Answered step by step

Verified Expert Solution

Question

1 Approved Answer

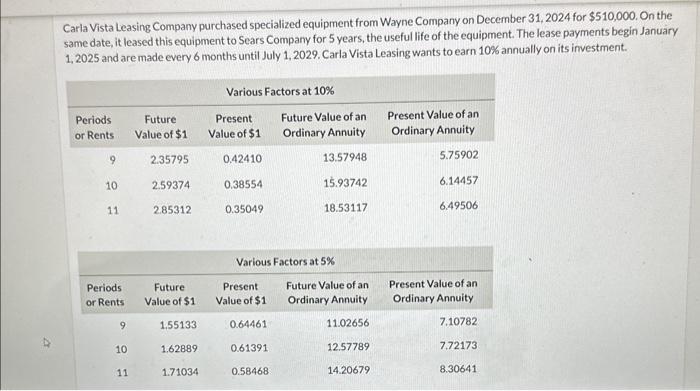

Carla Vista Leasing Company purchased specialized equipment from Wayne Company on December 31, 2024 for $510,000. On the same date, it leased this equipment

Carla Vista Leasing Company purchased specialized equipment from Wayne Company on December 31, 2024 for $510,000. On the same date, it leased this equipment to Sears Company for 5 years, the useful life of the equipment. The lease payments begin January 1, 2025 and are made every 6 months until July 1, 2029. Carla Vista Leasing wants to earn 10% annually on its investment. Periods or Rents 9 10 11 Periods or Rents 9 10 11 Future Value of $1 2.35795 2.59374 2.85312 Future Value of $1 1.55133 1.62889 1.71034 Various Factors at 10% Present Value of $1 0,42410 0.38554 0.35049 Various Factors at 5% Present Value of $1 0.64461 Future Value of an Ordinary Annuity 13.57948 15.93742 18.53117 0.61391 0.58468 Future Value of an Ordinary Annuity 11.02656 12.57789 14.20679 Present Value of an Ordinary Annuity 5.75902 6.14457 6.49506 Present Value of an Ordinary Annuity 7.10782 7,72173 8.30641 Calculate the amount of each rent. (Round factor values to 5 decimal places, eg. 1.25124 and final answer to O decimal places, e.g. 458,581.) Amount of rent $

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Step 11 Computation of the amount of each rent for Carla Vista Company Purchas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started