Answered step by step

Verified Expert Solution

Question

1 Approved Answer

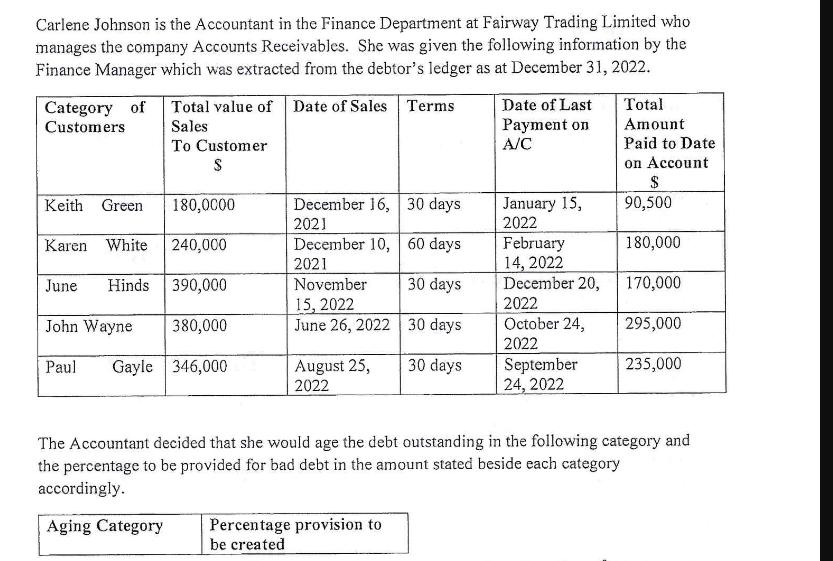

Carlene Johnson is the Accountant in the Finance Department at Fairway Trading Limited who manages the company Accounts Receivables. She was given the following

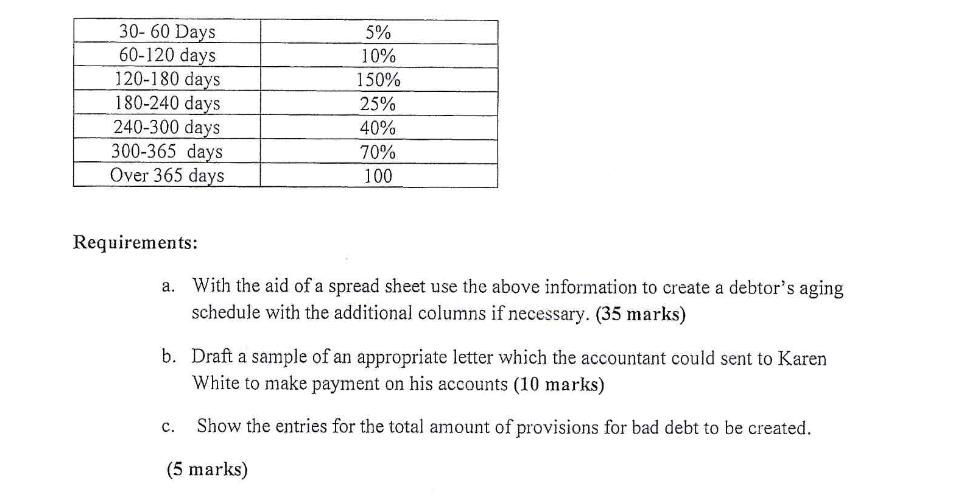

Carlene Johnson is the Accountant in the Finance Department at Fairway Trading Limited who manages the company Accounts Receivables. She was given the following information by the Finance Manager which was extracted from the debtor's ledger as at December 31, 2022. Terms Category of Total value of Date of Sales Customers Sales To Customer $ Keith Green 180,0000 Karen White 240,000 June Hinds 390,000 John Wayne 380,000 Paul Gayle 346,000 December 16, 2021 December 10, 2021 November 15, 2022 June 26, 2022 August 25, 2022 30 days Percentage provision to be created 60 days 30 days 30 days 30 days Date of Last Payment on A/C January 15, 2022 February 14, 2022 December 20, 2022 October 24, 2022 September 24, 2022 Total Amount Paid to Date on Account $ 90,500 180,000 170,000 295,000 235,000 The Accountant decided that she would age the debt outstanding in the following category and the percentage to be provided for bad debt in the amount stated beside each category accordingly. Aging Category 30-60 Days 60-120 days 120-180 days 180-240 days 240-300 days 300-365 days Over 365 days Requirements: 5% 10% 150% 25% 40% 70% 100 a. With the aid of a spread sheet use the above information to create a debtor's aging schedule with the additional columns if necessary. (35 marks) b. Draft a sample of an appropriate letter which the accountant could sent to Karen White to make payment on his accounts (10 marks) Show the entries for the total amount of provisions for bad debt to be created. (5 marks) C.

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started