Answered step by step

Verified Expert Solution

Question

1 Approved Answer

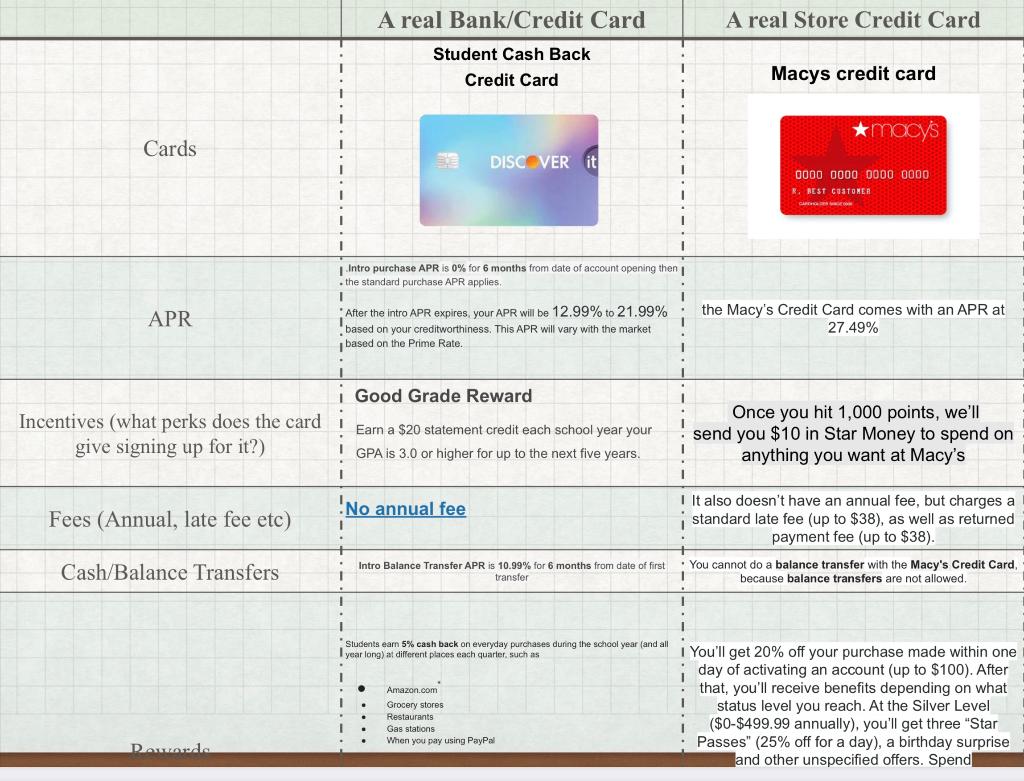

Cards APR A real Bank/Credit Card A real Store Credit Card Student Cash Back Credit Card DISCOVER it Intro purchase APR is 0% for

Cards APR A real Bank/Credit Card A real Store Credit Card Student Cash Back Credit Card DISCOVER it Intro purchase APR is 0% for 6 months from date of account opening then the standard purchase APR applies. After the intro APR expires, your APR will be 12.99% to 21.99% based on your creditworthiness. This APR will vary with the market based on the Prime Rate. . Macys credit card 0000 0000 0000 0000 K. BEST CUSTOMER the Macy's Credit Card comes with an APR at 27.49% Incentives (what perks does the card give signing up for it?) Fees (Annual, late fee etc) Cash/Balance Transfers i Good Grade Reward Earn a $20 statement credit each school year your GPA is 3.0 or higher for up to the next five years. No annual fee Intro Balance Transfer APR is 10.99% for 6 months from date of first transfer I I Once you hit 1,000 points, we'll send you $10 in Star Money to spend on anything you want at Macy's I It also doesn't have an annual fee, but charges a standard late fee (up to $38), as well as returned payment fee (up to $38). You cannot do a balance transfer with the Macy's Credit Card, because balance transfers are not allowed. Doworde Students earn 5% cash back on everyday purchases during the school year (and all year long) at different places each quarter, such as Amazon.com Grocery stores Restaurants Gas stations When you pay using PayPal I You'll get 20% off your purchase made within one day of activating an account (up to $100). After that, you'll receive benefits depending on what status level you reach. At the Silver Level ($0-$499.99 annually), you'll get three "Star Passes" (25% off for a day), a birthday surprise and other unspecified offers. Spend Which card would you choice and why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the image you sent the better choice between the two cards depends on your spending habits and priorities Heres a breakdown of the cards Disc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started