Answered step by step

Verified Expert Solution

Question

1 Approved Answer

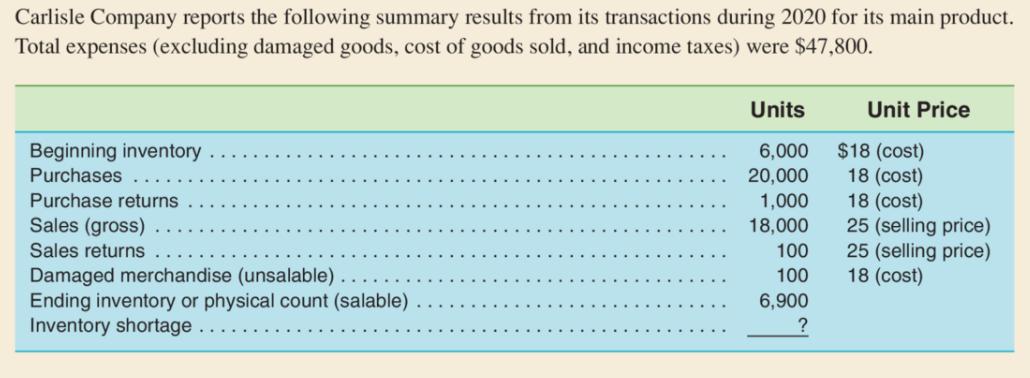

Carlisle Company reports the following summary results from its transactions during 2020 for its main product. Total expenses (excluding damaged goods, cost of goods

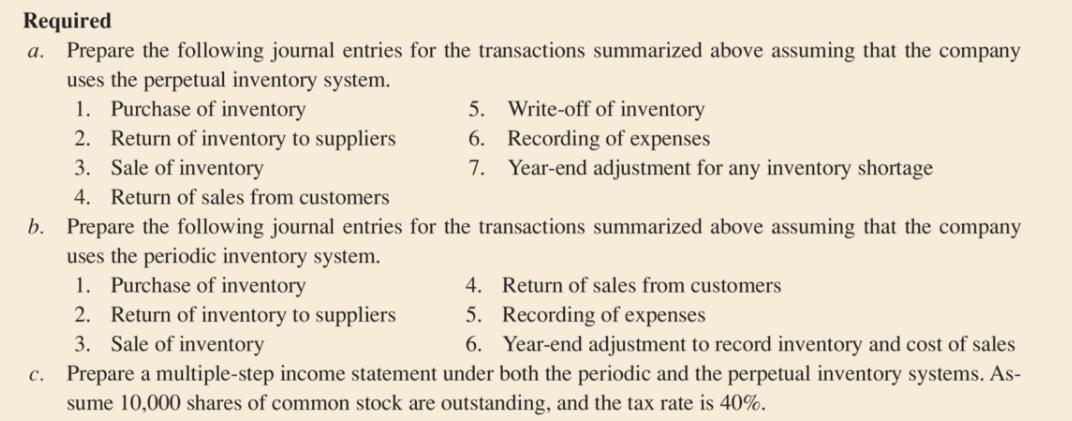

Carlisle Company reports the following summary results from its transactions during 2020 for its main product. Total expenses (excluding damaged goods, cost of goods sold, and income taxes) were $47,800. Beginning inventory Purchases Purchase returns Sales (gross) Sales returns Damaged merchandise (unsalable). Ending inventory or physical count (salable) Inventory shortage Units 6,000 20,000 1,000 18,000 100 100 6,900 ? Unit Price $18 (cost) 18 (cost) 18 (cost) 25 (selling price) 25 (selling price) 18 (cost) Required a. Prepare the following journal entries for the transactions summarized above assuming that the company uses the perpetual inventory system. 1. Purchase of inventory 2. Return of inventory to suppliers 3. Sale of inventory 4. Return of sales from customers 5. Write-off of inventory 6. Recording of expenses 7. Year-end adjustment for any inventory shortage b. Prepare the following journal entries for the transactions summarized above assuming that the company uses the periodic inventory system. 1. Purchase of inventory 4. Return of sales from customers 5. Recording of expenses 6. Year-end adjustment to record inventory and cost of sales c. Prepare a multiple-step income statement under both the periodic and the perpetual inventory systems. As- sume 10,000 shares of common stock are outstanding, and the tax rate is 40%. 2. Return of inventory to suppliers 3. Sale of inventory

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

SNo Accounts 1 Inventory 2000018 Cash 2 Cash 100018 Inventory 3 Cash 1800025 Sales Revenue Cos...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started