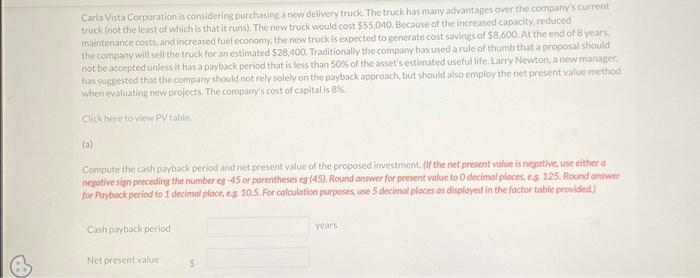

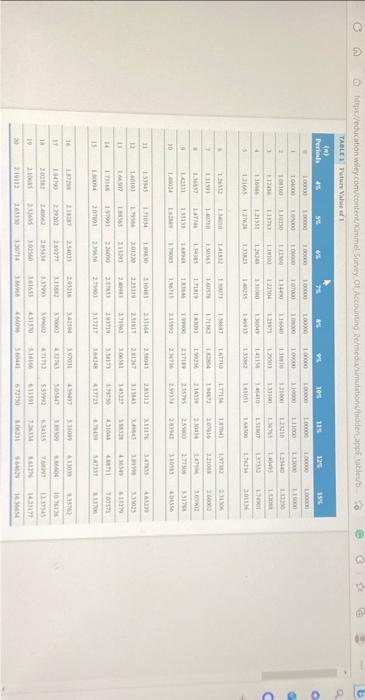

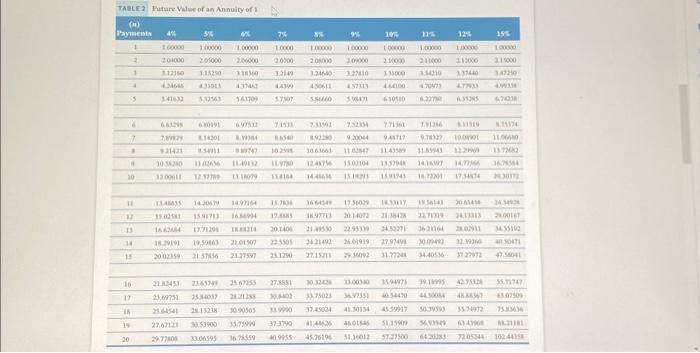

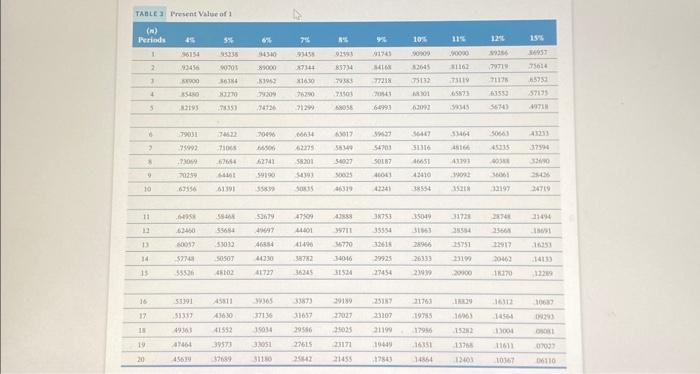

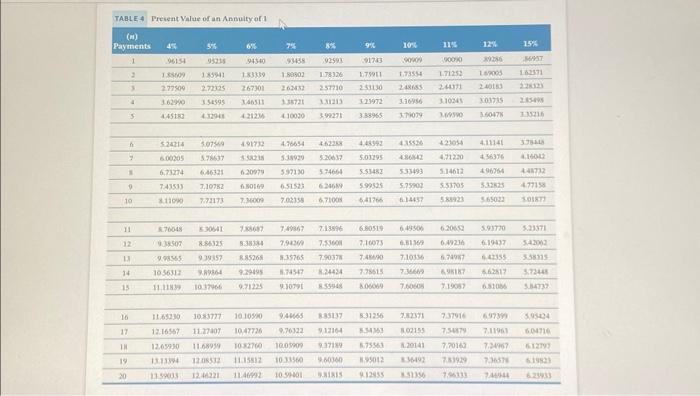

Carla Vista Corporation is considering purchasing a new delivery truck. The truck has many advantages over the compiny s culfent truck (not the least of which is that it runs). The new truck would cost $55,040. Because of the increased capacity, reduced maintenance costs, and increased fuel econony, the new truck is expected to generate cost savings of 56,600 . At the end of 8 years. the company will sell the truek for an estimated $28,400. Traditionally the company has used a rule of thumb that a proposal should not be accepted unlessit has a payback period that is less than 50 \& of the asset's estimated usefullife. Larry Newton, anew manager. has suegested that the company should not rely solely on the payback approach, but should also employ the net present valuemethod When evaluatine new projects. The company's cost of capitalis 8% Click here ta view py table (a) Compute the cakh payback periodarid net present value of the proposed investment. (if the net present value is negotive, use cither a negative sign preceding the number eg 45 or parentheses eg (45). Round answer for present value to 0 decimal places, es. 125. Round amswer for Poybock period to 1 decimal place, es 10.5. For calculatbon purposes, use 5 decimal places as displayed in the factor table provided) Cash payback period Net present value TheLe F Futare Velue of an Annuity of 1 TAnLe a Wrasens Value of I TABLE4 Preient Value of an Annultyot. Carla Vista Corporation is considering purchasing a new delivery truck. The truck has many advantages over the compiny s culfent truck (not the least of which is that it runs). The new truck would cost $55,040. Because of the increased capacity, reduced maintenance costs, and increased fuel econony, the new truck is expected to generate cost savings of 56,600 . At the end of 8 years. the company will sell the truek for an estimated $28,400. Traditionally the company has used a rule of thumb that a proposal should not be accepted unlessit has a payback period that is less than 50 \& of the asset's estimated usefullife. Larry Newton, anew manager. has suegested that the company should not rely solely on the payback approach, but should also employ the net present valuemethod When evaluatine new projects. The company's cost of capitalis 8% Click here ta view py table (a) Compute the cakh payback periodarid net present value of the proposed investment. (if the net present value is negotive, use cither a negative sign preceding the number eg 45 or parentheses eg (45). Round answer for present value to 0 decimal places, es. 125. Round amswer for Poybock period to 1 decimal place, es 10.5. For calculatbon purposes, use 5 decimal places as displayed in the factor table provided) Cash payback period Net present value TheLe F Futare Velue of an Annuity of 1 TAnLe a Wrasens Value of I TABLE4 Preient Value of an Annultyot