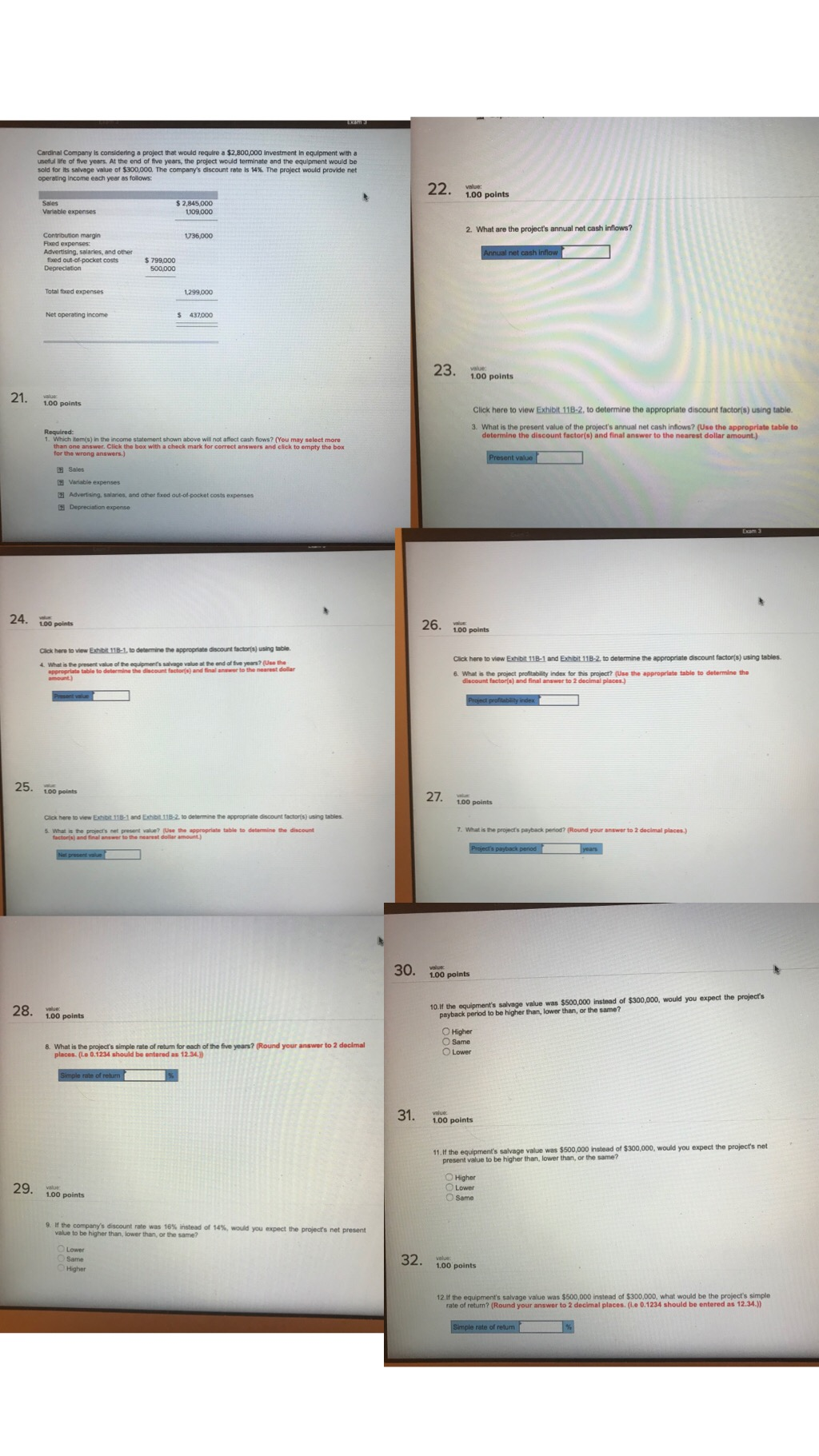

| Cardinal Company is considering a project that would require a $2,800,000 investment in equipment with a useful life of five years. At the end of five years, the project would terminate and the equipment would be sold for its salvage value of $300,000. The companys discount rate is 14%. The project would provide net operating income each year as follows: |

| |

| Sales | | | $ | 2,845,000 |

| Variable expenses | | | | 1,109,000 |

| | | | | |

| Contribution margin | | | | 1,736,000 |

| Fixed expenses: | | | | |

| Advertising, salaries, and other fixed out-of-pocket costs | $ | 799,000 | | |

| Depreciation | | 500,000 | | |

| | | | | |

| Total fixed expenses | | | | 1,299,000 |

| | | | | |

| Net operating income | | | $ | 437,000 |

| | | | | |

| |

Exhibit 11b-1: http://lectures.mhhe.com/connect/0078025419/Exhibit/Exhibit%2011B-1.JPG

exhibit 11b-2: http://lectures.mhhe.com/connect/0078025419/Exhibit/Exhibit%2011B-2.JPG

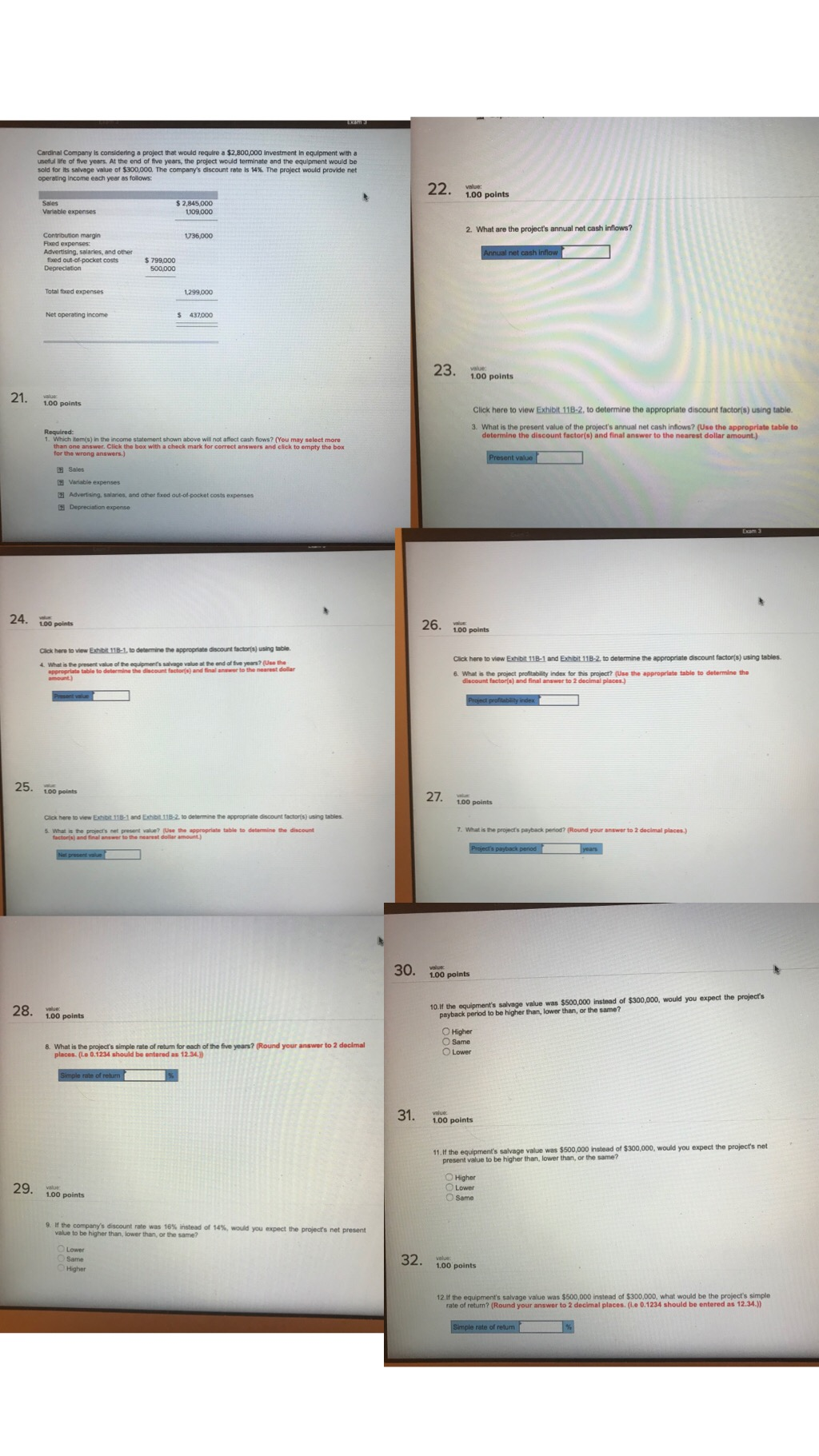

Cardinal Company is considering a project that would require a $2,800,000 Investment in equipment with a useful life of of five years. At the end of five years, the project would terminate and the equipment would be sold for its salvage value of $300,000. The company's discount rate is 14%. The project would provide net operating income each year as follows: 22. You 1.00 points Sales Variable expenses $ 2,845,000 1109,000 2. What are the project's annual net cash inflows? 36,000 Contribution margin Foad expenses Advertising, salaries, and other fixed out-of-pocket costs Depreciation Annual net cash inflow $ 299,000 500,000 Total bed expenses 1.299,000 Net operating income $ 437,000 23. 1.00 points 21. 1.00 points Click here to view Exhibit 11B-2, to determine the appropriate discount factor(s) using table. 3. What is the present value of the project's annual net cash inflows? (Use the appropriate table to determine the discount factor(s) and final answer to the nearest dollar amount.) Required hitem(s) in the income statement shown above will not affect cash flows? (You may select more than one answer. Click the box with a check mark for correct answers and click to empty the box for the wrong answers.) Present value Sales Variable expenses Advertising, salaries, and other food out-of-pocket costs expenses 2 Depreciation expense 24. 100 points 26. 100 points Click here to view Ext 118-1. to determine the appropriate discount factor(s) single 4. What is the present value of the equipment's savage value at the end of five years? (U appropriate able to determine the discount factors) and final to the nearest dollar amount) Click here to view Exhibit 118-1 and Exhibit 11B-2. to determine the appropriate discount factor(s) using tables 6. What is the project profitability index for this project? (Use the appropriate table to determine the discount factor(s) and final answer to 2 decimal places) e profitability indes 25. 100 points 27. 100 points Click here to view Ext 118-1 and 113-2. to determine the appropriate discount factors) using tables 5. What is the project's net present value? Use the appropriate table to determine the discount factors and final answer to the nearest dolar mount) 7. What is the project's payback period? (Round your answer to 2 decimal places.) Project's payback period years 30. 1.00 points 28. 100 points 10.If the equipment's salvage value was $500,000 instead of $300,000, would you expect the project's payback period to be higher than, lower than, or the same? Higher O Same Lower 8. What is the project's simple rate of return for each of the five years? (Round your answer to 2 decimal places. (La 0.1234 should be entered as 12.34.) ble rate of return 31. value 1.00 points 11. If the equipment's salvage value was $500,000 instead of $300,000, would you expect the project's net present value to be higher than, lower than, or the same? 29. Higher Lower Same 1.00 points 9. If the company's discount rate was 16% instead of 14%, would you expect the project's net present value to be higher than, lower than, or the same? Lower Same Higher 32. 1.00 points 12. If the equipment's salvage value was $500,000 instead of $300,000, what would be the project's simple rate of return? (Round your answer to 2 decimal places. (.e 0.1234 should be entered as 12.34.)) Simple rate of retum