Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Carey Company had sales in 2019 of $1,923,000 on 64,100 units. Variable costs totaled $897,400, and fixed costs totaled $502,000. A new raw material

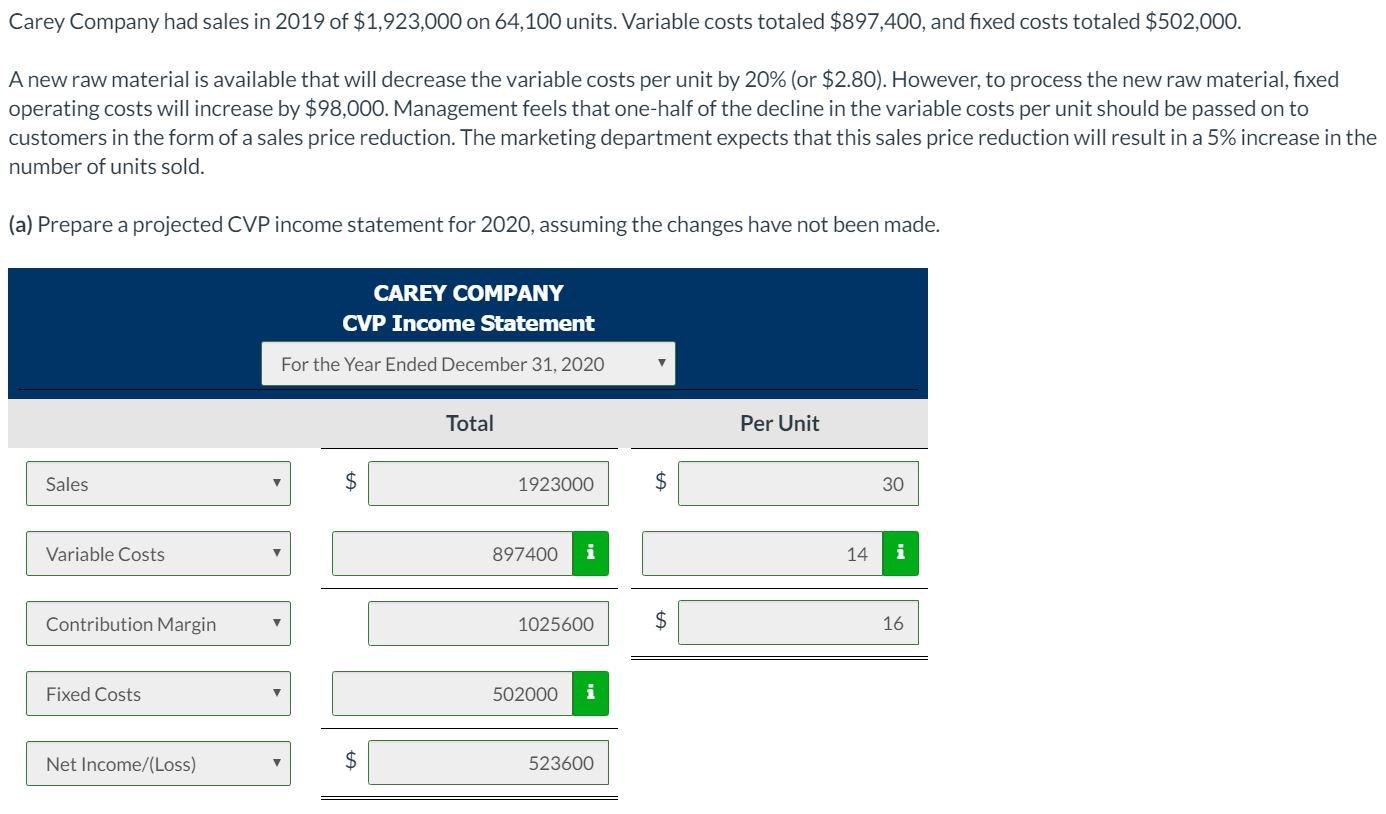

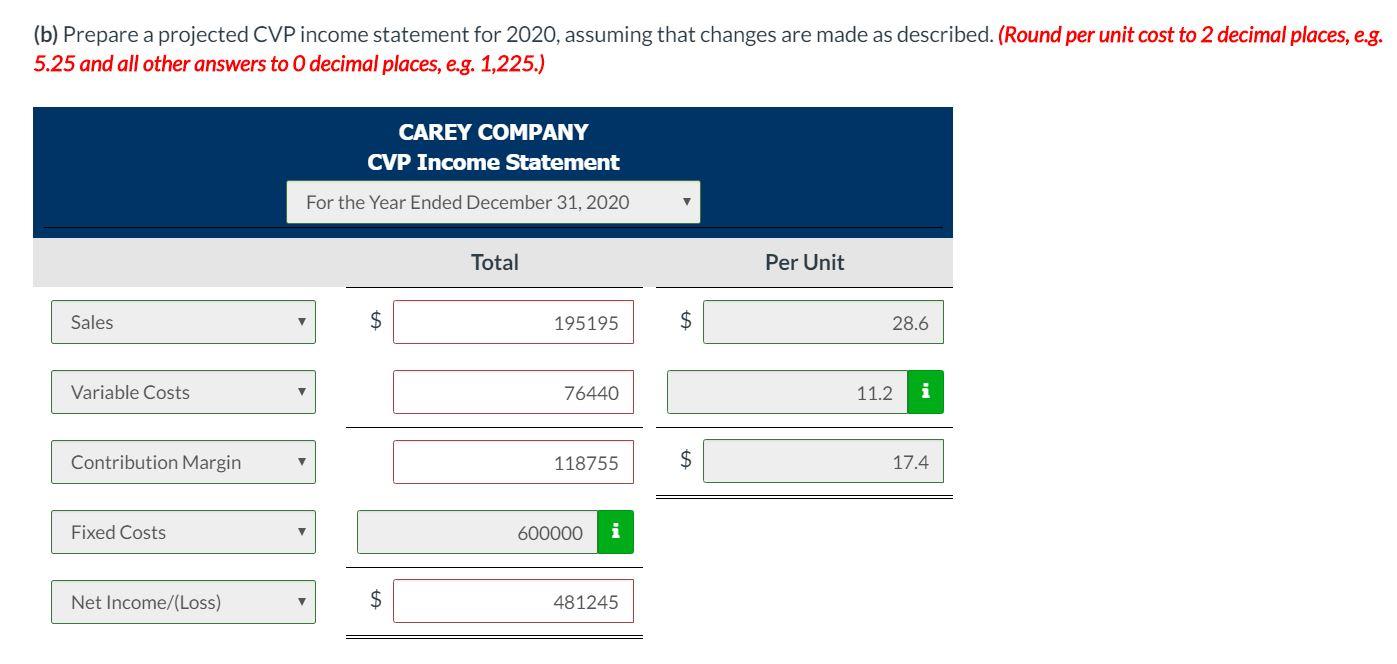

Carey Company had sales in 2019 of $1,923,000 on 64,100 units. Variable costs totaled $897,400, and fixed costs totaled $502,000. A new raw material is available that will decrease the variable costs per unit by 20% (or $2.80). However, to process the new raw material, fixed operating costs will increase by $98,000. Management feels that one-half of the decline in the variable costs per unit should be passed on to customers in the form of a sales price reduction. The marketing department expects that this sales price reduction will result in a 5% increase in the number of units sold. (a) Prepare a projected CVP income statement for 2020, assuming the changes have not been made. Sales Variable Costs Contribution Margin Fixed Costs Net Income/(Loss) CAREY COMPANY CVP Income Statement For the Year Ended December 31, 2020 $ $ Total 1923000 897400 1025600 502000 i 523600 $ +A $ Per Unit 14 30 i 16 (b) Prepare a projected CVP income statement for 2020, assuming that changes are made as described. (Round per unit cost to 2 decimal places, e.g. 5.25 and all other answers to O decimal places, e.g. 1,225.) Sales Variable Costs Contribution Margin Fixed Costs Net Income/(Loss) CAREY COMPANY CVP Income Statement For the Year Ended December 31, 2020 $ Total 195195 76440 11875 600000 i 481245 $ $ Per Unit 28.6 11.2 i 7.4

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Contribution margin income statement T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started