Answered step by step

Verified Expert Solution

Question

1 Approved Answer

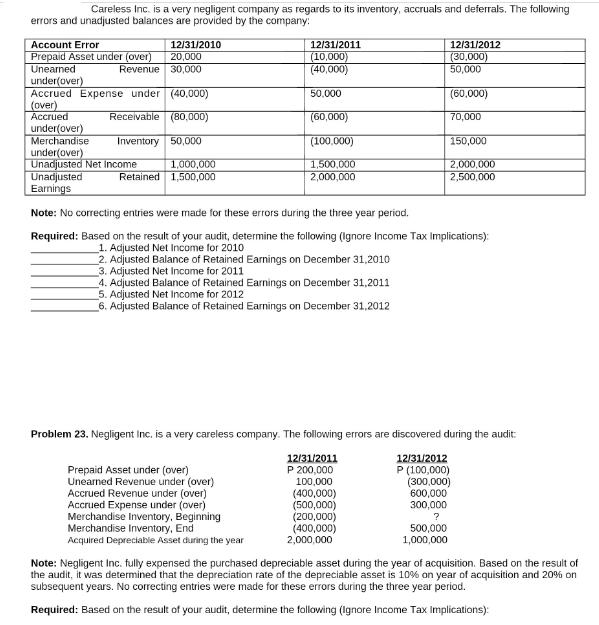

Careless Inc. is a very negligent company as regards to its inventory, accruals and deferrals. The following errors and unadjusted balances are provided by

Careless Inc. is a very negligent company as regards to its inventory, accruals and deferrals. The following errors and unadjusted balances are provided by the company: Account Error Prepaid Asset under (over) Unearned under(over) Accrued Expense under (40,000) (over) Accrued Receivable (80,000) Inventory 50,000 12/31/2010 20,000 Revenue 30,000 under(over) Merchandise under(over) Unadjusted Net Income Unadjusted Earnings Retained 1,000,000 1,500,000 12/31/2011 (10,000) (40,000) 50,000 (60,000) (100.000) 1,500,000 2,000,000 Prepaid Asset under (over) Unearned Revenue under (over) Accrued Revenue under (over) Accrued Expense under (over) Merchandise Inventory, Beginning Merchandise Inventory, End Acquired Depreciable Asset during the year 3. Adjusted Net Income for 2011 4. Adjusted Balance of Retained Earnings on December 31,2011 5. Adjusted Net Income for 2012 6. Adjusted Balance of Retained Earnings on December 31,2012 Note: No correcting entries were made for these errors during the three year period. Required: Based on the result of your audit, determine the following (Ignore Income Tax Implications): 1. Adjusted Net Income for 2010 2. Adjusted Balance of Retained Earnings on December 31,2010 Problem 23. Negligent Inc. is a very careless company. The following errors are discovered during the audit: 12/31/2012 P (100,000) (300,000) 600,000 300,000 12/31/2011 P 200,000 100,000 (400,000) (500,000) (200,000) 12/31/2012 (30,000) 50,000 (60,000) 70,000 150,000 2,000,000 2,500,000 (400,000) 2,000,000 ? 500,000 1,000,000 Note: Negligent Inc. fully expensed the purchased depreciable asset during the year of acquisition. Based on the result of the audit, it was determined that the depreciation rate of the depreciable asset is 10% on year of acquisition and 20% on subsequent years. No correcting entries were made for these errors during the three year period. Required: Based on the result of your audit, determine the following (Ignore Income Tax Implications):

Step by Step Solution

★★★★★

3.58 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

You have provided an image of a set of accounting problems from a practice or homework assignment pertaining to errors found during a companys audit These errors affected the companys financial statem...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started