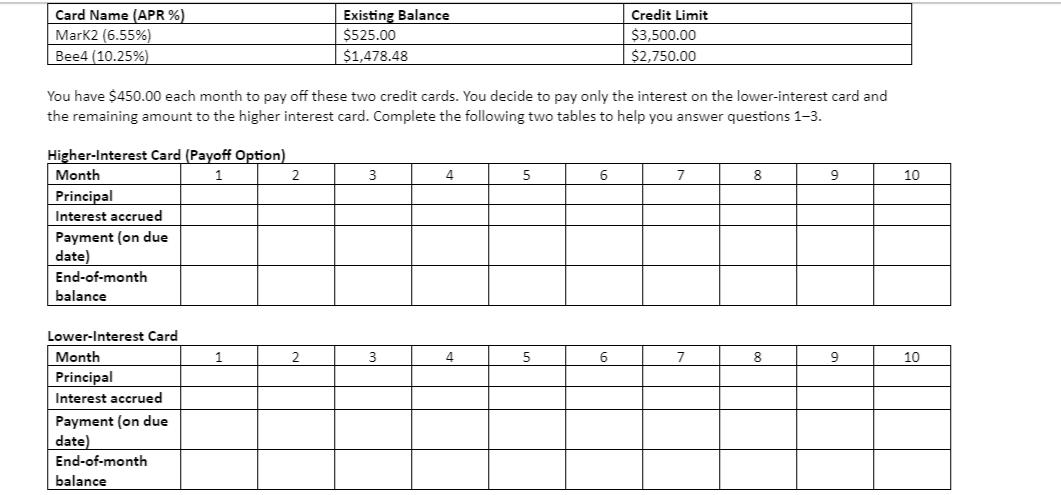

Card Name (APR %) Mark2 (6.55%) Bee4 (10.25%) Existing Balance $525.00 $1,478.48 Credit Limit $3,500.00 $2,750.00 You have $450.00 each month to pay off

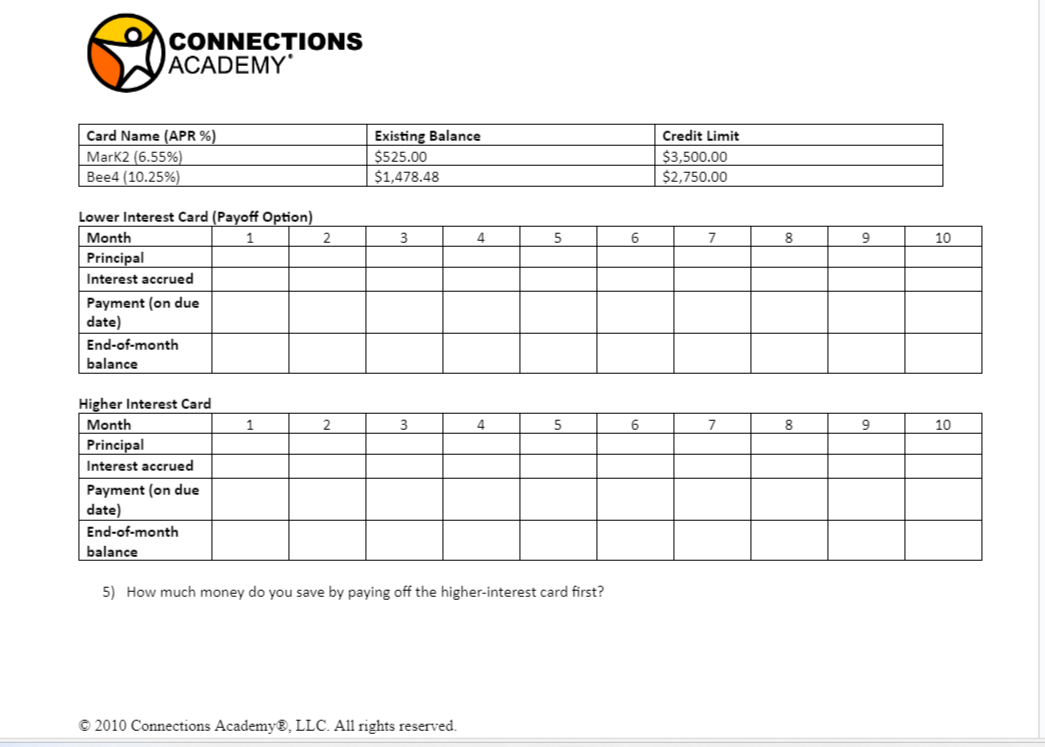

Card Name (APR %) Mark2 (6.55%) Bee4 (10.25%) Existing Balance $525.00 $1,478.48 Credit Limit $3,500.00 $2,750.00 You have $450.00 each month to pay off these two credit cards. You decide to pay only the interest on the lower-interest card and the remaining amount to the higher interest card. Complete the following two tables to help you answer questions 1-3. Higher-Interest Card (Payoff Option) Month Principal Interest accrued Payment (on due date) End-of-month balance Lower-Interest Card Month Principal Interest accrued Payment (on due date) End-of-month balance 1 2 3 4 5 6 7 8 9 10 1 2 3 4 5 6 7 8 9 10 CONNECTIONS ACADEMY 1) How long does it take to pay off the higher-interest card? 2) What is the amount of the last payment on the higher-interest card? Why? 3) At the end of the month that you pay off the higher-interest card, after you have started to pay down your debt on the lower-interest card, what is the balance of the lower-interest card? Why? Complete the following two tables to help you answer questions 4-5. 4) Rework the problem below so that you pay off the lower-interest card first. CONNECTIONS ACADEMY Card Name (APR %) Mark2 (6.55%) Bee4 (10.25%) Lower Interest Card (Payoff Option) Month Principal Interest accrued Payment (on due date) End-of-month balance Higher Interest Card Month Principal Interest accrued Payment (on due date) End-of-month 1 Existing Balance $525.00 $1,478.48 Credit Limit $3,500.00 $2,750.00 2 3 4 5 6 7 8 9 10 1 2 3 4 5 6 7 8 9 10 balance 5) How much money do you save by paying off the higher-interest card first? 2010 Connections Academy, LLC. All rights reserved.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started