Answered step by step

Verified Expert Solution

Question

1 Approved Answer

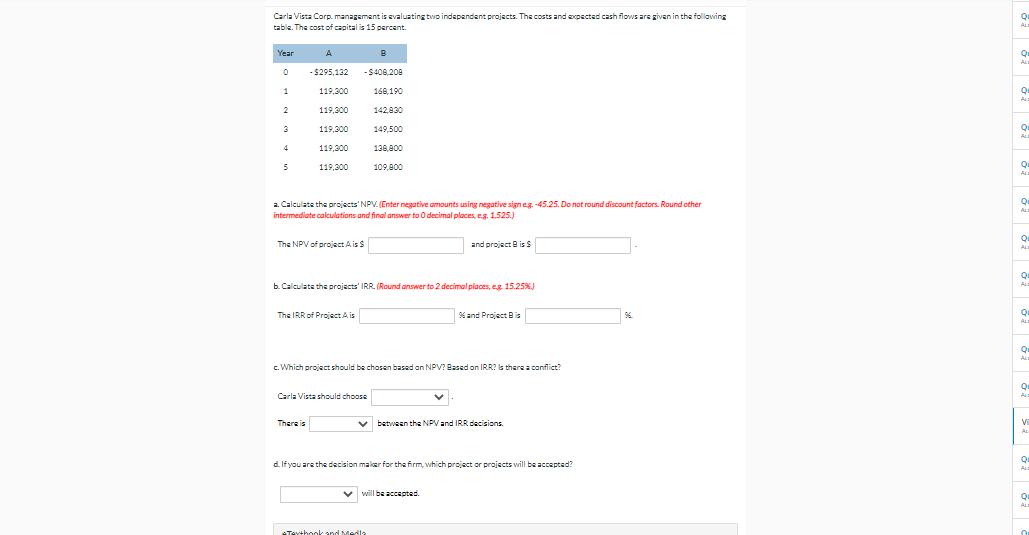

Carla Vista Corp. management is evaluating two independent projects. The costs and expected cash flows are given in the following table. The cost of

Carla Vista Corp. management is evaluating two independent projects. The costs and expected cash flows are given in the following table. The cost of capital is 15 percent. Year 1 2 3 4 5 A -$295,132 119,300 119,300 119,300 119,300 119,300 The NPV of project A is $ There is -$406,208 168,190 142,830 The IRR of Project A is B a. Calculate the projects' NPV. (Enter negative amounts using negative sign eg. -45.25. Do not round discount factors. Round other intermediate calculations and final answer to 0 decimal places, eg. 1.525.) Carla Vista should choose 149,500 138,800 b. Calculate the projects' IRR. (Round answer to 2 decimal places, eg. 15.25%) 109,900 c. Which project should be chosen based on NPV? Based on IRR? Is there a conflict? Tauthonk and Media and project is s % and Project Bis V between the NPV and IRR decisions. will be accepted. d. If you are the decision maker for the firm, which project or projects will be accepted? Q ALE Q Q Q ALL Q Q Q ALE Q ALE Q ALT Q Q 52 52 02 02 A Q

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Step by Step Explanation A 103 164 165 166 167 168 169 170 171 172 173 a 174 175 176 b 177 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started