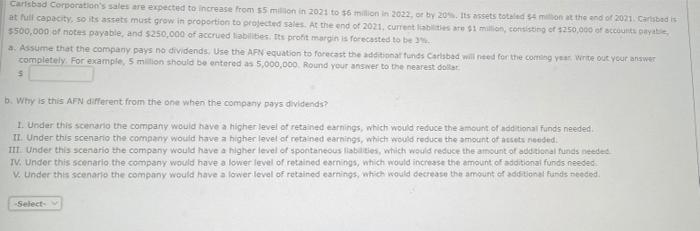

Carlsbad Corporation's sales are expected to increase from 55 million in 2021 to $6 million in 2022, or by 203. Its assets totalmont the end of 201 Carbadis at hull capacity, so its assets must grow in proportion to projected sales. At the end of 2021, current liabilities are $1 million consisting of $250,000 of accounts 5500,000 of notes payable, and $250,000 of accrued abilities. Its profit margin is forecasted to be a. Assume that the company pays no dividends. Use the AFN equation to forecast the additional funds Carlsbad will need for the coming year write out your answer completely. For example, 5 milion should be entered as 5,000,000 Round your answer to the nearest do b. Why is this AFN different from the one when the company pays dividends? 1. Under this scenario the company would have a higher level of retained earnings, which would reduce the amount of additional funds needed TL Under this scenario the company would have a higher level of retained earnings, which would reduce the amount of assets needed TIL Under this scenario the company would have a higher level of spontaneous fiabilities, which would reduce the amount of additional funds needed TV. Under this scenario the company would have a lower level of retained earnings, which would increase the amount of additional funds needed V. under this scenario the company would have a lower level of retained earnings, which would decrease the amount of additional funds needed Select Carlsbad Corporation's sales are expected to increase from 55 million in 2021 to $6 million in 2022, or by 203. Its assets totalmont the end of 201 Carbadis at hull capacity, so its assets must grow in proportion to projected sales. At the end of 2021, current liabilities are $1 million consisting of $250,000 of accounts 5500,000 of notes payable, and $250,000 of accrued abilities. Its profit margin is forecasted to be a. Assume that the company pays no dividends. Use the AFN equation to forecast the additional funds Carlsbad will need for the coming year write out your answer completely. For example, 5 milion should be entered as 5,000,000 Round your answer to the nearest do b. Why is this AFN different from the one when the company pays dividends? 1. Under this scenario the company would have a higher level of retained earnings, which would reduce the amount of additional funds needed TL Under this scenario the company would have a higher level of retained earnings, which would reduce the amount of assets needed TIL Under this scenario the company would have a higher level of spontaneous fiabilities, which would reduce the amount of additional funds needed TV. Under this scenario the company would have a lower level of retained earnings, which would increase the amount of additional funds needed V. under this scenario the company would have a lower level of retained earnings, which would decrease the amount of additional funds needed Select