Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Carlos, Bradley, and Dawson are partners in CBD partnership. Ellen is to be admitted to the partnership with a 20% interest in the business.

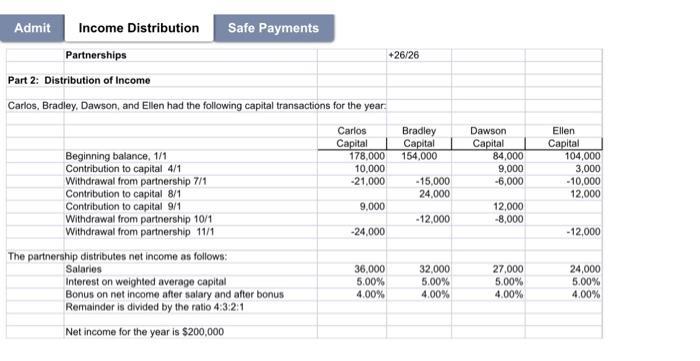

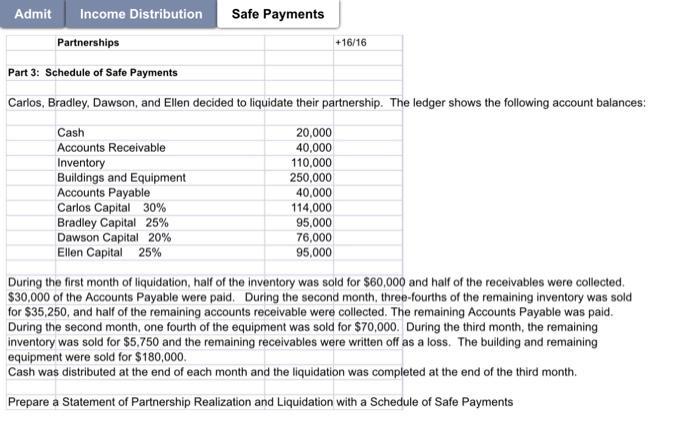

Carlos, Bradley, and Dawson are partners in CBD partnership. Ellen is to be admitted to the partnership with a 20% interest in the business. The new name of the partnership is CBDE Partnership. Carlos Bradley Dawson Capital Balance Profit Loss Ratio 170,000 4:2:2 150,000 80,000 Ellen invests $120,000. Total capital to be $520,000, the partners use the bonus method. Record the journal entry to add Ellen to the partnership. Debit Credit Admit Income Distribution Partnerships Part 2: Distribution of Income Carlos, Bradley, Dawson, and Ellen had the following capital transactions for the year. Carlos Capital Safe Payments Beginning balance, 1/1 Contribution to capital 4/1 Withdrawal from partnership 7/1 Contribution to capital 8/11 Contribution to capital 9/1 Withdrawal from partnership 10/1 Withdrawal from partnership 11/1 The partnership distributes net income as follows: Salaries Interest on weighted average capital Bonus on net income after salary and after bonus Remainder is divided by the ratio 4:3:2:1 Net income for the year is $200,000 178,000 10,000 -21,000 9,000 -24,000 36,000 5.00% 4.00% +26/26 Bradley Capital 154,000 -15,000 24,000 -12,000 32,000 5.00% 4.00% Dawson Capital 84,000 9,000 -6,000 12,000 -8,000 27,000 5.00% 4.00% Ellen Capital 104,000 3,000 -10,000 12,000 -12,000 24,000 5.00% 4.00% Admit Income Distribution Partnerships Part 3: Schedule of Safe Payments Carlos, Bradley, Dawson, and Ellen decided to liquidate their partnership. The ledger shows the following account balances: Cash 20,000 Accounts Receivable 40,000 Inventory 110,000 250,000 Buildings and Equipment Accounts Payable 40,000 114,000 95,000 76,000 95,000 Safe Payments Carlos Capital 30% Bradley Capital 25% Dawson Capital 20% Ellen Capital 25% +16/16 During the first month of liquidation, half of the inventory was sold for $60,000 and half of the receivables were collected. $30,000 of the Accounts Payable were paid. During the second month, three-fourths of the remaining inventory was sold for $35,250, and half of the remaining accounts receivable were collected. The remaining Accounts Payable was paid. During the second month, one fourth of the equipment was sold for $70,000. During the third month, the remaining inventory was sold for $5,750 and the remaining receivables were written off as a loss. The building and remaining equipment were sold for $180,000. Cash was distributed at the end of each month and the liquidation was completed at the end of the third month. Prepare a Statement of Partnership Realization and Liquidation with a Schedule of Safe Payments

Step by Step Solution

★★★★★

3.40 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Calculations Initial Capital Contributions Carlos 114000 Bradley 95000 Dawson 76000 Ellen 95000 Total Initial Capital 114000 95000 76000 95000 380000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started