Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Carl Fredricksen would like to buy an apartment that costs $1, 130, 000. He has $170,000 in cash that he can put down as

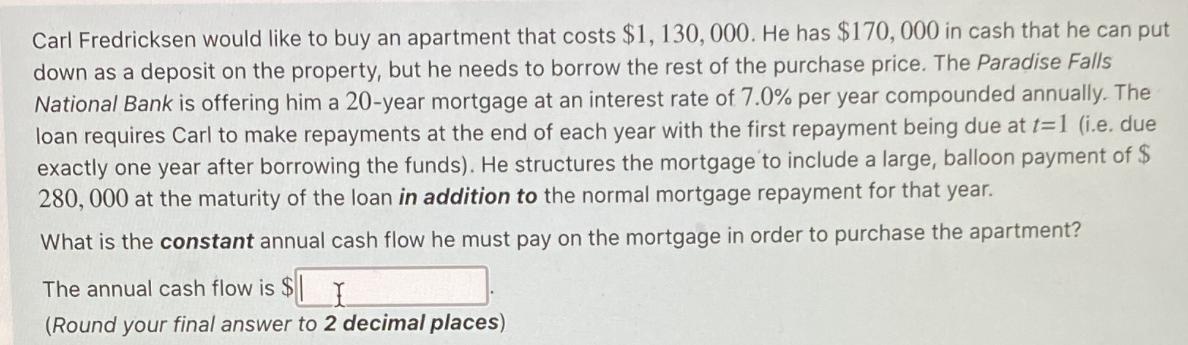

Carl Fredricksen would like to buy an apartment that costs $1, 130, 000. He has $170,000 in cash that he can put down as a deposit on the property, but he needs to borrow the rest of the purchase price. The Paradise Falls National Bank is offering him a 20-year mortgage at an interest rate of 7.0% per year compounded annually. The loan requires Carl to make repayments at the end of each year with the first repayment being due at t=1 (i.e. due exactly one year after borrowing the funds). He structures the mortgage to include a large, balloon payment of $ 280, 000 at the maturity of the loan in addition to the normal mortgage repayment for that year. What is the constant annual cash flow he must pay on the mortgage in order to purchase the apartment? The annual cash flow is $I (Round your final answer to 2 decimal places)

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the constant annual cash flow Carl must pay on the mortgage we can break ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started