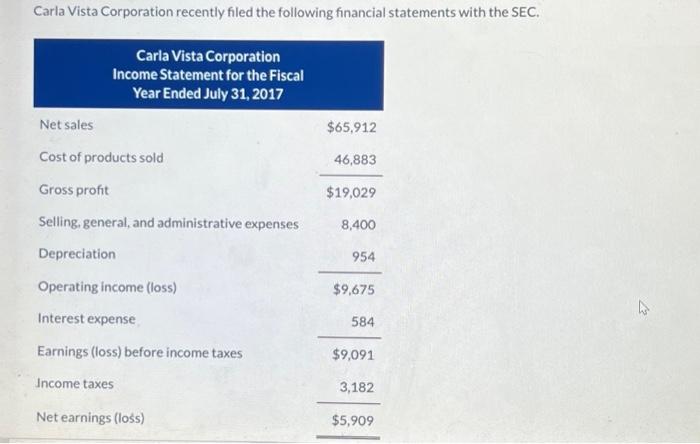

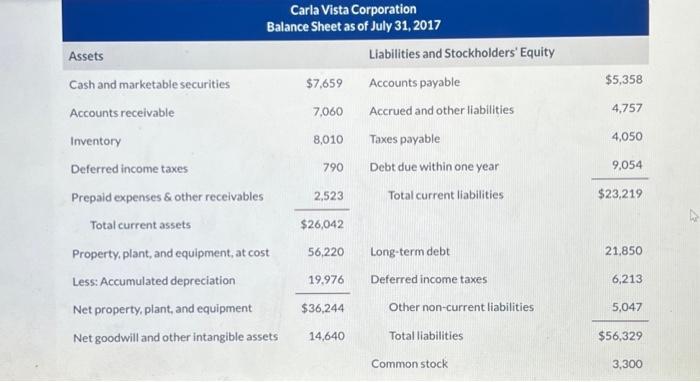

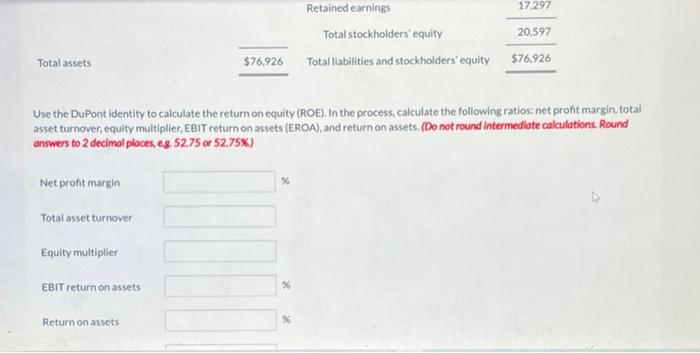

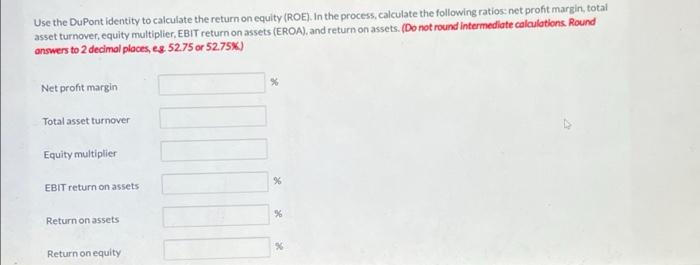

Carla Vista Corporation recently filed the following financial statements with the SEC, $65,912 46,883 $19,029 Carla Vista Corporation Income Statement for the Fiscal Year Ended July 31, 2017 Net sales Cost of products sold Gross profit Selling, general, and administrative expenses Depreciation Operating income (loss) Interest expense Earnings (loss) before income taxes 8,400 954 $9,675 hs 584 $9,091 Income taxes 3,182 Net earnings (loss) $5,909 $5,358 4,757 4,050 9,054 Carla Vista Corporation Balance Sheet as of July 31, 2017 Assets Liabilities and Stockholders' Equity Cash and marketable securities $7,659 Accounts payable Accounts receivable 7,060 Accrued and other liabilities Inventory 8,010 Taxes payable Deferred income taxes 790 Debt due within one year Prepaid expenses & other receivables 2,523 Total current liabilities Total current assets $26,042 Property, plant, and equipment, at cost 56,220 Long-term debt Less: Accumulated depreciation 19,976 Deferred income taxes Net property, plant, and equipment $36,244 Other non-current liabilities Net goodwill and other intangible assets 14,640 Total liabilities Common stock $23,219 21.850 6,213 5,047 $56,329 3,300 Retained earnings 17.297 Total stockholders' equity 20,597 Total liabilities and stockholders equity $76,926 Total assets $76,926 Use the DuPont identity to calculate the return on equity (ROE). In the process, calculate the following ratios; net profit margin, total asset turnover, equity multiplier, EBIT return on assets (EROA), and return on assets. (Do not round Intermediate calculations. Round answers to 2 decimal places, es, 5275 or 52.75%) Net pront margin %6 Total asset turnover Equity multiplier EBIT return on assets 96 Return on assets % Use the DuPont identity to calculate the return on equity (ROE). In the process, calculate the following ratios: net profit margin, total asset turnover, equity multiplier. EBIT return on assets (EROA), and return on assets. (Do not round intermediate calculations. Round answers to 2 decimal places, es 52.75 or 52.75%) % Net profit margin Total asset turnover Equity multiplier % EBIT return on assets % Return on assets * Return on equity