Question

Carlos operates a Nightclub. His gross receipts from admissions during the month amounted to P126,700. The foods and drinks being served inside the nightclub

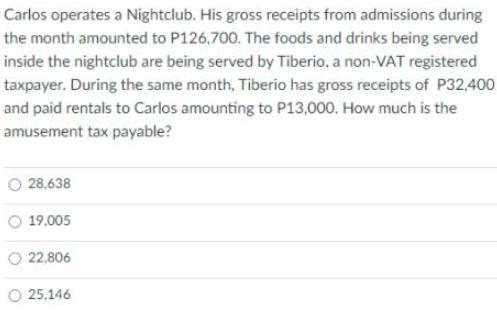

Carlos operates a Nightclub. His gross receipts from admissions during the month amounted to P126,700. The foods and drinks being served inside the nightclub are being served by Tiberio, a non-VAT registered taxpayer. During the same month, Tiberio has gross receipts of P32,400 and paid rentals to Carlos amounting to P13,000. How much is the amusement tax payable? 28,638 19,005 22,806 25,146

Step by Step Solution

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Answer The correct option i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Quantitative Methods For Business

Authors: Donald Waters

5th Edition

273739476, 978-0273739470

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App